Featured News Headlines

Solana Faces 2026 With Falling Prices but Rising On-Chain Adoption

As 2026 begins, investors continue to rebalance portfolios amid persistent macro uncertainty. With broader volatility still unfolding, recent price fluctuations across crypto markets do not yet signal a definitive breakout. In this environment, capital rotation into higher-risk assets appears measured rather than aggressive.

Against this backdrop, long-term holder conviction has become increasingly important. For Solana (SOL), the pressure is particularly pronounced. From a technical perspective, SOL closed 2025 as the weakest performer among major large-cap assets, declining approximately 35% over the year. Since September, the asset has also failed to establish a consistent support zone.

Technical Weakness Tests Market Confidence

Price structure remains fragile. Solana has recorded four consecutive lower lows, with the most recent forming near $120. This pattern suggests that downside support has yet to solidify, placing long-term conviction under strain. In such conditions, some market participants may interpret reduced exposure as a defensive response rather than a directional call.

However, technical weakness alone does not fully capture Solana’s broader positioning as it enters 2026.

Fundamentals Tell a Different Story

While price action has lagged, institutional and on-chain metrics have shown notable improvement. In 2025, Solana reached what many observers described as an inflection point, as its infrastructure increasingly translated into real-world blockchain usage.

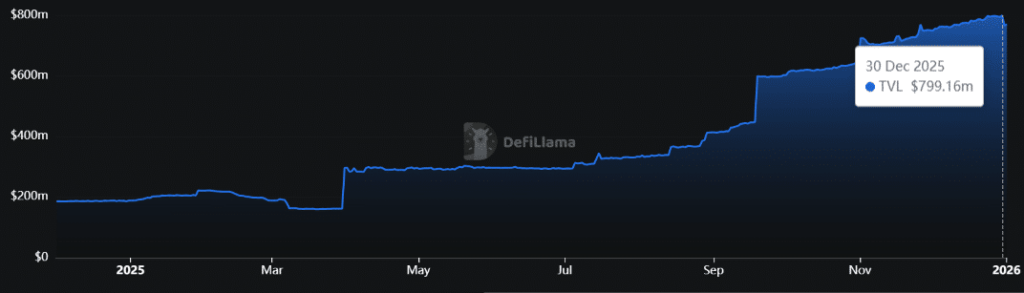

One key indicator of this shift is Real-World Asset (RWA) total value locked. On Solana, RWA value has climbed to a record $800 million, representing a 325% increase since the start of 2025, or roughly $600 million in net inflows. This growth highlights expanding on-chain utilization rather than speculative activity.

Roadmap Momentum Shapes 2026 Outlook

Solana’s 2026 roadmap emphasizes network upgrades, ecosystem expansion, and strategic partnerships aimed at scaling institutional participation. This alignment between infrastructure development and adoption has fueled renewed discussion around long-term potential, with some market projections referencing a “$400 year-end target.”

While such figures remain speculative, the underlying narrative is clearer: fundamentals, adoption trends, and roadmap execution are increasingly aligned. As risk appetite eventually returns, Solana’s current technical weakness may give way to broader structural reassessment—without implying any guaranteed outcome.

Comments are closed.