Tether’s Gold Purchases Surpass National Demand

Tether, the world’s largest stablecoin issuer, has emerged as the top buyer of gold in the third quarter, outpacing demand from several central banks.

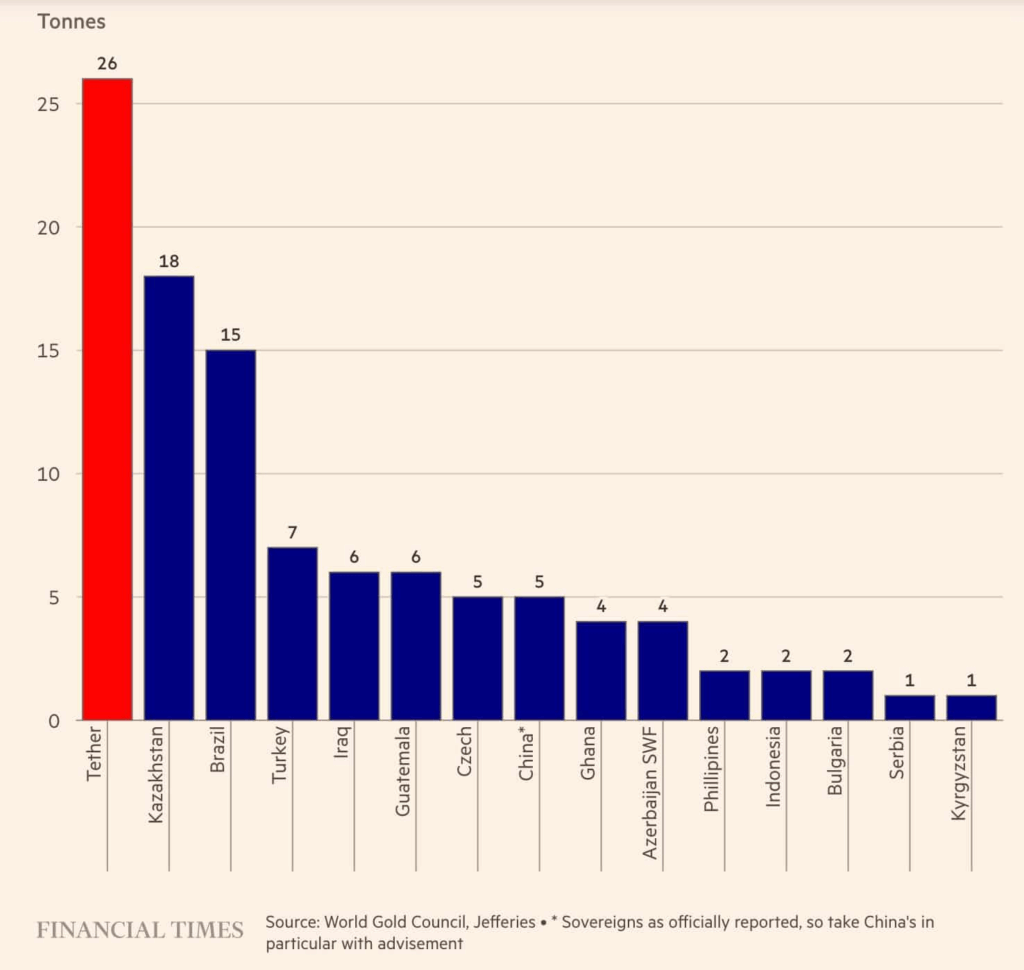

According to aggregated data reported by the Financial Times (FT), Tether acquired 26 tonnes of gold, surpassing purchases made by the central banks of Kazakhstan and Brazil. Investment bank Jefferies noted that Tether is now the largest holder of gold outside central banks, citing the company’s 116 tonnes of gold disclosed in its September reserve attestation.

Jefferies added that Tether’s gold reserves now “roughly equal that of smaller central banks, such as Korea, Hungary, and Greece.”

Rising Demand for Tokenized Gold

Gold has long been a part of the reserves backing Tether’s USDT stablecoin. But alongside the surge in gold prices, demand for Tether Gold (XAUT) — the company’s tokenized gold product — has also climbed sharply.

