Featured News Headlines

Solana and XRP Attract $146M as Bitcoin Loses Institutional Appeal

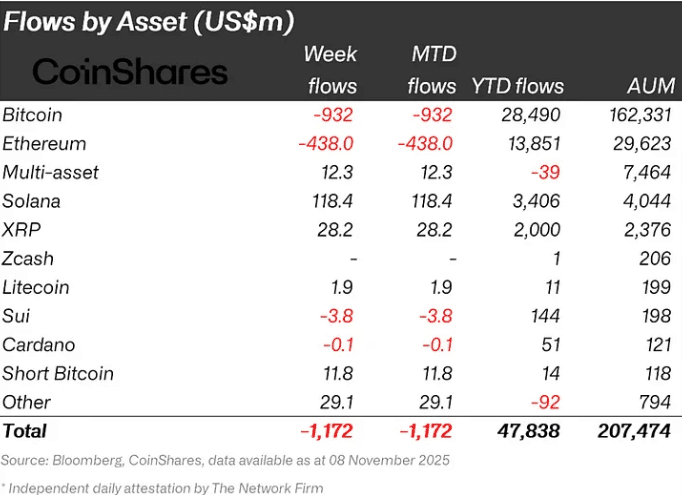

The crypto market staged a notable recovery last week, led by Solana (SOL). According to a recent CoinShares report, institutional inflows into SOL reached $118 million, the highest among all digital assets. XRP followed with $28.2 million, while Bitcoin (BTC) and Ethereum (ETH) recorded net outflows, signaling a rotation toward alternative assets.

The rally came on the heels of the U.S. Spot Solana ETF launch, which attracted strong initial demand. Market observers suggest that the debut not only boosted sentiment but also redirected liquidity from major coins to mid-cap altcoins.

Meanwhile, expectations are rising for XRP ETFs, anticipated to go live this week. Analysts believe the anticipation of these products could have already strengthened institutional confidence in XRP.

Are Altcoins Preparing for a Wider Comeback?

The recent market rebound has reignited an old debate — is altcoin season returning? Several assets, including NEAR Protocol, have already erased most of their October losses.

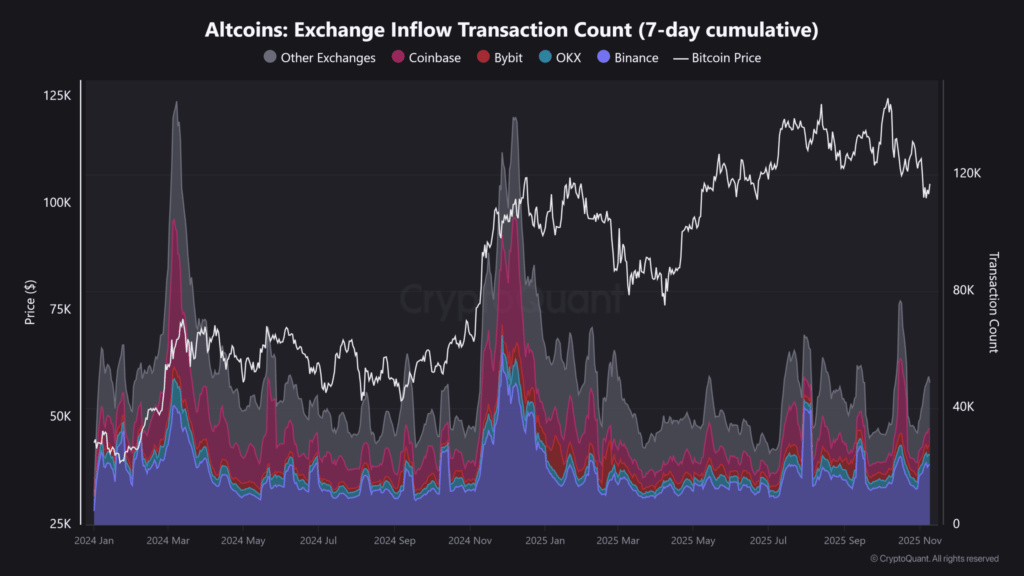

Still, not every investor appears convinced. CryptoQuant data revealed a sharp spike in the Altcoin Exchange Inflow Transaction Count, a metric that often tracks increased selling pressure. In past market cycles, such spikes have typically accompanied short-term relief rallies rather than long-lasting bullish reversals.

This mixed sentiment suggests that, while institutional money is flowing in, some traders may be taking profits after the latest bounce.

Bitcoin Dominance Drops as Liquidity Rotates to Altcoins

One of the more telling indicators of the current market shift is Bitcoin’s declining dominance. During BTC’s recent rebound to $106,000, its market share fell from 60% to 59% — a clear signal that capital is rotating into altcoins.

Similarly, USDT’s market share has dipped, hinting that investors are converting stablecoins into risk assets. Should this trend continue, the altcoin market could see a broader rally supported by fresh liquidity.

