DOGE Price Eyes Breakout Above $0.232 as Whales Buy the Dip

Large Dogecoin holders have increased their positions significantly, signaling renewed confidence in the asset’s short-term potential.

Since August 14, wallets holding over 1 billion DOGE have added nearly 270 million DOGE, raising their total from 70.84 billion to 71.11 billion. This accumulation began as Dogecoin approached a key short-term support level near $0.21. Rather than selling into weakness, large holders appear to be absorbing the dip — an early bullish signal.

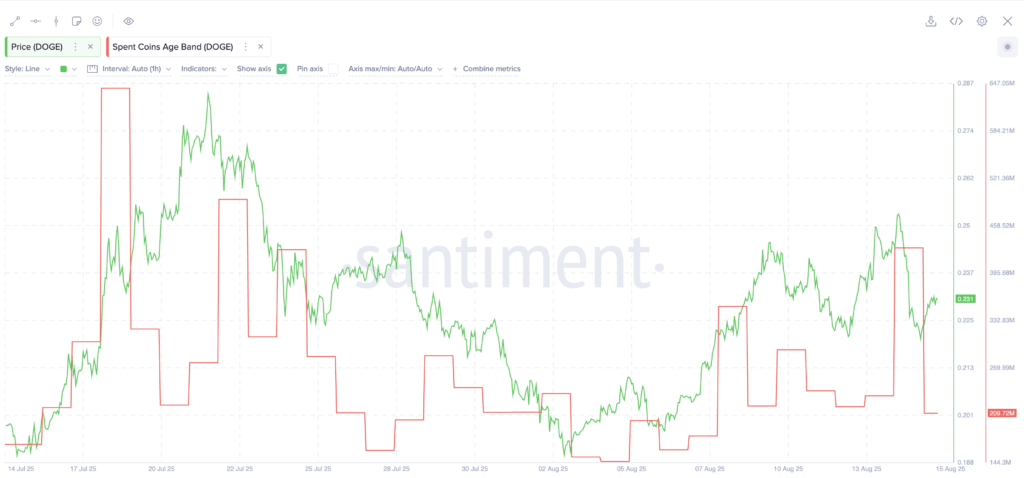

On-Chain Data Backs Bullish Outlook

Another key indicator supporting this view is the Spent Coins Age Band, which tracks the movement of older, dormant coins. When this metric declines, it suggests long-term holders are not actively selling. In the past 24 hours, spent volume dropped from 429.77 million to 209.72 million DOGE. This cooling off in older supply, combined with whale accumulation, reduces overall selling pressure.

Historically, similar setups have preceded price rallies — notably between August 2 and August 5, when this metric also hit a monthly low before price momentum increased.

Key Price Levels and Technical Setup

On the 4-hour chart, Dogecoin is forming an ascending triangle, a pattern often associated with upward continuation. Price is approaching resistance near $0.232, a level that has acted as a barrier multiple times. A confirmed break above this level could trigger renewed upside toward $0.239 and $0.246.

Supporting this view, the Bull Bear Power (BBP) indicator is climbing from its lows, suggesting a shift in momentum from sellers to buyers.

Unless price closes decisively below $0.216, the technical and on-chain setup continues to favor a bullish breakout in the near term.

Comments are closed.