Featured News Headlines

Rheinmetall Stock Forecast: What the Latest Decline Means for Investors

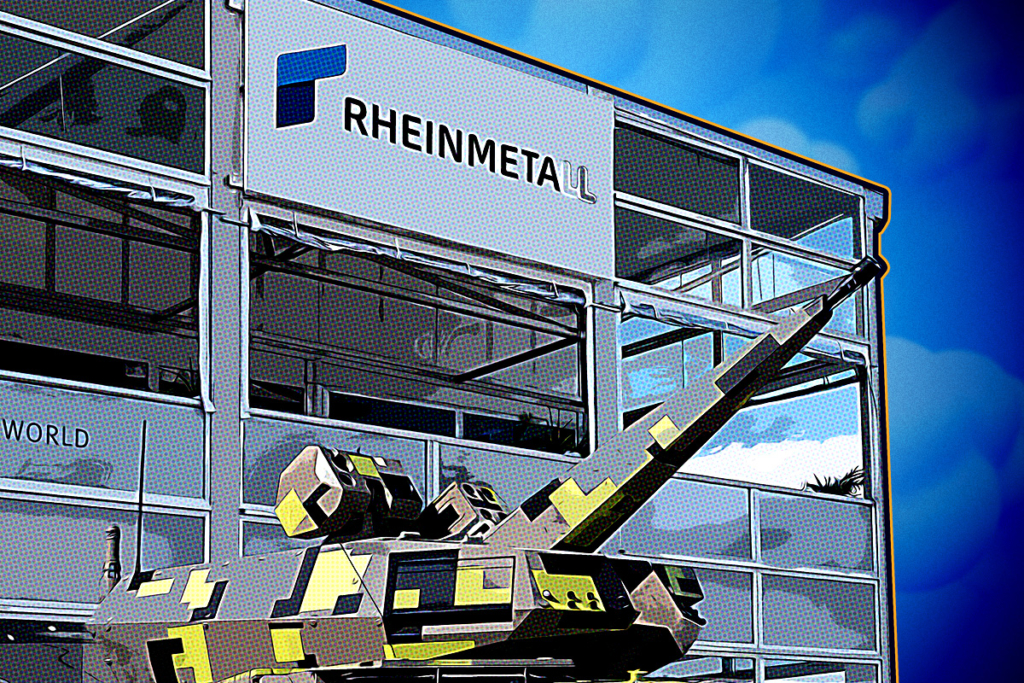

Rheinmetall, a major player in the defense and technology sector, saw its stock price drop unexpectedly today, raising questions among investors and analysts. While the company has shown strong performance in recent months, this downturn appears to stem from a mix of internal factors and broader market concerns. This article breaks down the possible causes, market reactions, and what this could mean for investors looking ahead.

What’s Behind the Recent Decline?

The fall in Rheinmetall’s share price isn’t random. Multiple factors—ranging from macroeconomic concerns to specific company developments—are likely at play.

One of the key reasons may be delays in defense contracts or changes in government spending plans. Rheinmetall’s business is closely tied to national defense budgets, and any shift in those budgets, whether due to elections, political uncertainty, or broader economic adjustments, can quickly impact investor confidence.

At the same time, global market sentiment toward defense-related stocks has become more cautious. As economic concerns rise and investors reassess risk across sectors, even traditionally stable industries like defense are not immune to sell-offs.

Profit-Taking Could Be a Factor

Rheinmetall’s stock had been on a strong upward trajectory in recent months, outperforming many of its peers. For some investors, today’s drop may be a natural phase of profit-taking—selling off after a rally to secure gains. This type of selling pressure can accelerate declines, even when there’s no fundamental change in the company’s outlook.

Cost Pressures and External Risks

Another element that could be influencing the stock is the rising cost of production. Increases in raw material prices and energy costs are affecting many industrial and manufacturing firms. If Rheinmetall is experiencing these pressures, it may lead to tighter margins—something investors always watch closely.

Political developments may also be playing a role. As geopolitical conditions shift, uncertainty about future military spending priorities or international defense collaborations can weigh on sentiment. Even if the long-term outlook remains intact, short-term hesitation can lead to stock volatility.

Analyst Reactions and Market Sentiment

Changes in analyst ratings or price targets often influence short-term stock movements. A downgrade or even a cautious revision in outlook can prompt both retail and institutional investors to reduce their positions.

Currently, analysts appear divided. Some point to near-term risks—including delays in project execution and tightening budgets—while others maintain a positive long-term view, citing strong fundamentals and a growing global demand for defense solutions.

Is This a Buying Opportunity?

For value-focused investors, a sudden drop in price can signal a potential buying opportunity—but only if the underlying fundamentals remain strong.

Rheinmetall’s financial health, order backlog, and global footprint in both defense and automotive sectors suggest that the company is not facing a structural decline. If current weakness is tied to temporary factors, this dip could represent an attractive entry point.

Still, timing matters. Some investors prefer to wait for confirmation of price stabilization before re-entering the market. Monitoring volume, support levels, and company announcements can help identify when the downward trend may be reversing.

Uncertainty is a normal part of investing, especially in sectors influenced by politics, economics, and global events. In times like these, having a balanced, informed approach is key.

Following credible financial news, reviewing official statements from the company, and keeping an eye on industry developments can help investors make more confident decisions. Portfolio diversification remains one of the best ways to protect against volatility in any single stock.

Comments are closed.