According to Nate Geraci, President of ETF Store, macro conditions may provide the next catalyst:

“The reopening of the U.S. government and renewed ETF demand could give altcoins, especially XRP, a new leg up,” said Geraci, noting that institutional appetite for alternative assets remains strong.

Altcoin Season Index Peaks at 100

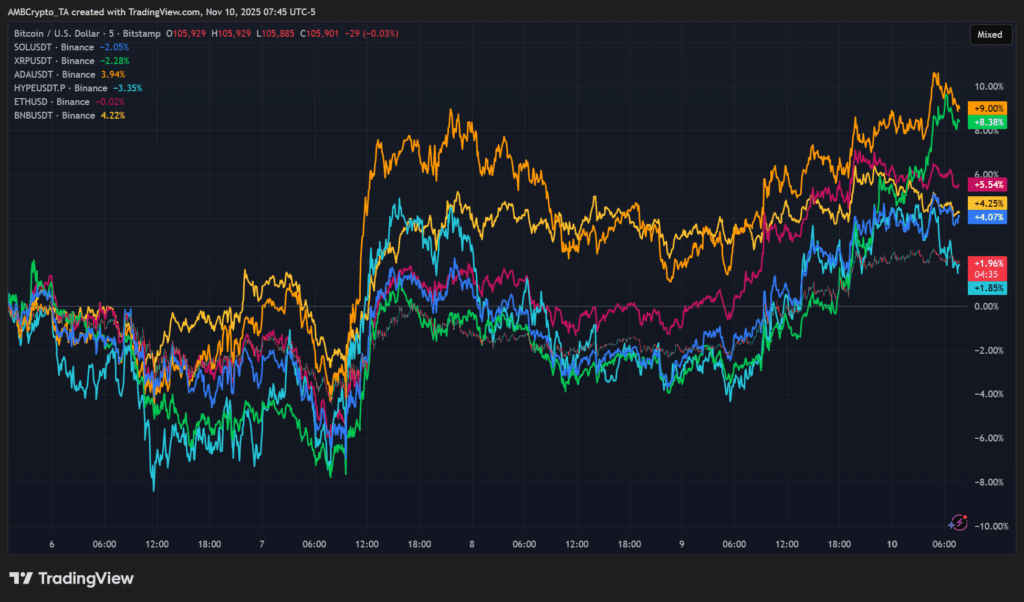

In performance terms, Cardano (ADA) led the rebound among major assets, surging 9% over the week. XRP followed with an 8% gain, while Ethereum (ETH) climbed 5%.

While Solana dominated institutional inflows, ADA and XRP stood out in terms of price performance. This diversification of momentum across multiple altcoins may indicate that the recovery is broadening rather than being confined to a single asset.

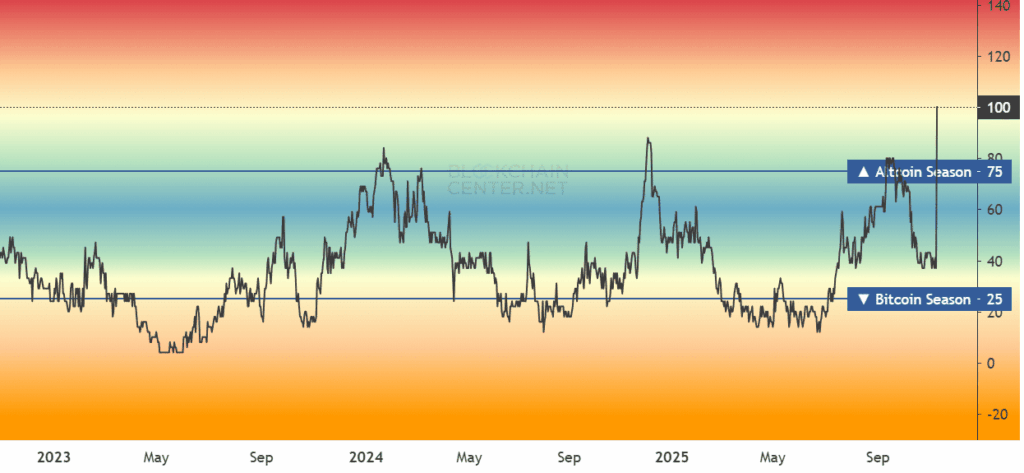

The Altcoin Season Index, a measure of relative strength between altcoins and Bitcoin, hit a perfect 100, signaling strong momentum. However, many altcoins still remain below their previous highs, suggesting that the recovery phase is uneven.

Sustainable Recovery or Short-Term Rally?

Data indicates a cautiously optimistic environment for altcoins. Institutional inflows and ETF developments are supporting sentiment, but the rise in exchange inflows hints at underlying profit-taking.

For a sustained uptrend to form, BTC and USDT dominance will likely need to decline further, creating more room for altcoin capital inflows. Otherwise, the current rebound may remain limited in scope.

In the coming weeks, macroeconomic shifts, ETF approvals, and liquidity flows will play key roles in determining whether this is a temporary recovery or the start of a new altcoin cycle.

Comments are closed.