Featured News Headlines

Visa’s Stablecoin to Unlock Billions in Liquidity and Transform Payments

Visa, the global payments giant, has revealed plans to launch its own stablecoin under the Visa Direct program, signaling a major push towards modernizing cross-border payments and reducing transaction costs.

Redefining Cross-Border Transactions with Stablecoins

Announced at SIBOS 2025, Visa’s stablecoin aims to significantly lower fees and enhance efficiency for businesses by enabling direct card funding with stablecoins. Chris Newkirk, President of Commercial & Money Movement Solutions at Visa, emphasized that Visa Direct’s integration with stablecoins is designed to enable instant global money movement, giving businesses more flexibility and faster payment options.

Having processed an impressive $15.7 trillion in payment volumes in 2024, Visa’s stablecoin entry could accelerate adoption across both retail and institutional sectors.

Solana Emerges as the Go-To Blockchain for Stablecoins

Visa’s move comes at a time when the stablecoin market is flourishing, boasting a market cap near $299 billion and daily trading volumes exceeding $180 billion.

Notably, Solana has become a favored platform for stablecoin projects due to its fast and low-cost infrastructure. The Trump-backed USD1 stablecoin, launched on Solana earlier this year, quickly became the fifth-largest stablecoin with a $2.68 billion market cap—a testament to Solana’s growing dominance.

The Market Outlook: Bullish Signs for Solana

Solana’s ecosystem is valued at approximately $14.13 billion, and with Visa potentially listing its stablecoin on Solana, the network’s growth momentum could accelerate further.

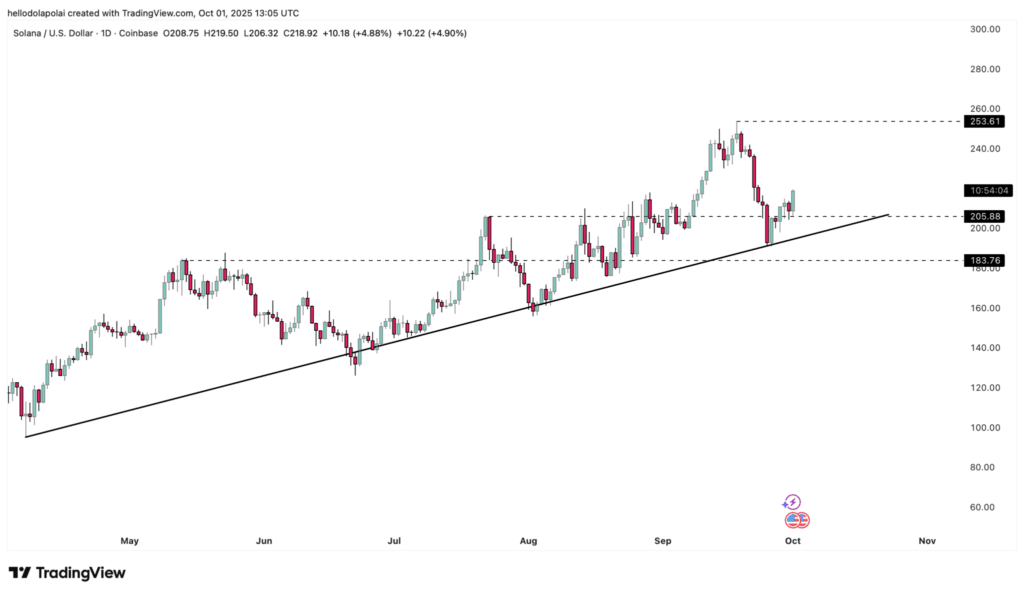

Technically, Solana’s price showed strength after bouncing from an ascending support line, gaining 7.22% in the last 24 hours and currently hovering near $205.88. Analysts remain optimistic that the bullish trend will continue through the week, with a potential to reclaim the $253 level.

Visa’s strategic stablecoin initiative and Solana’s rise highlight a pivotal moment in the crypto space, where traditional finance meets blockchain innovation—ushering in a new era for digital payments.

Comments are closed.