Price Consolidates, Whales Position Strategically

Since reaching $9.25 on September 1, the Official Trump (TRUMP) memecoin has remained range-bound, trading between $8.10 and $8.50. This tight consolidation phase reflects a cooling market, yet investor interest—particularly among whales—remains strong.

While retail traders appear cautious, large holders are reportedly positioning for the token’s next big move.

Futures Activity Suggests Bullish Outlook

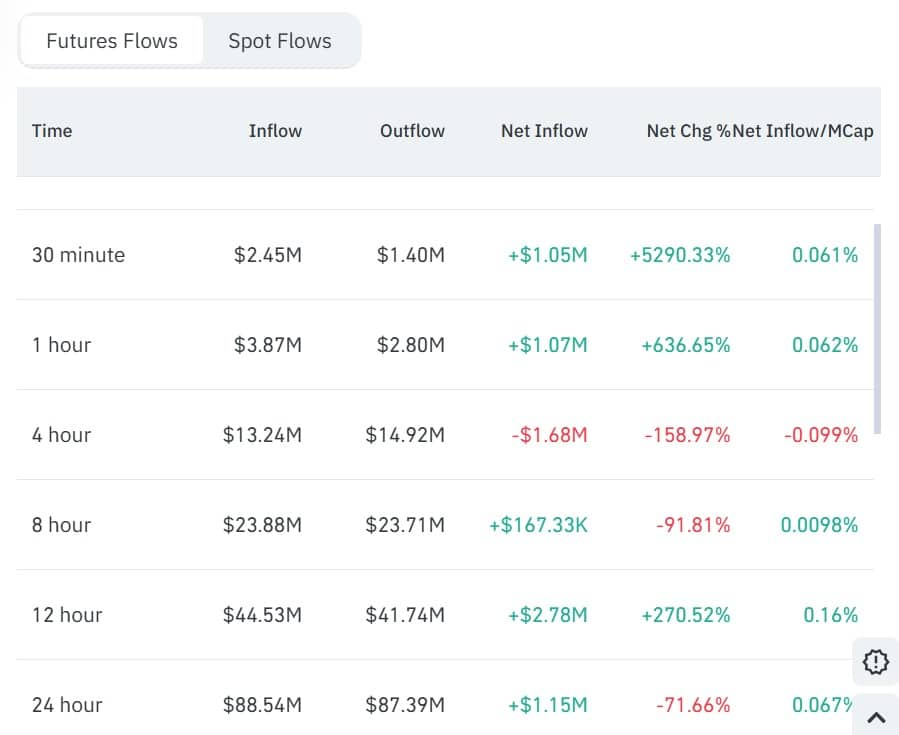

According to CoinGlass data, TRUMP Futures recorded $88.54 million in inflows against $87.39 million in outflows over the past 24 hours, resulting in a net inflow of $1.15 million. The Long/Short Ratio surged to 3.61, with 78% of traders holding long positions. “Such dominance typically signals bullish sentiment,” CoinGlass noted.

