STRK Momentum Continues Amid Massive On-Chain Inflows

For the past 30 days, Starknet (STRK) has maintained its momentum in the market. In just seven days, the asset increased by 80.6%. As volume rose rapidly during the past 24 hours, the price increased by a further 21%, reaching $0.2499 at the time of publication. Additionally, Starknet has had a significant on-chain inflow. This has bolstered the strong rally over the past day. A total of $10.16 million worth of STRK has been bought and secured for long-term storage under a number of processes. A long-term perspective is reflected in this activity. By locking assets in pools and preparing for a wider market rally, investors hope to collect income.

Investors Watch STRK at Crucial Liquidity and Resistance Zones

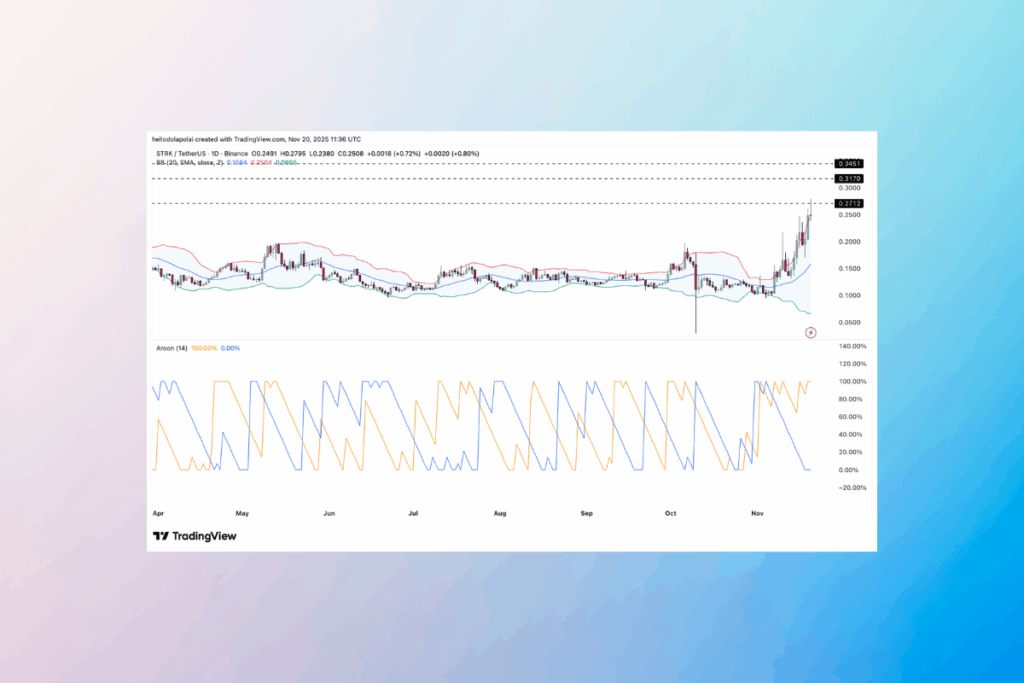

On-chain activity is showing an increasing trend that has reached a crucial point. It is now essential to have new liquidity. The price has entered the previously rejected $0.27 area on the chart. The Doji candlestick’s formation, which indicates increasing selling pressure at that level, supports this. STRK may move down the chart if selling volume continues. However, two crucial levels to keep an eye on if bulls take back control are $0.317 and $0.345. These zones are still significant because they show fair value gaps, or places on the chart where there are still a lot of unfulfilled orders. The price frequently offers support for a possible rally when it gets close to these zones.

Starknet’s Uptrend Faces Heat Warning From Bollinger Bands

There are conflicting readings on the technical indicators on the possibility of an ongoing rally. STRK may continue its upward trend, according to the Aroon indicator, which gauges trend strength. The Aroon Down line (blue) is still declining and getting closer to the 0% level, while the Aroon Up line (orange) stays at 100%. The Bollinger Bands show a warning indication because the price has entered the overvalued area, even though this pattern indicates positive conditions. When the price crosses the upper band, this happens. It indicates that the asset might be overheated and may undergo a brief correction.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.