Record BTC Options Expiry Could Trigger Sharp Holiday Volatility

On December 26, a record $23 billion worth of options contracts are scheduled to expire, bringing Bitcoin closer to a significant derivatives event. Both institutional and individual investors are keeping a close eye on this expiry due to its size. Market participants are getting ready for increased volatility because positioning is tilted toward the upside, and liquidity is anticipated to be low because of the holiday season. According to the arrangement, even small flows could cause significant price movements.

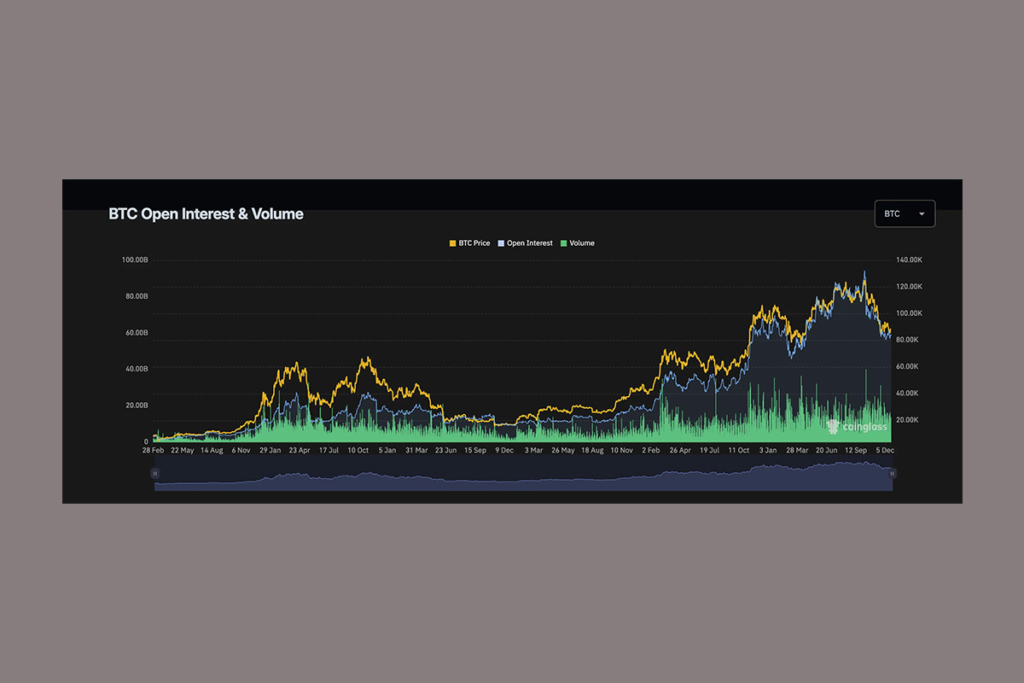

Record Bitcoin Options Expiry Signals Major Volatility Ahead

Market data indicates that this is the biggest Bitcoin options expiry ever. A significant concentration of call options at higher strike prices is evident in open interest. This indicates that instead of actively hedging against negative risk, traders are placing bets on more upside. Conversely, put options are concentrated at lower levels, indicating locations where support is thought to exist.

The present trading range of Bitcoin is in close proximity to the maximum pain level. This raises the possibility that prices will compress prior to expiration and then fluctuate sharply once holdings are liquidated or rolled over. In the past, when hedges were unwound and open interest reset, such huge expiries frequently resulted in abrupt volatility.

Bullish Put-to-Call Ratio Sets Stage for Post-Expiry BTC Move

The put-to-call ratio is still skewed in favor of calls. Despite Bitcoin trading below recent highs, this indicates an increasing sense of optimism. Expecting a post-expiry breakout rather than a significant correction, traders seem willing to keep their upside position.

Another level of danger is introduced by the timing. Holiday weeks, when market liquidity is usually weaker, coincide with the expiration. Large orders can affect prices more readily under such circumstances. Sharp intraday fluctuations are more likely as a result of this dynamic, which also intensifies the effects of derivative flows.

All things considered, the $23 billion expiry underscores the growing significance of derivatives in the movement of Bitcoin prices. The options markets are now a major source of short-term volatility, and institutional participation is still increasing. December 26 stands out to investors as a crucial date that might determine the course of Bitcoin’s next significant development.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.