Featured News Headlines

XRP Price Recovery Possible as Exchange Supply Plummets

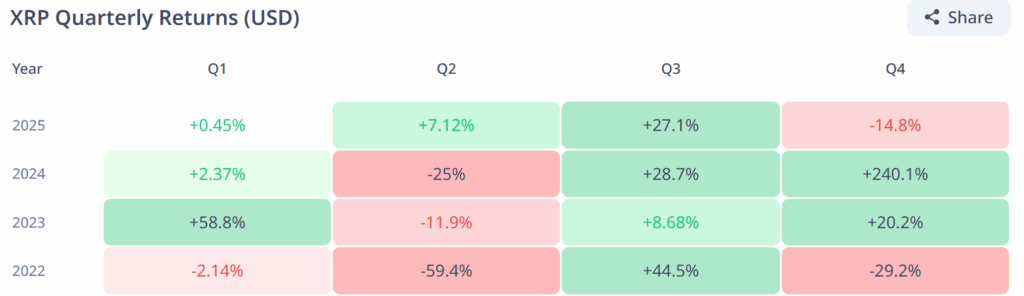

XRP has historically delivered mixed results in the final quarter of the year, with some periods marked by sharp losses and others by impressive rallies. As Q4 2025 progresses, the altcoin is once again drawing attention—this time for growing signs of bullish momentum amid strong on-chain activity and renewed investor interest.

XRP’s Q4 History

Over the past several years, XRP has followed different trajectories in Q4, influenced by both internal developments and broader market trends.

In Q4 2022, XRP was hit hard by the collapse of FTX, which triggered widespread panic across the cryptocurrency market. Billions were wiped out in market value, and XRP ended the year deep in negative territory as investor confidence plummeted.

A year later, in Q4 2023, the asset saw a moderate rebound. Regulatory uncertainty was easing slightly, and sentiment across the crypto space was improving. However, it was Q4 2024 that truly stood out. With the long-running Ripple vs. SEC lawsuit appearing close to a resolution, market optimism soared. The possibility of a favorable outcome for Ripple, coupled with expectations of SEC Chair Gary Gensler’s exit under a Trump administration, led many investors to anticipate a more crypto-friendly regulatory climate.

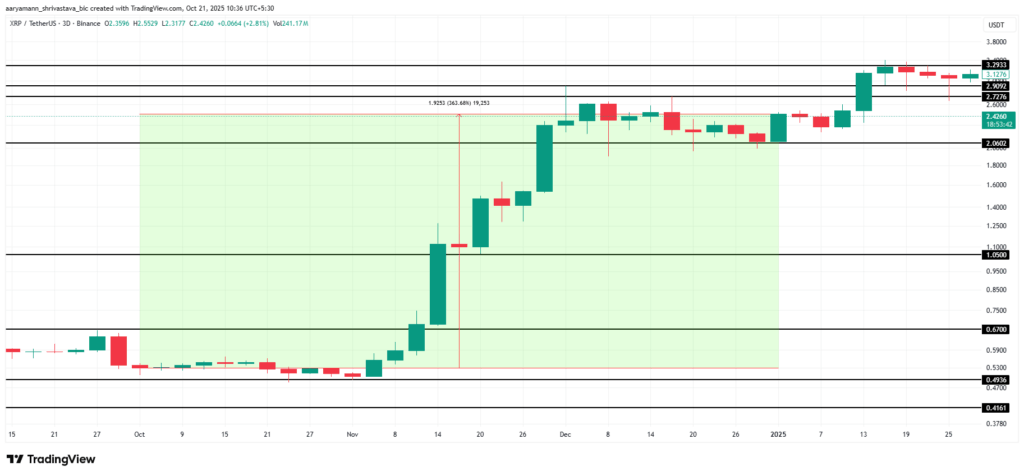

That optimism translated into a massive 363% rally, sending XRP to multi-year highs.

Q4 2025: Bullish Signals Emerge

As we move through Q4 2025, XRP is once again showing signs of strength. According to on-chain data, accumulation is accelerating at one of the fastest rates seen in the past five years.

