Featured News Headlines

XRP Price Stagnates Amid Mixed On-Chain Metrics and Cooling ETF Inflows

XRP has seen a modest uptick of 2.3% over the past 24 hours, yet the broader market picture remains under pressure. The token is still down approximately 14% over the last month and 8.5% over the past seven days, reflecting lingering weakness despite ongoing institutional interest.

ETF Inflows Remain Positive, But Momentum Slows

On the surface, six straight weeks of spot XRP ETF inflows appear bullish. Since mid-November, these inflows have surpassed $1.01 billion in cumulative net additions, signaling sustained institutional appetite.

Early inflows were particularly strong:

- Week of November 14: $243.05 million

- November 21: $179.60 million

- November 28: $243.95 million

- Week of December 5: $230.74 million

However, the pace of inflows has cooled considerably in recent weeks. The December 11 week saw net inflows drop to $93.57 million, while the most recent week ending December 16 added just $19.44 million.

While the headlines highlight “six weeks of inflows,” the underlying momentum is slowing. ETF demand is still positive, but the reduced acceleration helps explain why XRP’s price has stalled instead of climbing in line with earlier inflow strength.

On-Chain Metrics Paint a Mixed Picture

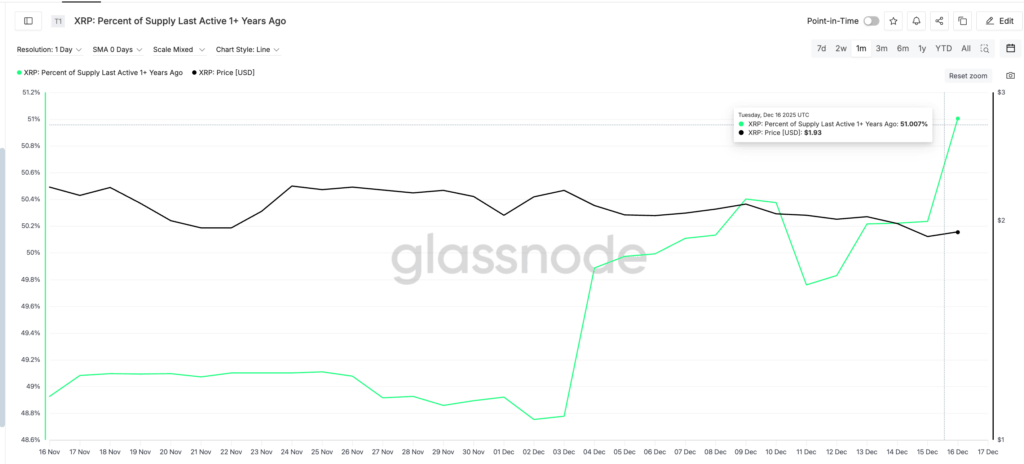

On-chain data suggests a split between holder groups, creating a nuanced picture for XRP.

One potentially bearish signal comes from the percent of XRP supply last active more than a year ago, which has risen from 48.75% on December 2 to 51.00% by mid-December—the highest in roughly a month. This indicates that long-held supply is becoming active, a trend that can create selling pressure even without panic.

Conversely, another long-term holder metric, Hodler net position change (tracking wallets holding XRP for over 155 days), shows selling pressure easing. Net outflows peaked at 216.86 million XRP on December 11 but decreased to 154.57 million XRP by December 16, a roughly 29% reduction.

This creates a mixed on-chain landscape. Some long-term holders are waking up, hinting at potential bearish pressure, while others are slowing their sales, helping prevent a sharp price decline. Analysts suggest that some holders may have already moved coins and are waiting to sell into price bounces.

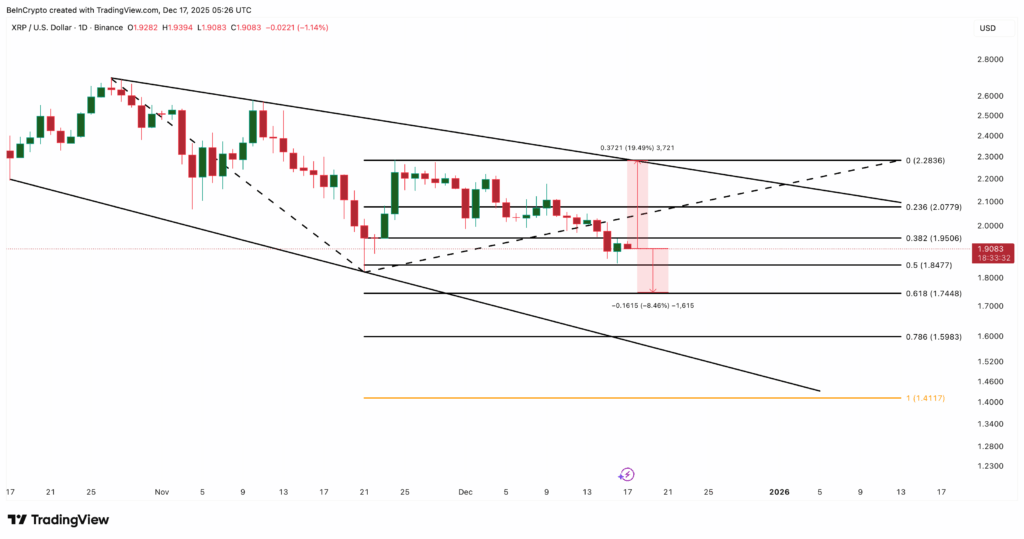

Price Action Highlights Key Levels

XRP is currently trading inside a falling wedge and stuck in the middle of its recent range, reflecting the tug-of-war between buyers and sellers.

For bulls, a daily close above $2.28 would break the wedge pattern, potentially signaling a 19% upside from current levels and shifting momentum toward buyers.

On the downside, immediate risk looms if XRP falls below $1.74, the 0.618 Fibonacci retracement level. This could open the door to $1.59, with a deeper extension near $1.41 if broader market weakness persists.

Source: TradingView

In essence, ETF inflows alone are not enough to drive XRP higher at this stage. With institutional demand cooling and on-chain metrics showing both bullish and bearish signals, XRP remains caught between support levels and gradually returning selling pressure.

The Takeaway

XRP’s recent market dynamics demonstrate the complexity of the current crypto landscape. While spot ETF inflows indicate sustained interest from institutional investors, slowing momentum and mixed on-chain signals are keeping the price range-bound.

Investors and observers should watch key price levels and holder behaviors closely, as these factors will likely determine whether the current stall transforms into a breakout or a deeper decline. For now, XRP reflects a market in transition, where early enthusiasm meets the reality of cooling inflows and selective holder activity.

Comments are closed.