Featured News Headlines

- 1 WazirX Exchange Promises Fund Recovery Within 10 Days After Court Approval

- 2 The Road to Recovery After North Korean Attack

- 3 Ten-Day Timeline Promise Sparks Hope

- 4 Previous Plan Rejected Over Regulatory Concerns

- 5 New Structure Shifts Operations to India and Panama

- 6 User Frustration Mounts Despite Approval

- 7 Legal Challenges and Long-Term Concerns

WazirX Exchange Promises Fund Recovery Within 10 Days After Court Approval

WazirX exchange users are finally seeing light at the end of the tunnel, more than a year after losing $234 million in a devastating hack that shook the crypto community. In a decisive vote, 95% of creditors have approved a new restructuring plan that could pave the way for fund recovery within days.

The Road to Recovery After North Korean Attack

The saga began in mid-July 2024 when WazirX suffered a catastrophic security breach, losing $234 million worth of cryptocurrency from a Safe Multisig wallet. The attack, later attributed to North Korean hackers, forced the exchange to immediately halt all crypto and Indian rupee withdrawals, leaving hundreds of thousands of users locked out of their funds.

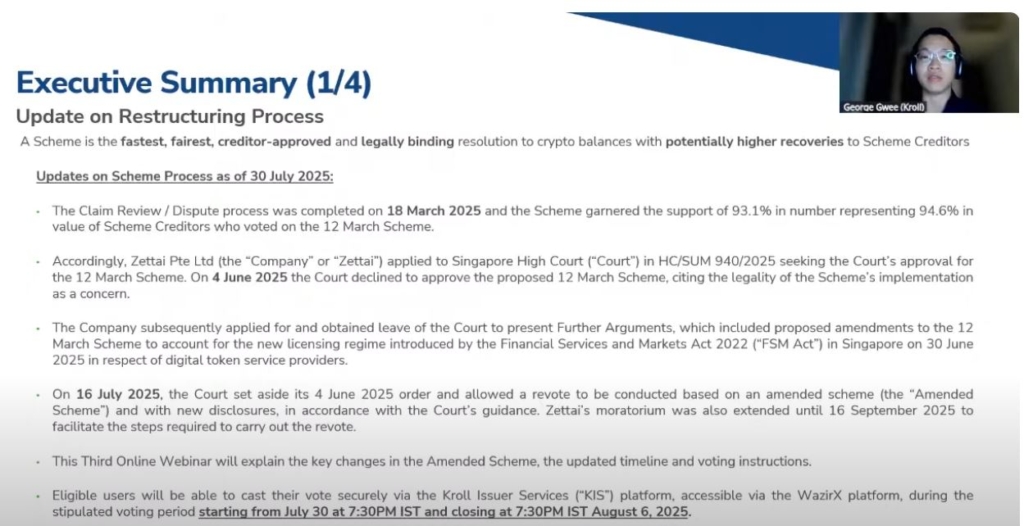

Nearly 150,000 creditors participated in the recent voting process between July 30 and August 6, representing over $206 million of the lost funds. The overwhelming approval marks a crucial step toward resolving one of India’s largest cryptocurrency exchange hacks.