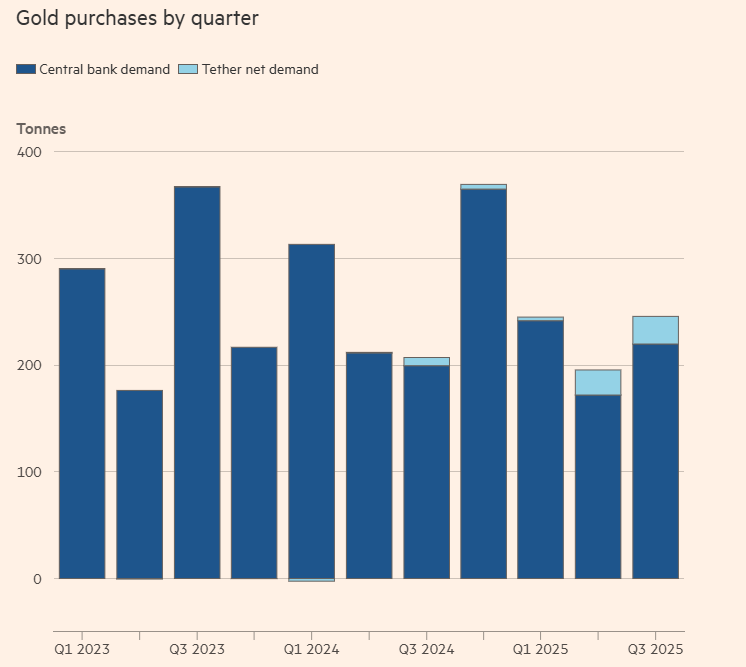

In 2024, Tether’s net quarterly demand for physical gold ranged between 3 and 7 tonnes. In 2025, that number surged to 23.5 tonnes in Q2 and 25.9 tonnes in Q3. Over the same period, gold’s price jumped by nearly 40%, rising from $3,000 to $4,300.

Analysts at Jefferies suggested that Tether has become a new demand driver in the gold market and “could have been a catalyst behind the rally.”

The bank also noted that Tether may be positioning itself for a future in which tokenized gold gains mainstream adoption, similar to the rise of stablecoins.

Retail Demand Shifts Toward On-Chain Gold

Jefferies highlighted that many retail investors face barriers when buying traditional gold ETFs due to high fees and minimum investment requirements. This has increased interest in digital alternatives.

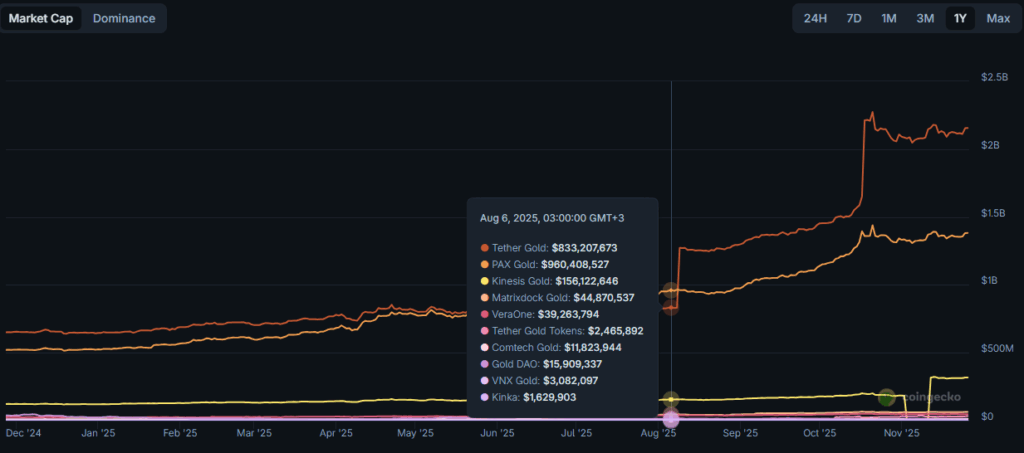

As a result, tokenized gold products such as Tether Gold (XAUT) and Pax Gold (PAXG) have become increasingly appealing, especially as they do not carry ETF restrictions and can be held directly on-chain.

In 2025, tokenized gold supply reached an all-time high of $3.9 billion, seeing inflows comparable to stablecoins.

Comments are closed.