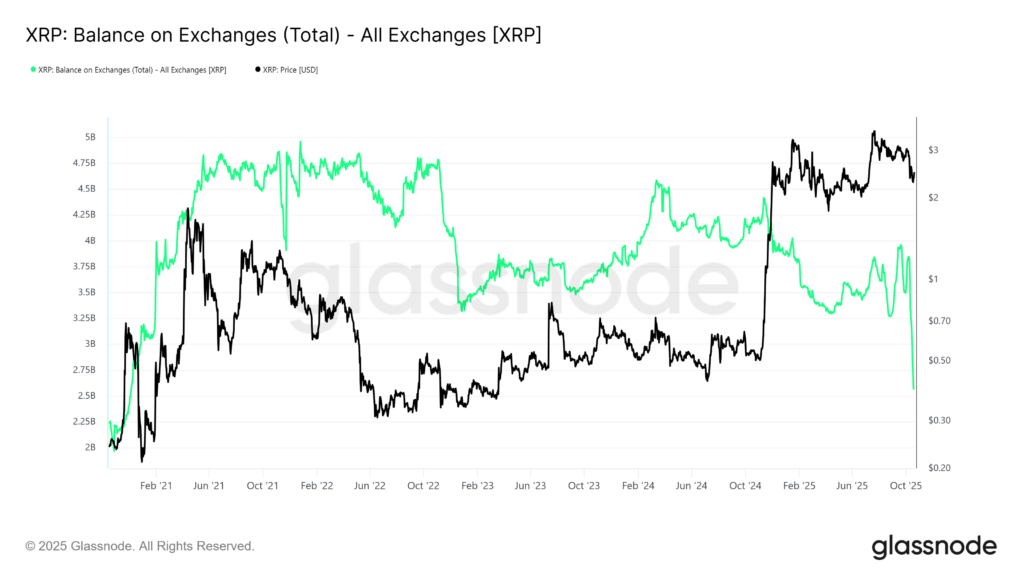

Since early October, more than 960 million XRP—worth approximately $2.3 billion—has been moved off centralized exchanges. This ongoing reduction in exchange-held supply has brought balances down to their lowest levels since 2020. Historically, such patterns have often preceded price surges, as reduced liquidity typically limits immediate sell-side pressure.

This trend signals increasing long-term confidence among holders, especially as XRP consolidates in the wake of a broader market downturn.

Price Outlook: Rebound in Focus

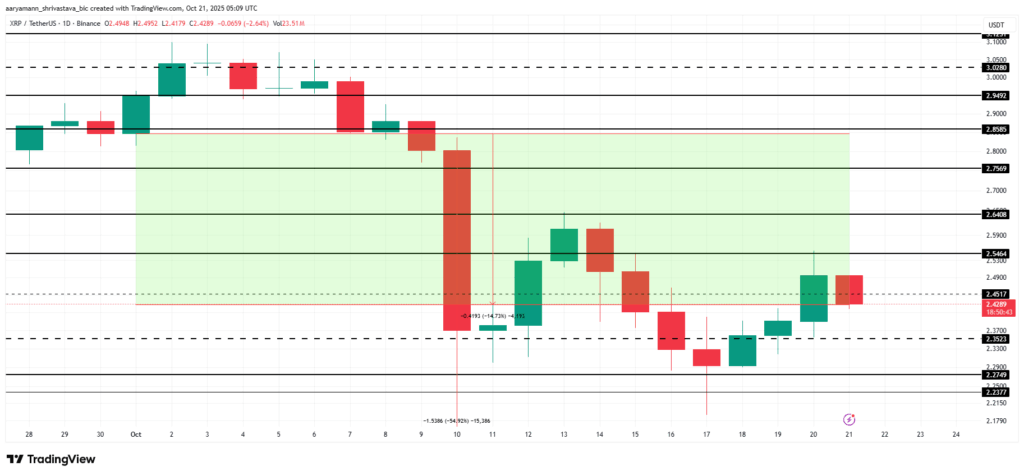

Despite a recent pullback, XRP is beginning to show early signs of recovery. The token is currently trading around $2.42, down 14% month-to-date following a sharp correction across the market. However, the improving sentiment and reduced exchange supply may set the stage for a bullish reversal.

According to market analysts, a decisive close above $2.54 could confirm the start of a recovery phase. If XRP manages to sustain momentum beyond that level, upside targets could extend toward $2.64 and potentially $3.00, especially if historical seasonal trends repeat.

Still, downside risks remain. Should market conditions deteriorate again, XRP may slide below $2.27, with a possible retest of the $2.00 support area. This would invalidate the current bullish thesis and shift momentum back in favor of bears.

Comments are closed.