XRP Price Tests Support as Selling Intensifies

Despite briefly testing higher resistance levels, XRP failed to sustain momentum as heavy selling pressure emerged, leading to a sharp pullback. Profit-taking by investors appears to be the main factor behind the altcoin’s recent decline.

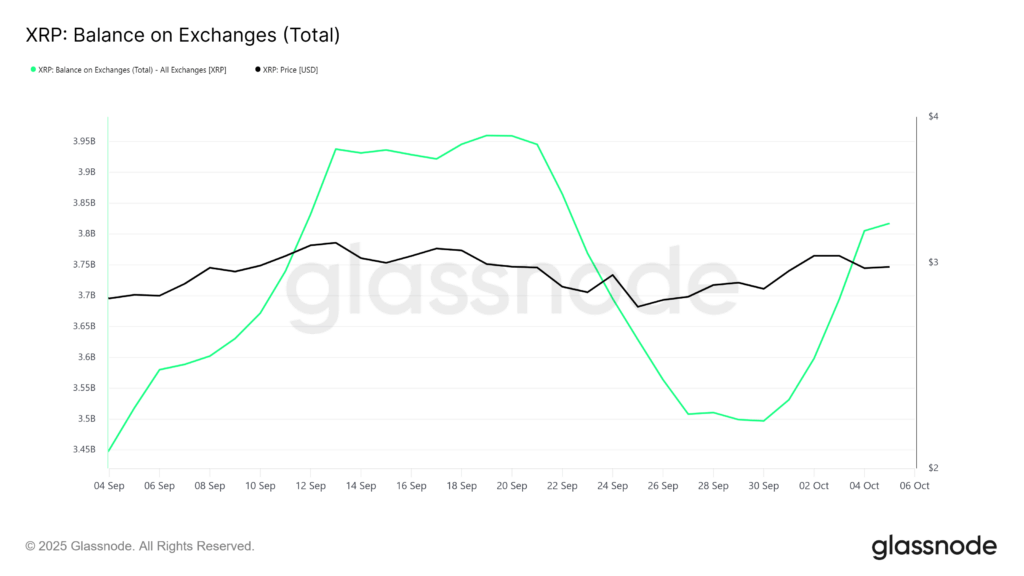

Exchange Inflows Suggest Investor Exit

On-chain data shows a clear rise in exchange inflows. Over the past week, more than 320 million XRP, worth nearly $950 million, were transferred to centralized trading platforms. This shift indicates that investors are moving quickly to secure profits rather than hold for long-term gains.

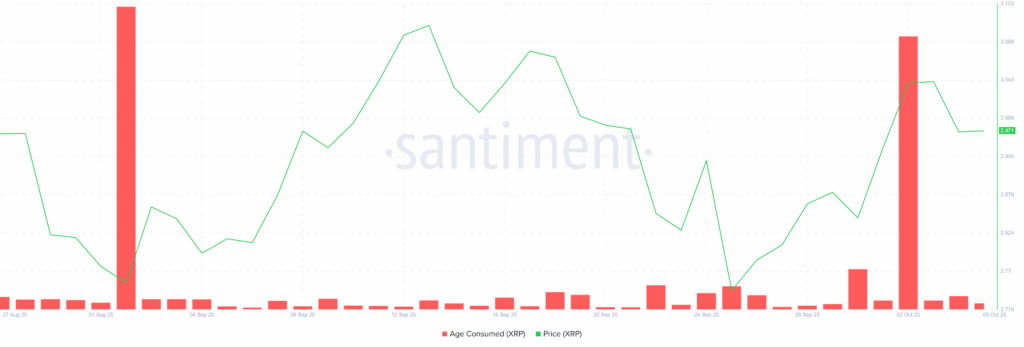

This behavior has weakened market confidence. “Such activity prevents sustainable recoveries and increases volatility,” analysts noted. The Age Consumed metric, which measures movement of older, long-held tokens, also spiked—implying that long-term holders (LTHs) are exiting. Historically, LTH sell-offs are seen as a bearish signal, often dampening both sentiment and liquidity.

Bearish Momentum Builds

With experienced holders cashing out, market sentiment has turned more negative. This wave of exits is reinforcing bearish pressure and discouraging new inflows, making any potential recovery short-lived.

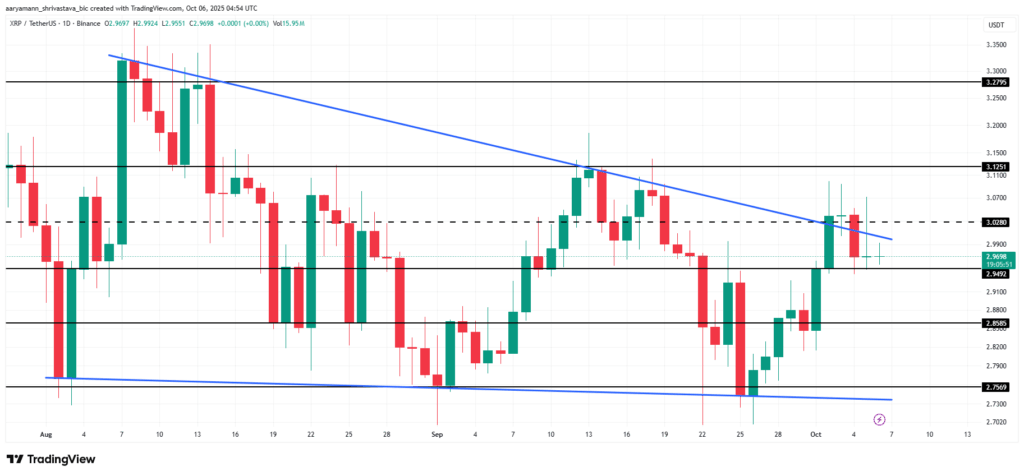

At the time of writing, XRP is trading at $2.96, hovering just above key support at $2.94. The altcoin had previously attempted to break out of its descending wedge pattern, but failed, hinting at further downside risk.

If the current trend continues, XRP may fall toward $2.85, and possibly retest $2.75, confirming bearish dominance. However, a decisive rebound above $3.02 could flip momentum and open a path toward $3.12, offering a chance to invalidate the negative outlook.

Comments are closed.