Old Bitcoin Wallets Dumping Holdings: Is the Bull Run at Risk?

Bitcoin’s (BTC) rise has halted above $120,000 since mid-July. Early Thursday, prices reached a fresh high of $124,457, but they have since retreated to $121,872 due to a lack of impetus. One of the questions that needs to be asked is who is selling their Bitcoin and driving the market down. Observers claim that blockchain data, which demonstrates that old wallets have been selling off their holdings, holds the solution.

It may be linked to concentrated selling pressure from long-term holders who have recently accelerated their selling. Historically, long-term holders’ selling phases are cleanly defined within the bitcoin cycle. This time, however, accumulation during Q2’s pullback has given way to renewed selling, suggesting the market’s structure may be shifting.

Gabriel Halm, senior blockchain analyst at Sentora

Over 300,000 BTC Sold by Long-Term Holders in Just 4 Weeks

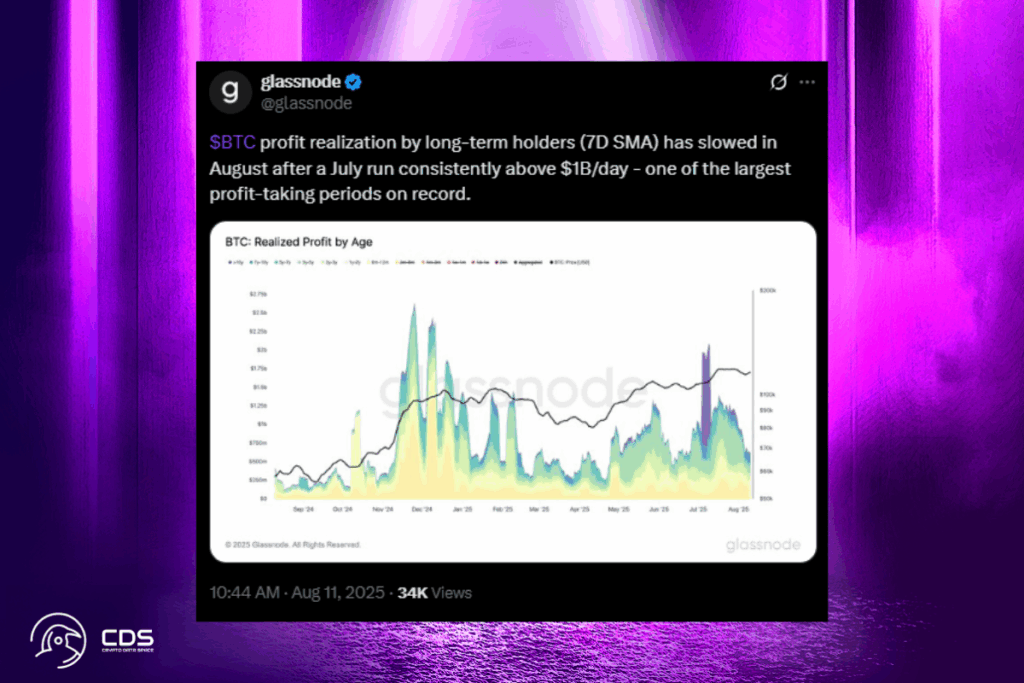

According to Bitcoin Magazine, in just four weeks, the amount of Bitcoin controlled by long-term holders has decreased by more than 300,000 BTC. The past four weeks have seen the reactivation of several wallets that have not been used for more than ten years, allowing them to transfer coins on the chain for the first time in years. These movements are thought to be motivated by the desire to make money. Long-term holders are still taking profits, although at a slower pace than in July, according to a statement released last week by blockchain analytics company Glassnode.

$BTC profit realization by long-term holders (7D SMA) has slowed in August after a July run consistently above $1B/day – one of the largest profit-taking periods on record,

Glassnode

The Obstacles to Bitcoin Rising Above $120,000

According to Sam Gaer, chief investment officer of the Directional Fund of Monarq Asset Management, the supply from old wallets has been limiting the upside but has been well-absorbed overall. He went on to say that this is consistent with the trend observed when the German state of Saxony sold off its interests last year.

Price levels in BTC have tended to consolidate around psychological levels (think $100,000, $110,000, $120,000) and specifically around ATH levels. This same pattern was seen just last month at the $110,000 level as we touched all-time highs at the 112 area and then drifted lower several times,

Gaer

The rally speed may have been impacted by institutions’ repeated selling of higher strike calls. Usually, they do this to supplement their spot market holdings with an extra yield. Gaer claims that the so-called call overwriting has caused a collapse in volatility.

For more up-to-date crypto news, you can follow Crypto Data Space.

[…] and convertible debt issuance, relying on the stock consistently trading above the value of its Bitcoin holdings. Without that premium, the model weakens […]