Featured News Headlines

TRX Price: Can TRX Sustain Momentum and Break Resistance?

TRX Price– TRON is making waves again. Over 8.29 million USDT transactions last week highlight a growing adoption trend among retail and institutional users alike. The surge is mainly fueled by mid-sized transfers ranging from $101 to $1,000, accounting for nearly 39% of activity. This signals TRON’s expanding role in remittances, freelance payments, and crypto commerce. Meanwhile, tiny microtransactions under $10 have dropped to just 5.63%, reflecting a maturing ecosystem moving beyond small transfers.

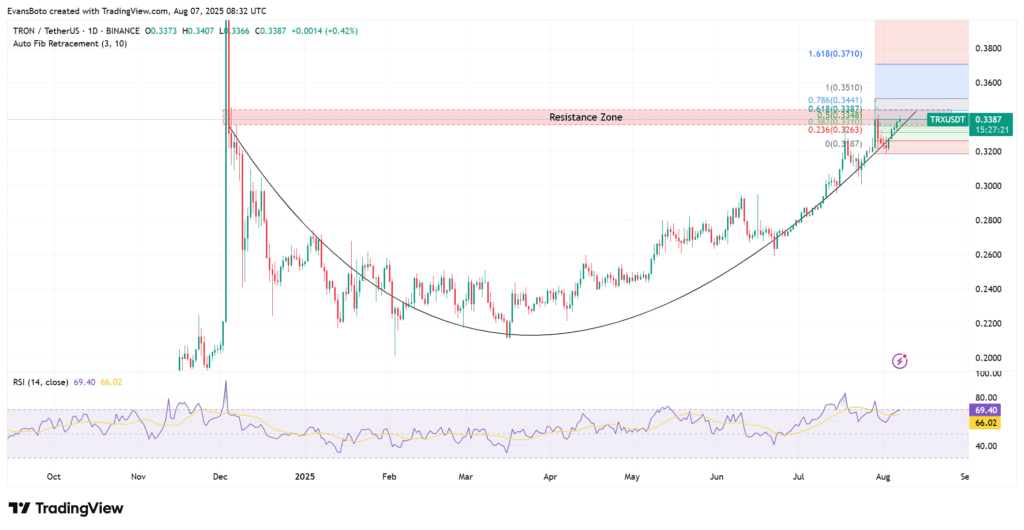

Approaching Critical Resistance: Will TRX Break Out?

Since mid-June, TRX has climbed from around $0.26 to $0.3393, forming a steep upward curve. Now, it faces a key resistance zone between $0.344 and $0.351 — a battleground defined by the 0.786 Fibonacci level and prior price rejections. Breaking above this zone could push TRX to the next target at $0.371 (1.618 Fibonacci extension), confirming a bullish trend. But a rejection here could mean retesting lower supports, making the coming days crucial for momentum.

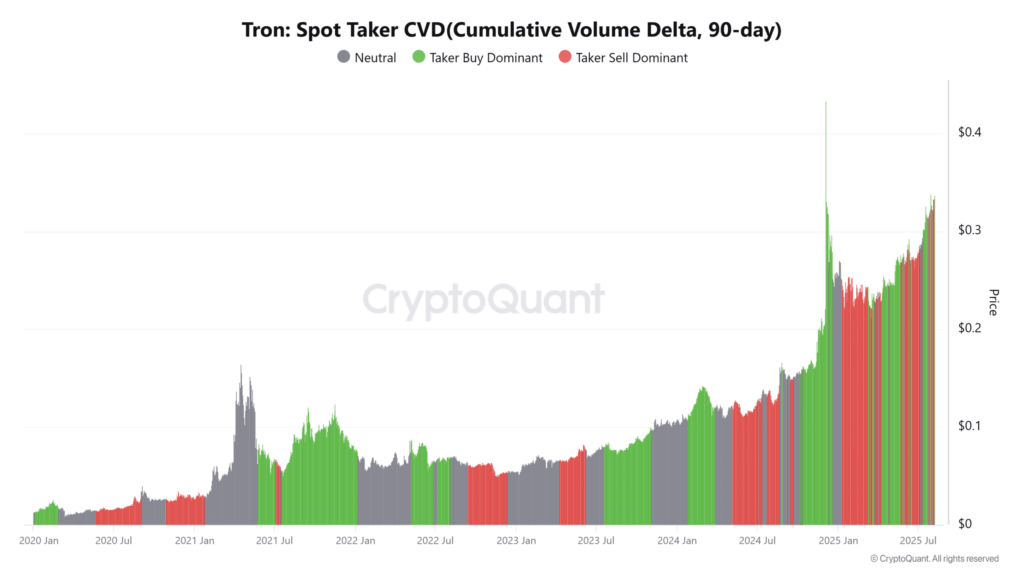

Strong Spot Market Demand Backs TRX Rally

Spot market data reveals buyers dominating with consistent taker buy activity, signaling genuine demand—not speculative hype. This urgent buying pressure supports TRX’s current price and suggests the rally could sustain if resistance flips into support.

High Profitability Lowers Sell-Off Risk

An impressive 96.38% of TRX holders are currently profitable, reducing the likelihood of panic selling near resistance. This strong profitability sets the stage for patient, long-term holders to stay invested, smoothing any breakout attempts.

Derivatives Boost Confidence but Caution Remains

Rising futures volume (+11.77%) and open interest (+6.82%) indicate increased trader confidence and positioning for continued upside. Yet, traders should watch funding rates closely to avoid volatility triggered by overleveraging.

Comments are closed.