Early ETF Inflows Push XRP Demand Higher

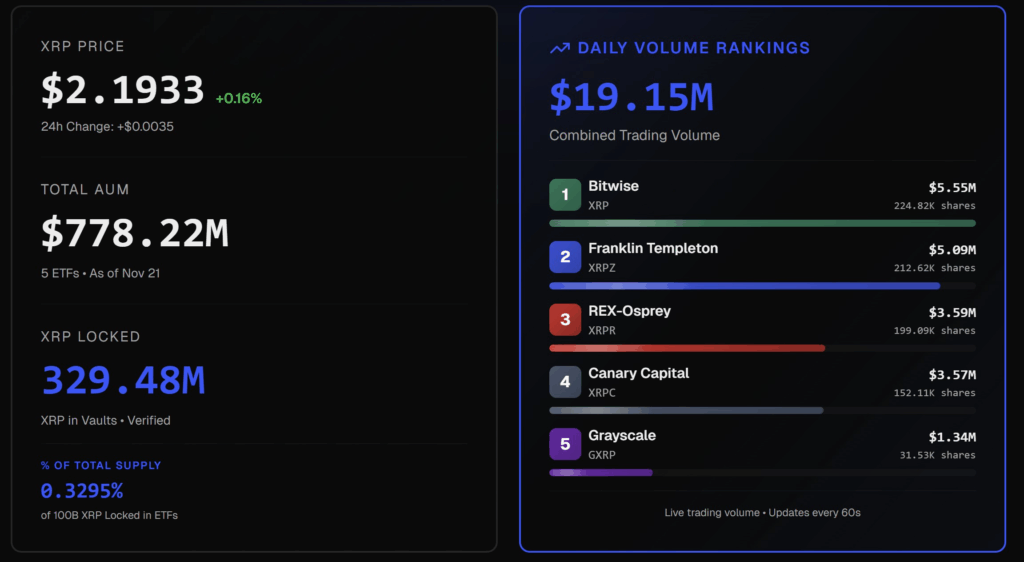

The launch of XRP exchange-traded funds has sparked renewed market optimism, with early inflows showing stronger-than-expected demand. On Nov. 24, Grayscale’s GXRP drew $67.4 million, while Franklin Templeton’s XRPZ attracted $62.6 million, lifting total XRP ETF assets to over $628 million in a single day.

Nearly 80 million XRP were absorbed within 24 hours—surpassing the early inflow momentum seen during Solana’s recent ETF debut, and occurring despite ongoing Bitcoin outflows. Four XRP ETFs are currently active, with Canary’s XRPC, listed on Nasdaq, leading at $331 million in cumulative inflows, followed by Bitwise’s XRP ETF at $168 million.

Analysts note that rapid ETF absorption matters because ETF demand reduces circulating supply. However, the long-term impact depends on whether inflows remain consistent over time.

Market Advocates Highlight ETF’s Influence

XRP community members expressed optimism about the stronger-than-expected launch dynamics. XRP advocate Chad Steingraber noted that “each share is 10 to 20 XRP… a significant bump for the share price,” adding that sustained demand could trigger a FOMO-driven volume surge. According to Steingraber, over time the ETF could become an “influencer of market dynamics.”

The momentum is likely to continue as 21Shares’ TOXR ETF is expected to launch on Nov. 29 on Cboe BZX after receiving S-1 and Form 8-A approval. The new product features a 0.50% fee and seeks $500,000 in seed capital, further expanding U.S. spot XRP exposure.

XRP Tests Key Resistance Levels

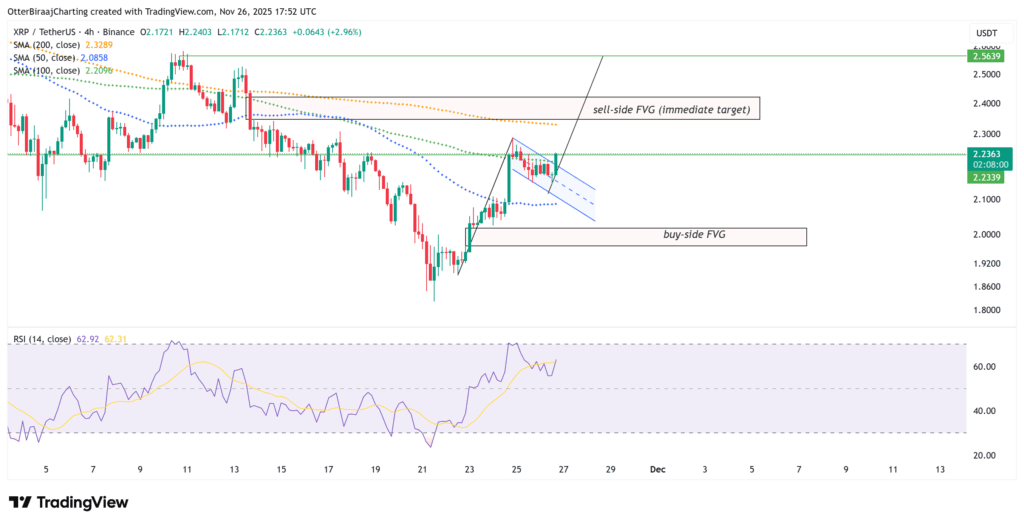

Among the top 10 crypto assets, XRP has been the strongest performer, recovering 5% from a $1.90 pullback to challenge the $2.20 resistance zone.

On the four-hour chart, XRP is forming a bullish flag pattern, with a potential breakout aiming at the $2.35–$2.45 sell-side fair value gap (FVG). A move through this region would sweep liquidity around $2.30 and $2.35.

However, failure to reclaim $2.20 could shift price action toward the $2.10–$2.00 buy-side FVG, where significant liquidity sits. As a result, market signals remain mixed, with no clear short-term directional bias.

The relative strength index (RSI) continues to hold above 50, pointing to sustained short-term demand. Yet XRP still trades below the 50, 100, and 200 EMAs on the four-hour timeframe, indicating that broader trend pressure remains downward.

Comments are closed.