Featured News Headlines

Bitcoin Price in Focus as Uptober 2025 Nears

With October just days away, crypto analysts are debating whether markets will repeat their historical trend of surging during the month often dubbed “Uptober.”

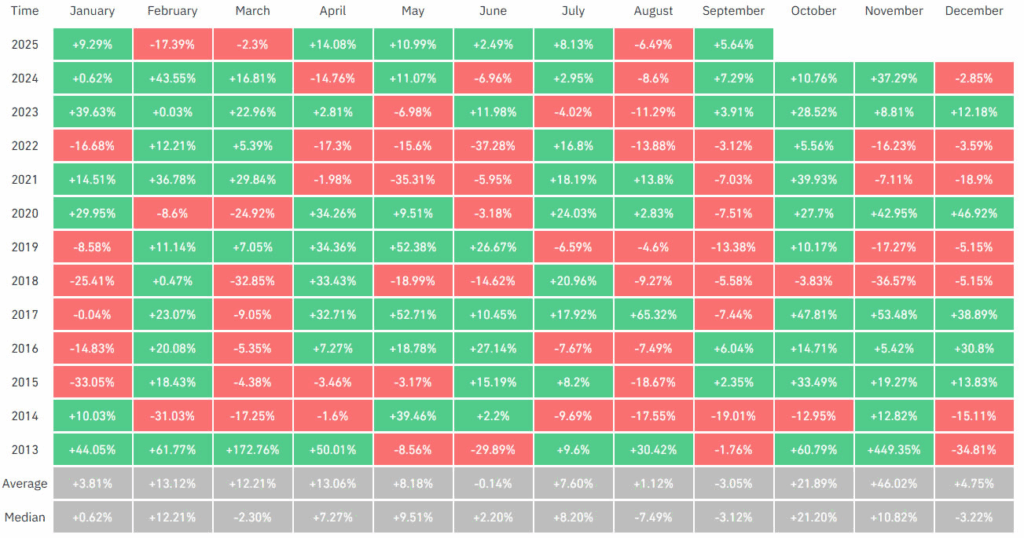

October: A Historically Bullish Month for Bitcoin

Since 2013, Bitcoin has posted positive returns in October 10 out of 12 times, according to data from CoinGlass. The last red October was in 2018, when BTC dropped 3.8%. Notably, during the bull runs of 2017 and 2021, Bitcoin soared 48% and 40% respectively in the same month.

If October follows a similar pattern this year, Bitcoin could rise from its current level of around $112,690 to approximately $165,000, according to some optimistic projections.

Analysts Cite Liquidity and Fed Policy

Bitcoiner Kyle Chassé noted on Monday that odds for a Federal Reserve rate cut next month have risen to 92%, citing CME futures data. “The easing cycle is basically priced in, and liquidity is on the way,” he said, adding that this liquidity could act as “fuel Bitcoin and crypto thrive on.”

Meanwhile, analyst Sykodelic shared a cautious short-term outlook before a potential surge. “$112,500 is the number, and when we get there… it’s on to new highs and the start of the explosive final leg,” they said.

Arthur Hayes, co-founder of BitMEX, predicted that markets would shift into “up only mode” once the U.S. Treasury finishes refilling the Treasury General Account, which recently topped $850 billion.

Not Everyone Is Convinced

Others remain skeptical. Augustine Fan of SignalPlus warned that any rally may be “relatively muted” due to low volatility and persistent profit-taking.

Jeff Mei, COO at BTSE, added: “We think the Uptober trend is less likely to occur this year given the macro uncertainty.”

Comments are closed.