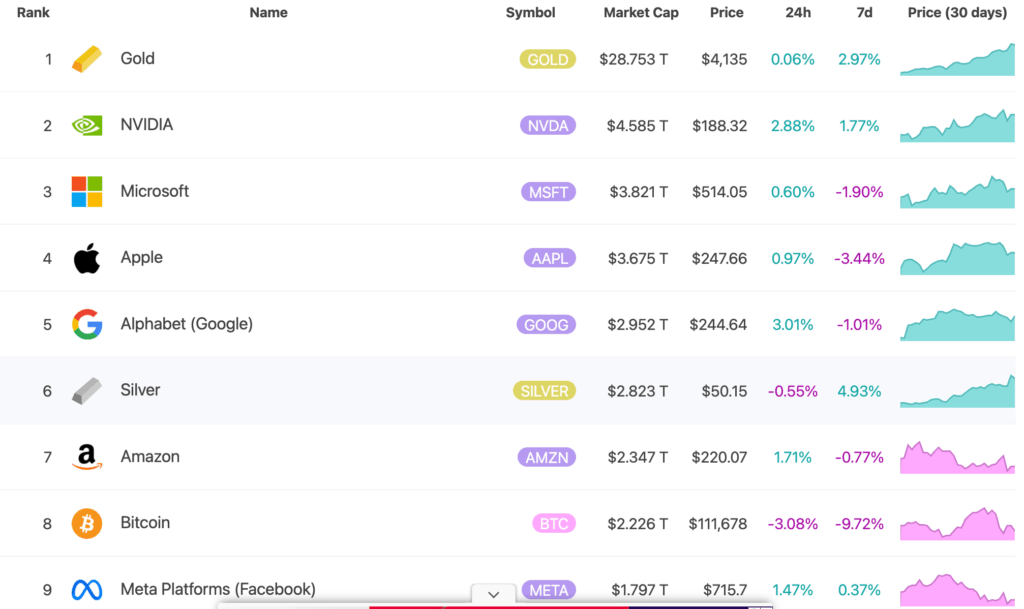

Silver Outshines Bitcoin in Market Capitalization

Global markets are experiencing a notable shift as silver climbs to its highest price level in nearly 45 years. This surge marks a significant milestone for the precious metal, fueled by an unprecedented increase in physical demand. Large-scale purchases and deliveries from international depositories highlight a renewed investor interest in tangible assets.

Alongside silver, gold is also showing strength, moving upward in tandem. In contrast, leading cryptocurrencies like Bitcoin and Ethereum have faced sharp declines following recent market turbulence dubbed “Crypto Black Friday.” As silver’s market capitalization ascends, it has even surpassed Bitcoin, signaling a divergence between traditional and digital asset classes. This contrast raises questions among investors about the potential emergence of a bearish phase for cryptocurrencies relative to precious metals.

Diverging Paths: Precious Metals vs. Cryptocurrencies

Prominent economist Peter Schiff commented on the current trend, noting, “Gold and silver continue to melt up as Bitcoin and Ether continue to melt down. Crypto buyers are in for a rude awakening and will soon learn a very valuable but expensive lesson. Fortunately, most crypto owners are young with lots of time to earn back what they’re about to lose.”

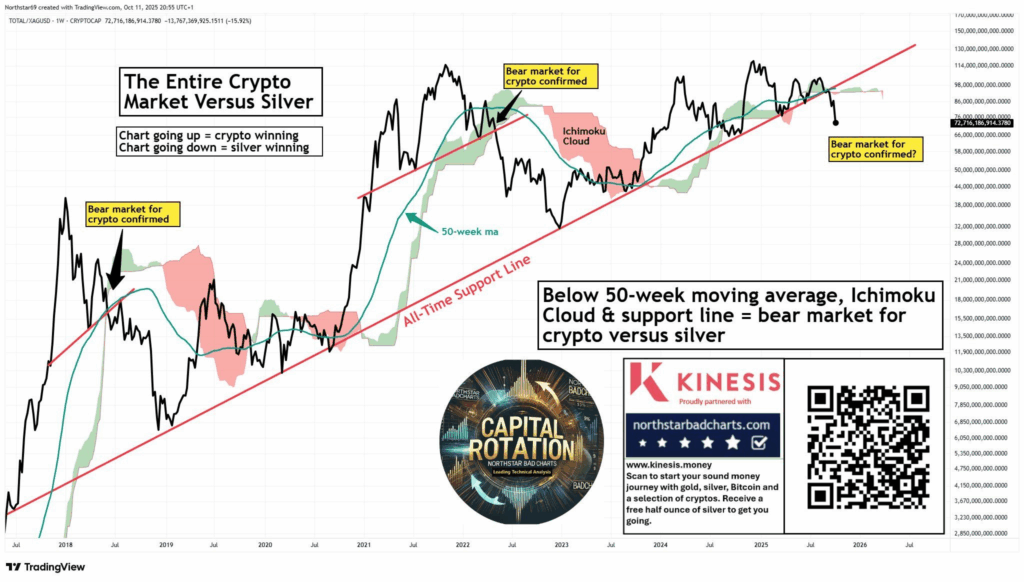

Technical analysis also indicates troubling signals for Bitcoin. Analyst Northstar pointed out that cryptocurrencies reached their peak relative to silver about four years ago. Since the highs of 2021, the Bitcoin-to-silver ratio has steadily declined and is currently experiencing another steep drop. Stories from investors recount heavy losses, such as one trader who saw their portfolio plunge by 80% in mere hours during the Crypto Black Friday event. Notably, this individual had previously been a strong proponent of silver before shifting into higher-risk crypto assets.

The Rotation Between Tangible and Digital Assets

This evolving dynamic illustrates a cyclical rotation between physical and digital investments. Concerns about an impending recession and persistently high interest rates are prompting a return to traditional safe havens. Commodity strategist Mike McGlone has suggested that the next market downturn, possibly expected in late 2025, could trigger a “mean reversion” effect in the crypto space, where valuations may adjust closer to fundamental worth.

Silver’s rise is attributed not only to its limited supply but also to a changing investor mindset. Growing apprehension about the stability of the U.S. financial system and escalating national debt is leading investors toward assets perceived as “real” and tangible.

Despite the recent trends, veteran investor Max Keiser remains optimistic about Bitcoin’s future, stating that it “remains the superior scarce asset, capable of outperforming everything else in the long run.” He suggests that while volatility is part of the journey, Bitcoin may regain investor interest as acquiring gold and silver becomes increasingly difficult over time.

Comments are closed.