Featured News Headlines

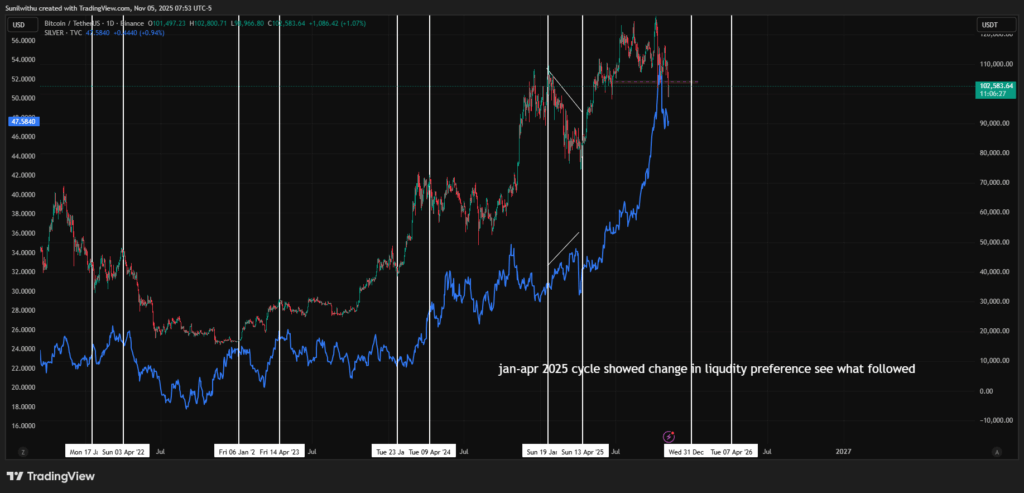

Bitcoin Down 20% While Silver Rises: 65-Month Cycle Analysis

According to the latest analysis from CrossBorder Capital, the global liquidity index is approaching a critical turning point. The Global Liquidity Index (GLI), shown as a black line in the company’s shared data, is rising sharply toward the peak zone marked in red. This movement shows significant similarities to the final stages of the 2016-2021 cycle and indicates entry into an overheating phase where asset prices exceed their intrinsic values.

This cycle was first identified through Fourier analysis in 1999 and has an average period of 5.5 years. Each cycle follows a similar pattern: strong capital inflows at the beginning, peaking when monetary policy is extremely loose, and then declining with credit contraction.

Liquidity Peak May Arrive in Spring 2026

Slope analysis of previous cycles suggests the next liquidity peak could emerge in Q1 or Q2 of 2026. This roughly corresponds to the March-June 2026 timeframe, just a few months away from the current situation.

However, an X user emphasizes the need for caution regarding these predictions. According to the analyst, cycle timing can show deviations of years on average.

“I like the chart and the overall analysis, but the timing of the cycle is on average off by years in this chart. So, you don’t know whether it has peaked, whether it will accelerate, or do nothing, based on the chart. It is a coinflip,” the analyst noted.

This uncertainty means risk assets could enter a repricing process in the near future. Technical analysis indicates Bitcoin could experience a 15-20% correction before forming a new cycle bottom.

Bitcoin Falls While Silver Rises: Safe-Haven Rotation

One of the notable trends of 2025 has been the inverse movement between Bitcoin and silver. Since 2021, Bitcoin has dropped approximately 15-20%, declining from $109,000 to $82,000. During the same period, silver rose 13%, climbing from $29 to $33.

This divergence shows that as global liquidity tightens, investors are exiting high-risk crypto assets and rotating toward collateral-backed instruments like precious metals. Bitcoin acts as a risk indicator that directly benefits from liquidity expansion, while silver carries both commodity and safe-haven characteristics.

Stagflation signals and historical liquidity cycle trends lead many experts to predict silver could outperform Bitcoin between January and April 2026. However, year-end 2025 rallies in both assets suggest this transition may occur gradually rather than abruptly.

“As we move into January-April 2026, we may see this trend accelerate. Bitcoin may only recover moderately, while silver rises sharply, deepening the rotation toward tangible collateral assets,” an analyst noted.

2026: A Pivotal Year for the Cycle?

While a 20% drop in Bitcoin sounds bearish, it doesn’t necessarily signal the end of the bull cycle. In late liquidity cycle phases, markets typically experience a sharp correction before the final upswing. This scenario is known as a “liquidity echo rally,” and if it materializes, Bitcoin could show strong recovery in the second half of 2026.

Silver, meanwhile, may sustain short-term gains fueled by industrial demand and hedging flows. However, when global liquidity expands again in 2027, speculative capital may shift from precious metals back to cryptocurrencies and equities in search of higher returns.

In conclusion, the 65-month liquidity cycle is entering a critical phase. While Bitcoin undergoes a temporary correction, silver continues to play the market’s “anchor of stability.” For long-term investors, this situation may present an opportunity to reposition portfolios ahead of the next liquidity wave in 2026-2027, rather than serving as an exit signal.

Comments are closed.