Featured News Headlines

Analyst Willy Woo: MicroStrategy Unlikely to Liquidate in 2027 Downturn

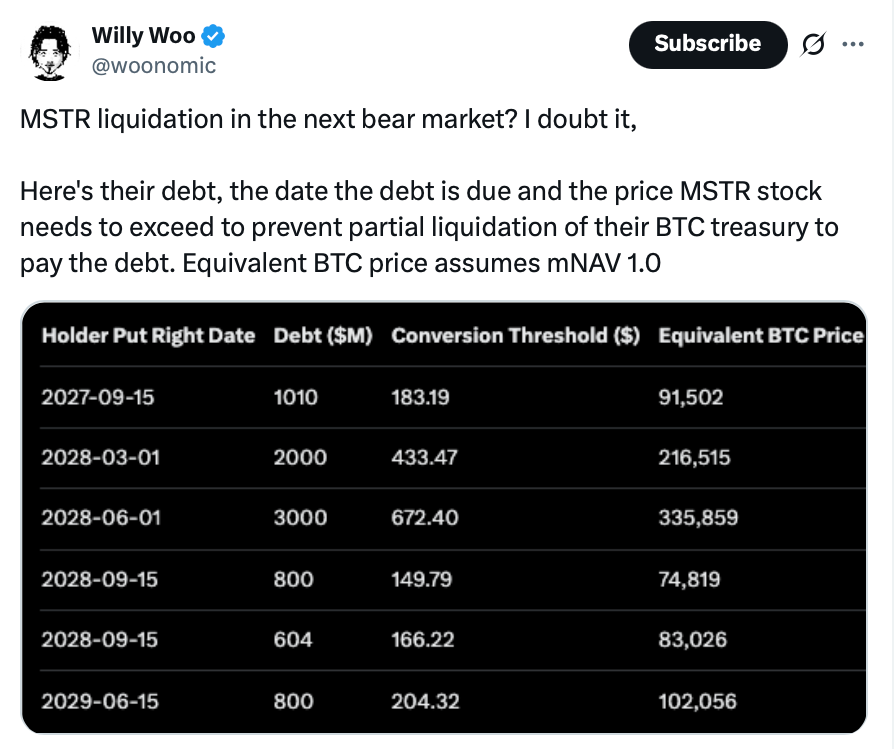

Bitcoin analyst Willy Woo believes Michael Saylor’s company, MicroStrategy (MSTR), will not need to sell any of its vast Bitcoin holdings during the next major market downturn. In a post on X (formerly Twitter) on Wednesday, Woo dismissed the idea that the company would face liquidation if the crypto market were to enter another extended bear phase.

“MSTR liquidation in the next bear market? I doubt it,”

said Woo.

Debt Structure Keeps MicroStrategy Safe

MicroStrategy’s debt is largely composed of convertible senior notes, which allow the company to settle payments in cash, common stock, or a mix of both when they come due. The firm has about $1.01 billion in debt maturing on September 15, 2027.

According to Woo, the company would only face repayment pressure if its stock price dropped below $183.19, which corresponds to a Bitcoin price of roughly $91,500, assuming a multiple net-asset-value (mNAV) of 1. This means that as long as Bitcoin remains above that level, MicroStrategy would not need to liquidate its assets.

Bitcoin analyst The Bitcoin Therapist echoed Woo’s sentiment, noting that it would take an unusually severe and prolonged market downturn for MicroStrategy to be forced to sell any Bitcoin.

“Bitcoin would have to perform horribly in the next market downturn for MicroStrategy to have to start selling,”

they said.

“It would be one hell of a sustained bear market to see any liquidation for Strategy.”

Bitcoin Holdings and Market Performance

MicroStrategy currently holds about 641,205 Bitcoin, valued at roughly $64 billion, according to data from Saylor Tracker. Despite recent market weakness, the firm’s position remains strong. On Tuesday, MicroStrategy’s stock closed at $246.99, marking a seven-month low after falling nearly 6.7%. Meanwhile, Bitcoin traded at $101,377, down almost 10% over the past week, according to CoinMarketCap.

Possibility of Partial Liquidation

While Woo is confident that MicroStrategy will weather the next downturn, he did acknowledge one potential risk scenario.

“Ironically, there’s a chance of a partial liquidation if BTC doesn’t climb in value fast enough in an assumed 2028 bull market,”

Woo warned.

This outlook suggests that MicroStrategy’s long-term stability remains tied to Bitcoin’s continued growth. Optimists such as ARK Invest CEO Cathie Wood and Coinbase CEO Brian Armstrong remain bullish, forecasting that Bitcoin could reach $1 million by 2030.

For now, Woo’s analysis indicates that even in turbulent times, Saylor’s Bitcoin strategy remains resilient—provided the cryptocurrency avoids a prolonged collapse.

Comments are closed.