Spot BTC ETFs Suffer Huge Outflow: Is the Rally Over?

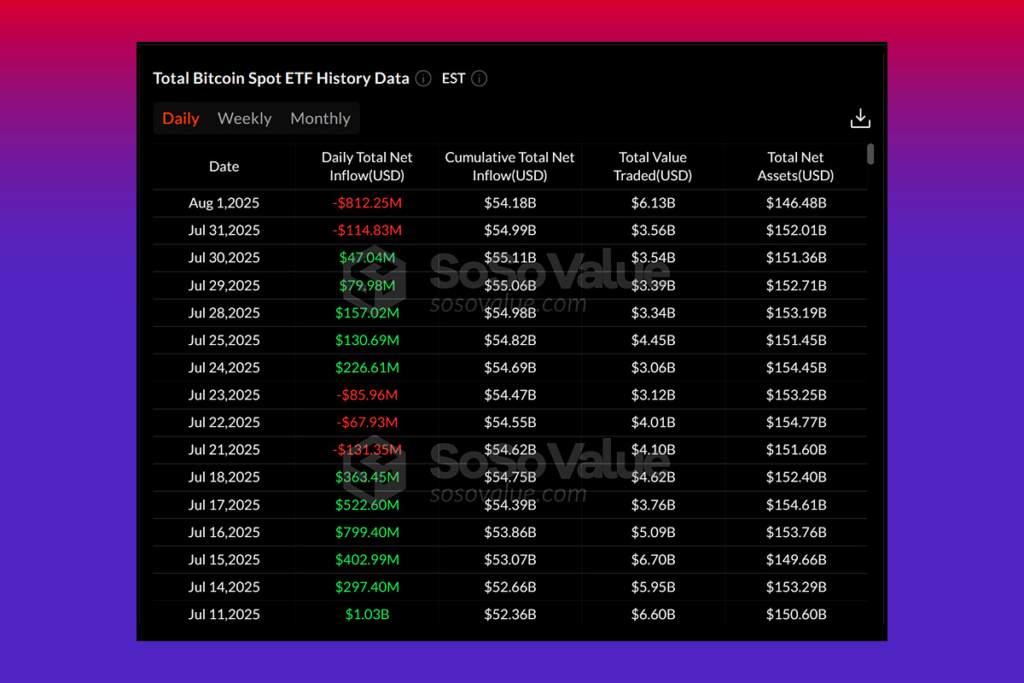

Friday was the second-largest single-day loss in the history of spot Bitcoin ETFs, with net outflows of $812.25 million. After a week of consistent gains, the downturn caused cumulative net inflows to drop to $54.18 billion. According to SoSoValue, total assets under control fell to $146.48 billion, or 6.46% of the market value of Bitcoin.

With $331.42 million in redemptions, Fidelity’s FBTC led the exodus, followed by ARK Invest’s ARKB, which experienced a significant $327.93 million drop. Additionally, Grayscale’s GBTC lost $66.79 million. IBIT for BlackRock reported a very small loss of $2.58 million. With $6.13 billion in value traded across all spot Bitcoin ETFs, trading volumes were still high.

Ether ETFs See $152M Outflow, Ending Historic 20-Day Inflow Streak

In the meantime, Ether ETFs saw the end of their longest run of inflows. Friday saw a $152.26 million outflow from the sector following 20 trading days of net inflows. $20.11 billion, or 4.70% of Ether’s market capitalization, is now the total amount of assets under administration.

Bitwise’s ETHW dropped $40.30 million, while Grayscale’s ETHE led the losses with a $47.68 million decline. The outflows for Fidelity’s FETH were $6.17 million. BlackRock’s ETHA, which had $10.71 billion in assets and no inflows or outflows, was the only stock that didn’t move during the day. A total of $2.26 billion was traded in all spot Ethereum ETFs.

Ethereum Accumulation by Companies Doubles Bitcoin Purchases

According to a recent Standard Chartered analysis, companies are now purchasing Ether at a rate that is double that of Bitcoin. Crypto treasury companies have acquired about 1% of Ethereum‘s total circulating supply since the beginning of June. The bank emphasized that a major factor in Ether’s recent surge has been this accumulation, together with consistent inflows into US spot Ether ETFs. It thinks that by the end of the year, these patterns might cause ETH to surpass its $4,000 price forecast.

For more up-to-date crypto news, you can follow Crypto Data Space.