Featured News Headlines

Revised Job Data Points to Softer Labor Conditions

Recent labor market data revisions have raised fresh concerns about the strength of the U.S. economy, with implications for Federal Reserve policy. According to a preliminary annual revision from the U.S. Bureau of Labor Statistics (BLS), job growth in the 12 months through March was overestimated by approximately 911,000 positions. This revision suggests that average monthly payroll gains were likely less than half the initially reported 147,000 figure.

The new data comes amid growing speculation that the Federal Reserve will begin easing interest rates as soon as its September 17 meeting.

Solomon: “Signs of Weakening Are Becoming More Evident”

Goldman Sachs CEO David Solomon commented on the shifting labor landscape in a recent interview with CNBC, stating:

“There’s some softening in the labor market. While the economy is still chugging along, the signs of weakening are becoming more evident.”

Solomon expressed confidence that the Federal Reserve is likely to deliver a 25 basis point rate cut in September. He remained skeptical about the likelihood of a 50 basis point move but did not rule out additional cuts later in the year.

“I’m pretty confident that we’ll have a 25 basis point cut. Whether or not we have a 50 basis point cut, I don’t think that’s probably in the cards,” Solomon said.

“There’s no question we’re going to see a slight change in the policy rate as we move into the fall. And I think it’ll be really data-dependent on how things evolve,” he added.

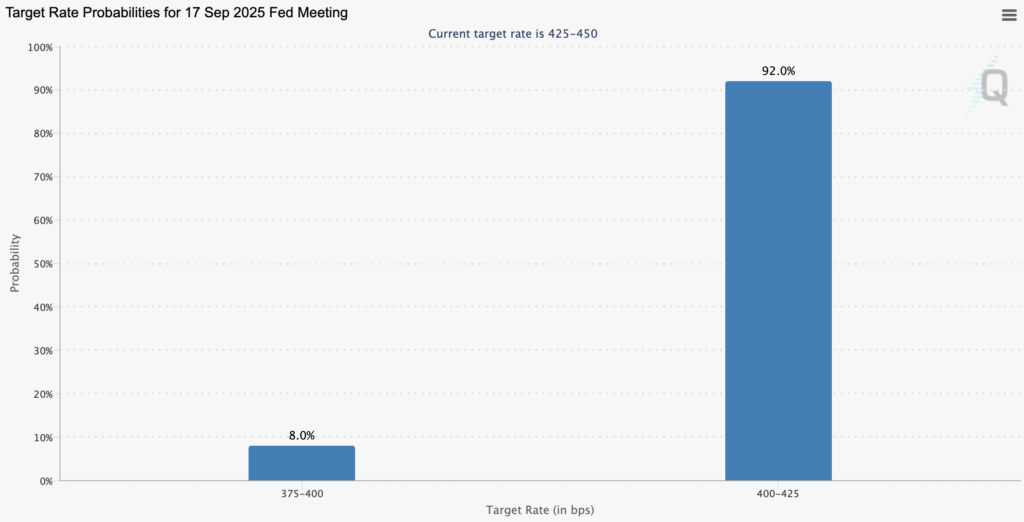

Markets Pricing In a 25 bps Cut

Market indicators largely align with Solomon’s forecast. The CME FedWatch Tool currently shows a 92% probability of a 25 basis point rate cut at the upcoming meeting, while the odds of a more aggressive 50 basis point move sit at 8%.

Standard Chartered Expects Aggressive Cut

In contrast to market consensus, Standard Chartered expects a sharper move from the central bank. The bank forecasts a 50 basis point cut, citing recent labor market weakness as a compelling reason for more decisive action.

Several market commentators have echoed this view. According to ZeroHedge:

“If the Fed knew how bad the labor market truly was, it would have cut 25bps in March and another 25bps in June/July. There is every case to be made for a 50bps rate cut in September.”

Potential Impact on Crypto Markets

Any interest rate reduction is likely to be viewed as a positive signal for risk assets, including cryptocurrencies. Lower rates typically increase liquidity and reduce borrowing costs—conditions that tend to support speculative investments.

Crypto market analyst Mister Crypto commented:

“There is now a 100% chance of a Fed rate cut in September. 10% chance it’s a 50bps cut. If that happens, crypto will explode through previous ATHs!”

Another analyst noted that while a 25 basis point cut is widely expected, a 50 basis point move would come as a surprise and could act as a strong catalyst for market momentum, especially across sectors such as Ethereum, DeFi, altcoins, NFTs, and blockchain gaming.

Comments are closed.