Vitalik Buterin Highlights Prediction Markets Lack Interest

Vitalik Buterin, a co-founder of Ethereum, has added his voice to the continuing discussion about prediction markets. In an article published on Farcaster on Sunday, Buterin stated that the majority of significant prediction markets do not offer interest. He claims that this reduces their appeal for hedging. In order to participate, he claimed, customers would have to forgo a guaranteed yield of about 4% annually on stable dollar-denominated investments.

I expect lots of hedging use cases to open up once that gets solved and volumes increase more,

Buterin

Polymarket Volume Drops but Active Users Rise

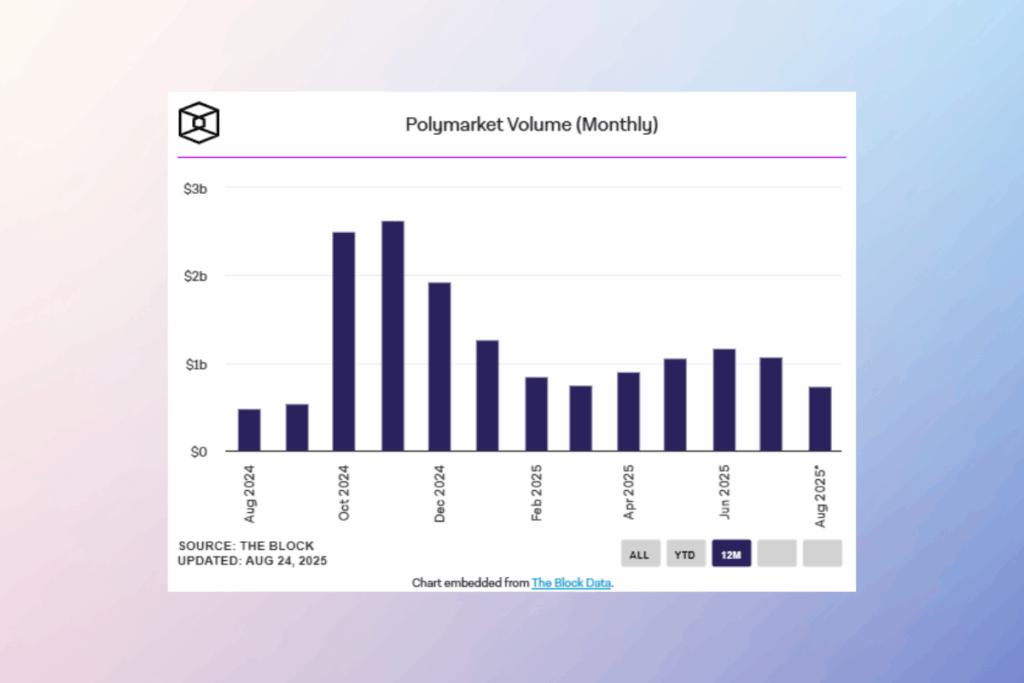

Buterin made the remark as Polymarket‘s volume dropped last month. As to The Block’s data dashboard, the prediction markets platform’s volume in July decreased to $1.06 billion from $1.16 billion in June. However, from 242,340 in June to 286,730 in July, there were more active traders on Polymarket.

The average user traded smaller in July even as the platform’s total users grew. Yet unlike the number of active traders, the number of new markets on the platform has consistently increased every month since Polymarket’s inception, reflecting expansion and diversification beyond the platform’s early politics-heavy focus.

Brandon Kae and Ivan Wu, researchers at The Block

Prediction Markets Set to Expand as Polymarket User Base Grows

Polymarket’s consistent growth in active users and additional markets indicates a growing prediction platform ecosystem, even though overall trading volume has slightly decreased. According to analysts, as these platforms broaden their scope beyond their original emphasis on politics, there may be a greater opportunity for cutting-edge financial products and hedging techniques. Analysts expect that prediction markets may soon draw in a larger investor base due to increased institutional interest and the possible integration of yield-bearing mechanisms, opening up new use cases for casual and professional traders alike. Resolving the present lack of interest, as Buterin pointed out, may be a crucial driver of long-term growth and market acceptance in the months to come.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.