Featured News Headlines

BTC and ETH Near Key Levels with $4B Options Set to Expire

Over $4 billion worth of Bitcoin and Ethereum options are set to expire today, creating a critical moment for crypto markets as Bitcoin trades near $99,000. While this figure is slightly lower than last week’s $5.4 billion expiry, market weakness amplifies the potential impact on short-term price movements.

Bitcoin Options Signal Cautious Optimism Despite Weakness

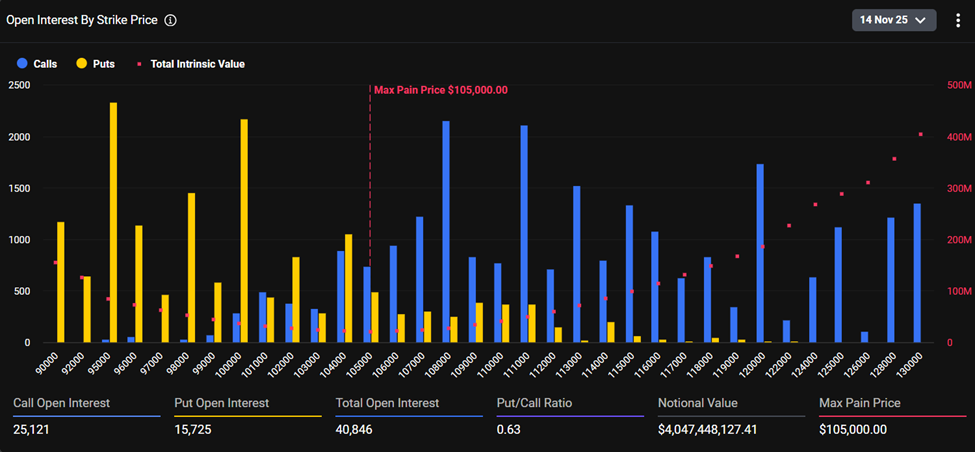

Deribit data reveals that Bitcoin’s maximum pain level sits at $105,000, the price point where most options traders face the largest losses as expiration approaches. The current Put-to-Call ratio stands at 0.63, indicating more call options than puts are being traded in the market.

This positioning reflects underlying bullish sentiment, as traders are placing heavier bets on upward price movement. Bitcoin currently trades at $99,092, down nearly 3% over the past 24 hours. The concentration of bets aligns with maximum pain theory, which suggests prices tend to gravitate toward strike prices where institutional money has the greatest influence.

Market data shows active hedging rather than panic selling among participants. Open interest clusters around the $95,000 and $100,000 put options alongside $108,000 and $111,000 call options, marking these levels as key battlegrounds. Total open interest reaches 40,846 contracts, with calls numbering 25,121 against 15,725 puts, translating to a notional value exceeding $4.04 billion.

Ethereum Positioning Shows Even Stronger Bull Bias

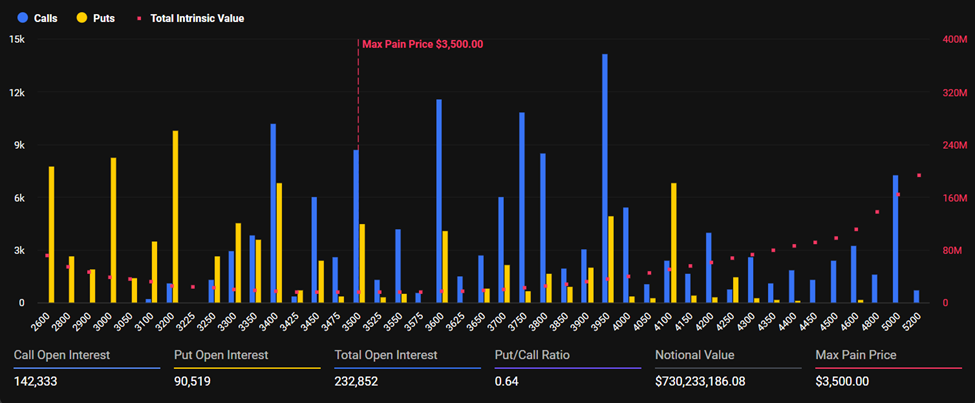

Ethereum options maintain a defensive posture with the cryptocurrency trading near $3,224 and maximum pain positioned close to $3,500. The total notional value for ETH options surpasses $730 million for today’s expiry.

The put-call ratio of 0.64 sits slightly higher than Bitcoin’s, signaling robust bullish expectations among Ethereum traders. Call options total 142,333 contracts compared to just 90,515 puts, representing a 1.5x difference in favor of upside bets. This spread indicates strong confidence in near-term price appreciation among market participants.

Total open interest for Ethereum options stands at 232,852 contracts. The positioning suggests traders are anticipating upward movement despite current market turbulence affecting the broader cryptocurrency sector.

Macro Factors Driving Market Uncertainty

Today’s options expiry unfolds against a backdrop of significant macroeconomic disruption. Greeks.live analysts point to the recently resolved US government shutdown as a major catalyst affecting market sentiment and data reliability.

“The US government ended an unprecedented 43-day shutdown, during which a significant amount of economic data was not released on schedule, forcing macroeconomic analysis to rely heavily on projections,” the analysts noted. They emphasize that missing CPI data amplifies uncertainty surrounding the next release, giving data agencies greater flexibility in their reporting.

The analysts identify the December Federal Reserve interest rate meeting as the most critical upcoming event. This importance grows amid rising uncertainty in macroeconomic indicators, geopolitical tensions, and ongoing developments in the artificial intelligence sector.

Options Market Shows Increasing Divergence

Both open interest and trading volume continue climbing in the options market, with notable increases in out-of-the-money option trades. This pattern indicates growing disagreement among market participants regarding future price direction, reflected in slight increases across major implied volatility maturities.

Greeks.live analysts observe that block trades have become more active recently. Market skew is moving toward equilibrium while the short-term volatility curve shows increasing fragmentation. These factors collectively point to heightened uncertainty about near-term price movements.

“Block trades have also become more active, skew is moving toward equilibrium, and the short-term curve has become more fragmented,” the analysts explained. They suggest these conditions create a plausible trigger for potential market reversal.

The combination of heavy options positioning, macro uncertainty, and technical factors sets the stage for potential volatility as expiration approaches. Markets typically stabilize following major expiry events as participants adjust to the new trading environment and repositioned market structure.

Comments are closed.