Featured News Headlines

BTC Demand Holds Despite Shutdown Concerns as Altcoin Sentiment Weakens

Bitcoin – The looming U.S. government shutdown is sending ripples across global markets, and the crypto sector is no exception. With the probability of a shutdown climbing from 60% to 70%, traders are bracing for volatility as Bitcoin (BTC), XRP, and other major assets already printed weekly lows on September 25.

A report from Forbes suggested that the shutdown could last at least a week if Congress fails to agree on funding, potentially deepening bearish sentiment. For altcoins in particular, the risks appear higher, especially as BTC dominance edges closer to 60%, up 4% in recent weeks.

Options Market Signals Short-Term Caution

Data from the options market highlights the prevailing uncertainty. Bitcoin’s 25-Delta Skew—a key gauge of call versus put demand—fell by 8% across both 1-week and 1-month contracts, signaling increased short-term hedging and stronger demand for bearish puts.

In contrast, the 3-month skew remained steady near 8%, suggesting that traders see potential recovery later in Q4. This mid-term optimism reflects a shift toward bullish bets, hinting that downside fears may ease once immediate macro risks pass.

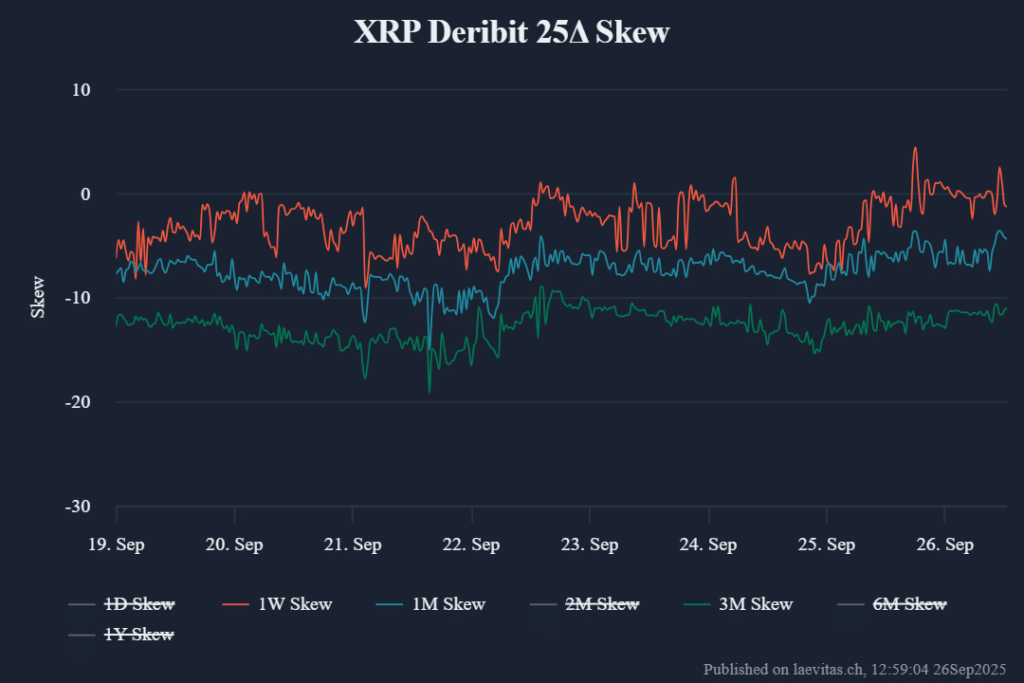

XRP Faces Neutral to Negative Outlook

While BTC showed resilience, XRP sentiment remained flat to negative across all tenors. Analysts warn that if Bitcoin continues to gain market share, altcoin momentum could stall further—posing a challenge for traders eyeing potential altcoin ETF approvals in October.

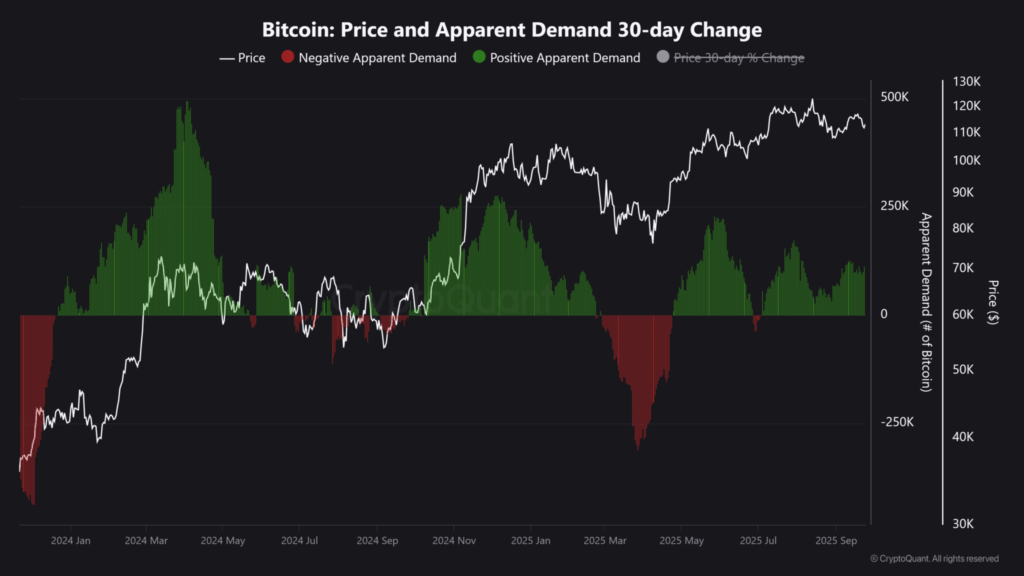

BTC Demand Holds Firm Despite Pullback

Despite recent pullbacks, demand from ETFs and crypto treasuries has stayed steady after a September surge. If institutional appetite picks up again in Q4, BTC could see renewed strength. However, any slowdown, similar to Q1 trends, might weigh on prices.

At the time of writing, BTC traded at $109K, while XRP hovered at $2.7, reflecting a cautious but diverging outlook heading into Q4.

Comments are closed.