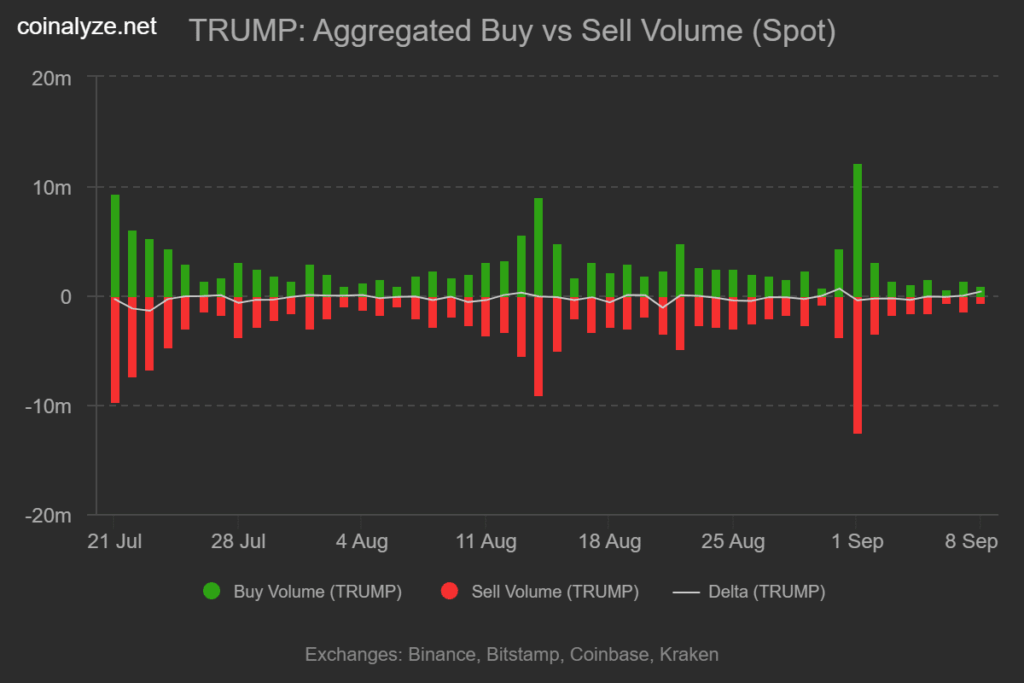

In contrast, spot trading paints a more bearish picture. Coinalyze reported a negative Buy/Sell Delta for seven of the past eight days, with $23.49 million in sell volume compared to $22.17 million in buys. This $1.32 million delta highlights ongoing selling pressure.

Additionally, CoinGlass observed two consecutive days of positive Spot Netflow—$3.73 million at press time—often a precursor to increased sell-side activity.

Whales Continue Accumulating

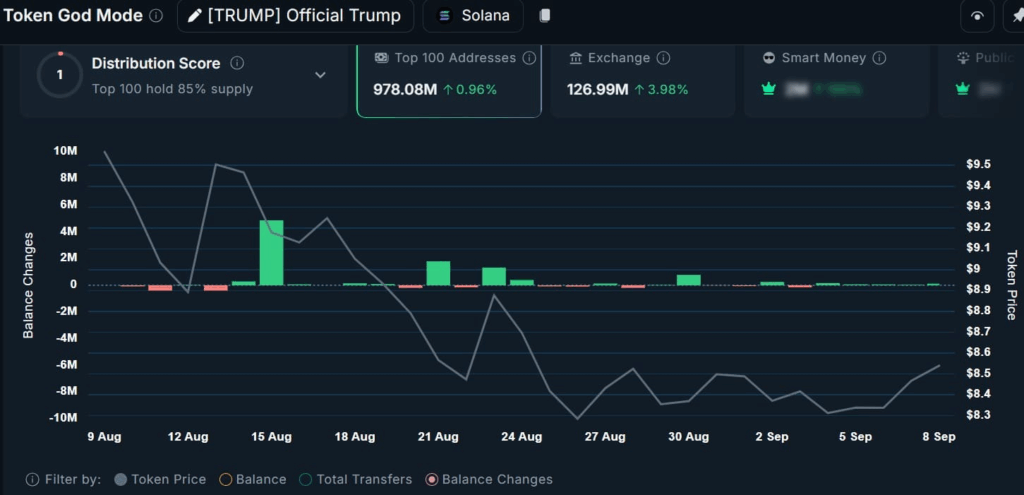

Despite the market cooling, whale accumulation remains steady. Blockchain analytics platform Nansen noted that TRUMP’s top holders increased their balances by 121,000 tokens in the last 24 hours—up from 44,000 the previous day.

“A positive Balance Change typically indicates whale buying,” Nansen reported, reinforcing long-term bullish sentiment.

TRUMP is currently trading above both its 9-day and 21-day moving averages, signaling short-term bullish momentum. However, it’s still below its Parabolic SAR at $9.16. A close above this level is needed to confirm a bullish reversal. Failure to do so may lead to a drop toward the $8.43 or $8.20 support zones.

Comments are closed.