Ten-Day Timeline Promise Sparks Hope

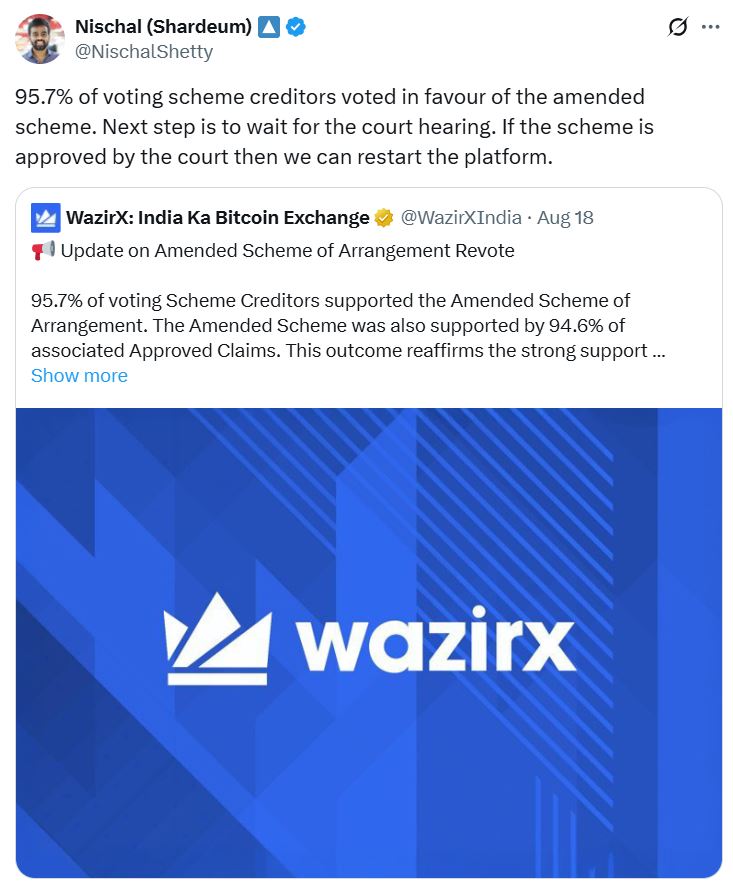

WazirX founder Nischal Shetty made headlines Monday with his bold promise that if the Singapore High Court approves the latest restructuring proposal, the exchange would restart operations and begin compensating users within just 10 days of the scheme taking effect.

This optimistic timeline represents a dramatic improvement from earlier estimates. During a July 30 town hall, George Gwee, a director at restructuring firm Kroll working with WazirX, had suggested users might wait two to three months after court approval before receiving any compensation.

Previous Plan Rejected Over Regulatory Concerns

The current proposal marks the second attempt at a restructuring plan. Users had approved a similar scheme back in April, but the Singapore High Court rejected it due to concerns about how recovery tokens would interact with Singapore’s proposed regulatory framework for digital token service providers.

The court’s decision came amid Singapore’s regulatory crackdown, with the central bank setting a June 30 deadline for local crypto service providers to cease offering digital token services to overseas markets.

New Structure Shifts Operations to India and Panama

A significant change in the approved plan involves the compensation structure. Under the amended scheme, recovery tokens will still be repurchased using net profits from the exchange, but distribution will now be managed through Zanmai India, a reporting entity under India’s Financial Intelligence Unit jurisdiction.

The restructuring also involves corporate relocations. WazirX’s parent company Zettai was originally based in Singapore, but following the court ruling, it incorporated a subsidiary called Zensui Corporation in Panama and transferred the platform’s cryptocurrency-related services operations there.

User Frustration Mounts Despite Approval

Despite the overwhelming vote approval, the WazirX community remains divided. Users on X and Reddit who supported the restructuring plan expressed fatigue with the prolonged saga and hope for at least partial fund recovery.

However, skeptical users raised concerns about ongoing delays, regulatory complications highlighted by the High Court, and the corporate structure changes. Some argued that holders of unhacked coins would suffer losses because token values have risen significantly since the security breach.

Legal Challenges and Long-Term Concerns

WazirX has repeatedly warned that without creditor approval of the restructuring plan, repayments could stretch until 2030 through traditional asset liquidation processes. Some users are pursuing legal action, though a separate Supreme Court of India judgment in April dismissed a petition from 54 hack victims, citing lack of authority over crypto policy matters.

The recovery tokens represent remaining claims not covered by initial distributions and track users’ outstanding balances. Token holders are expected to receive periodic additional distributions funded by WazirX profits and recovered assets.

While the creditor approval represents significant progress, the ultimate timeline for fund recovery now rests with the Singapore High Court’s decision on the restructuring proposal.

Comments are closed.