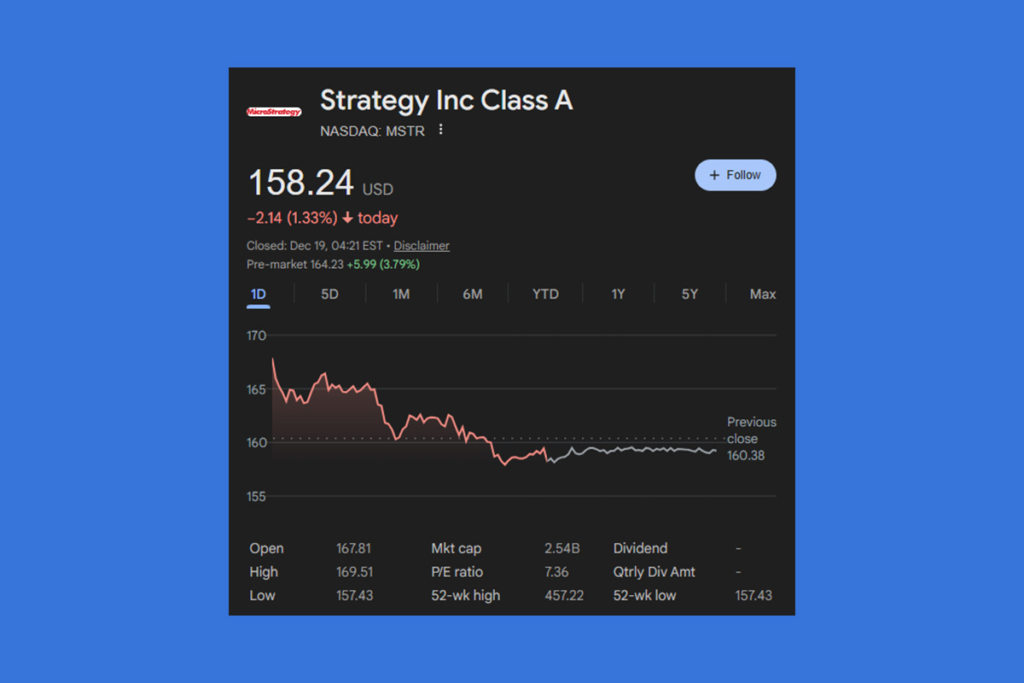

Strategy Stock Weakens While Broader Market Pushes Higher

Despite advances reported by major indices, Strategy’s shares outperformed the broader equity markets. Given the volatility of cryptocurrency prices and changing macroeconomic conditions, the gap highlights the growing prudence of investors toward Bitcoin proxy stocks. Short-term price activity indicates susceptibility to both BTC movements and equities risk sentiment, even if the Strategy is still strongly reliant on Bitcoin’s long-term thesis.

Bitcoin Exposure Drives Strategy Stock Volatility

Bitcoin holdings make up the majority of Strategy‘s balance sheet. Therefore, the stock and changes in the price of Bitcoin are highly connected. Despite growth in traditional stocks, MSTR had downward momentum as Bitcoin halted and faced selling pressure. This relationship strengthens MSTR’s position as a high-beta tool as opposed to a protective equity strategy. In the current market climate, investors seem to be shifting toward assets with better profit visibility.

Why Is MSTR Struggling While Bitcoin Consolidates?

The stock’s price in relation to net asset value (NAV) is another element putting pressure on it. MSTR’s premium typically decreases as Bitcoin consolidates because traders reevaluate funding costs and leverage. The scrutiny of the Strategy’s debt structure is also intensified by higher interest rate forecasts. Despite its long-term optimistic crypto story, MSTR might keep underperforming the overall market until Bitcoin regains significant upward momentum.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.