Featured News Headlines

Whale Moves and Technical Indicators Highlight Downside Risk

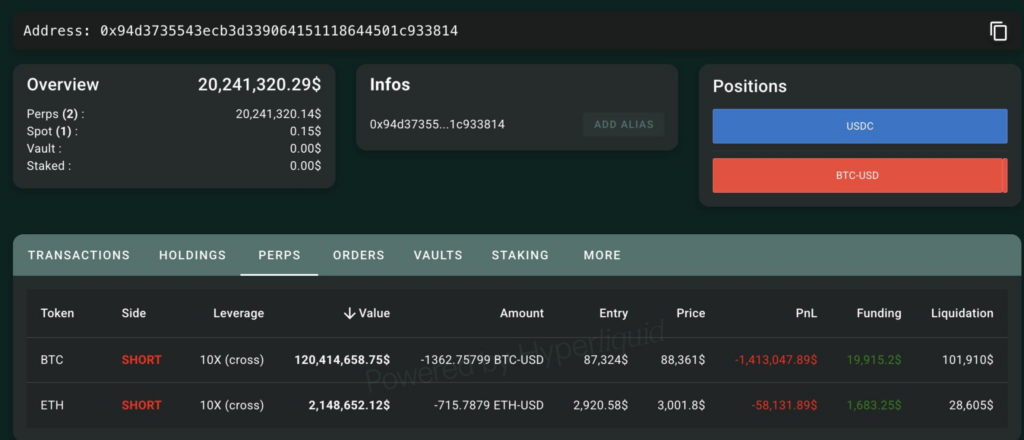

On-chain data reveals that a major whale wallet, identified as 0x94d3, has significantly increased its downside exposure after previously reducing Bitcoin holdings earlier this week. Blockchain analytics firm Lookonchain reports that the wallet sold 255 BTC last Friday, valued at $21.77 million, with an average sale price of $85,378 per Bitcoin.

Leveraged Shorts on Bitcoin and Ethereum

Following this partial exit from spot holdings, the whale aggressively shifted into leveraged short positions. On Friday, the wallet opened 10× leveraged shorts: 876.27 BTC worth approximately $76.3 million and 372.78 ETH, valued near $1.1 million. By Monday, the wallet expanded these positions, adding 486.49 BTC and 343.01 ETH, bringing total exposure to 1,362.76 BTC ($120.41 million) and 715.79 ETH ($2.15 million).

On-Chain Metrics Indicate Unrealized Losses

Current on-chain metrics show that the Bitcoin short has an average entry price of $87,324, with liquidation estimated around $101,910. With Bitcoin trading near $88,361, the position has an unrealized loss of approximately $1.41 million. Ethereum’s short, entered around $2,920 with a liquidation near $28,605, shows an unrealized loss of about $58,131 at the current $3,001 market price.

Technical Indicators Suggest Downside Risk

Analyst CryptoOnchain notes that selling pressure continues to dominate Bitcoin’s price, which currently hovers near its Point of Control (POC)—a key level often acting as support or resistance. Failing to reclaim prior highs could put Bitcoin at risk of a drop toward $70,000–$73,000. A bearish divergence in the RSI further indicates potential for deeper pullbacks.

Citi Outlook Highlights Market Uncertainty

Citigroup recently echoed caution in its research note, emphasizing wide-ranging potential outcomes for Bitcoin over the next year. In a bearish scenario, Bitcoin could fall to $78,000, whereas a bullish scenario could see prices reach $189,000, underscoring the significant uncertainty currently affecting the market.

These developments illustrate that while the crypto market shows tentative recovery signs, aggressive whale activity and technical signals suggest that underlying volatility and downside risk remain prominent.

Comments are closed.