Featured News Headlines

Bitcoin Whale Strategy Shift: $76M BTC Sale for Ethereum Longs

Bitcoin Whale Strategy Shift – A legendary Bitcoin whale who held onto their cryptocurrency stash for seven years has made a dramatic pivot, selling a substantial portion of their BTC holdings to establish massive Ethereum positions. This move highlights a growing trend of veteran Bitcoin investors diversifying into ETH as both cryptocurrencies hover near record highs.

$1.6 Billion Whale Makes Strategic Pivot

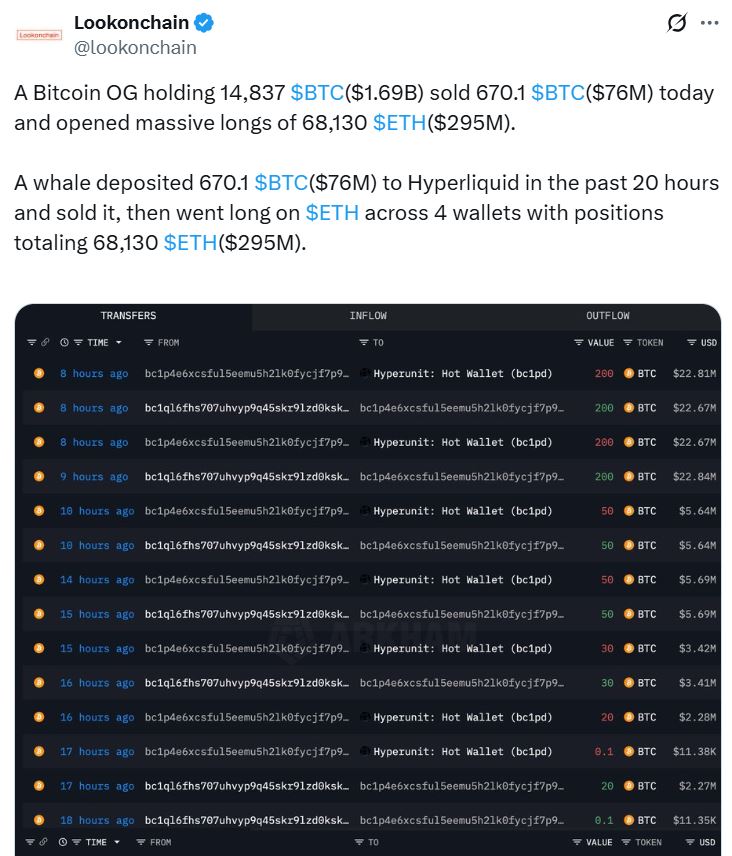

The OG whale, tracked by blockchain analytics firm Lookonchain, offloaded 670 Bitcoin worth $76 million on Wednesday. Before this sale, the investor commanded an impressive portfolio of 14,837 Bitcoin valued at over $1.6 billion, accumulated through purchases on Binance and HTX exchanges dating back seven years.

The timing appears strategic, coming just one week after Bitcoin reached its all-time high of $124,128 on August 14, while Ethereum nearly reclaimed its 2021 peak of $4,878.

High-Risk Leveraged Ethereum Strategy

The whale didn’t simply swap cryptocurrencies—they went all-in with leveraged positions. Using the $76 million from their Bitcoin sale, they opened four separate ETH long positions totaling 68,130 tokens around the $4,300 price level.

The majority of these holdings utilized 10x leverage, with a smaller position of 2,449 ETH on 3x leverage. However, this aggressive strategy immediately faced turbulence as Ethereum’s price dropped to $4,080, pushing three positions into the red and dangerously close to liquidation levels between $3,699-$3,732.

Institutional Interest Mirrors Whale Activity

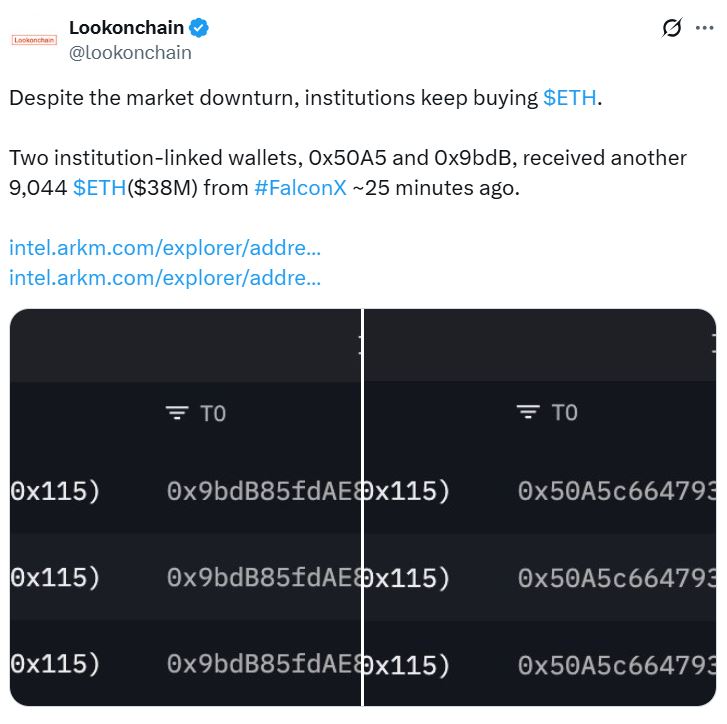

The whale’s move coincides with broader institutional accumulation of Ethereum. While some traders panic-sold during Tuesday’s market dip—with three whales dumping 17,972, 13,521, and 3,003 ETH respectively—institutional players were buying the decline.

Two institution-linked wallets accumulated 9,044 ETH each, worth $38 million combined. Meanwhile, BitMine Immersion Technologies significantly expanded their Ethereum treasury by adding 52,475 tokens, bringing their total holdings to 1.52 million ETH valued at $6.6 billion.

Market Maturation Signal

This whale activity reflects broader market evolution, with veteran Bitcoin holders gradually diversifying their portfolios. Crypto analyst Willy Woo previously noted that whales holding over 10,000 Bitcoin have been steadily selling since 2017.

However, analysts suggest this redistribution indicates healthy market maturation, as new buyers replace longtime holders, creating more distributed ownership patterns across the cryptocurrency ecosystem.

Comments are closed.