Debasement Trade Explained: How Institutions Hedge Against Fiat Decline

Financial institutions are increasingly recognizing a phenomenon known as the “debasement trade,” which is drawing renewed attention to assets like gold and Bitcoin.

Entrepreneur Anthony Pompliano described this emerging trend in a recent podcast, explaining that institutions are now embracing what gold enthusiasts and Bitcoin advocates have long emphasized: “no one is ever going to stop printing money.” He noted, “This now feels like there is no longer a debate about this. People realize the dollar and bonds are going to have a lot of trouble moving forward, and therefore Bitcoin and gold are definitely benefiting.”

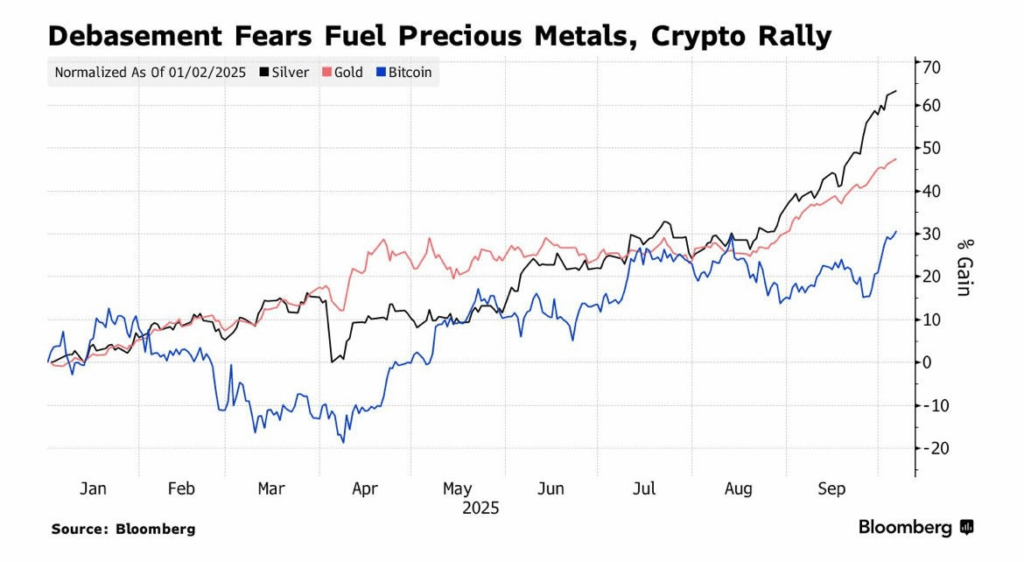

The debasement trade refers to an investment strategy focused on safeguarding value as fiat currencies lose purchasing power due to monetary expansion and central bank money printing. Investors look to assets believed to retain or grow in value despite currency debasement. Gold, for instance, has increased by 50% this year, while Bitcoin has also drawn significant interest.

Jeff Park, Chief Investment Officer at ProCap BTC, remarked, “We’ve been wanting to see private wealth management and financial advisers come to embrace Bitcoin as an allocation [in portfolios].”

Matt Hougan, CIO of Bitwise, likened the debasement trade to “the dark matter of finance. You can’t quite touch it, but it affects everything.” Onramp Bitcoin’s Chief Strategy Officer, Brian Cubellis, further explained: “Deficits mount, debt stacks higher, and accommodative policy suppresses real yields… Investors who expect ongoing dilution look for a yardstick that will not change on them, and that search shows up across both gold and Bitcoin.”

Bitcoin stands apart as more than just digital gold. Enrique Ho, CFO of Blink Wallet, highlighted Bitcoin’s unique attributes: “It is anti-debasement by design: fixed supply, transparent issuance, and trustless verification,” adding it represents “the purest expression of capital preservation in a world where money itself is being repriced.”

The weakening of the US dollar is reflected in the US Dollar Index (DXY), which has dropped about 12% this year, hitting a three-year low in mid-September before a slight rebound in October.

Comments are closed.