Featured News Headlines

Solana’s AWS Outage Victory: Why Institutions Are Paying Attention

Solana Proves Its Power – When Amazon Web Services (AWS) suffered a major outage on October 20, parts of the internet — including several leading crypto platforms — ground to a halt. But amid the chaos, one blockchain stood out for its stability: Solana (SOL).

Solana Operates Seamlessly Through AWS Outage

While major crypto players like Coinbase’s Base, MetaMask, and Crypto.com experienced significant disruptions, Solana’s network performance remained completely unaffected. There was zero throughput drop, no transaction delay, and uninterrupted validator participation throughout the AWS outage.

According to data from AMBCrypto, Solana was the best-performing Layer-1 blockchain during the incident — a testament to its independent validator network and minimal reliance on centralized cloud providers like AWS or Infura.

Most Solana validators run on decentralized or alternative infrastructure, meaning that even as parts of the internet flickered, Solana’s network integrity held strong. Its Proof-of-History (PoH) consensus design promotes high throughput and global validator participation, significantly reducing dependency on any single infrastructure provider.

Institutional Confidence Surges Amid Network Strength

Solana’s ability to remain stable during a global cloud outage has strengthened its reputation among institutional investors. Following the disruption, the stablecoin market cap on the Solana network surged past $15 billion, signaling renewed trust in the blockchain’s reliability and scalability.

Analysts noted that institutions are increasingly viewing Solana as a preferred network for token launches, and this growing activity could soon influence SOL’s price action.

Price Outlook: Short-Term Pressure, Long-Term Potential

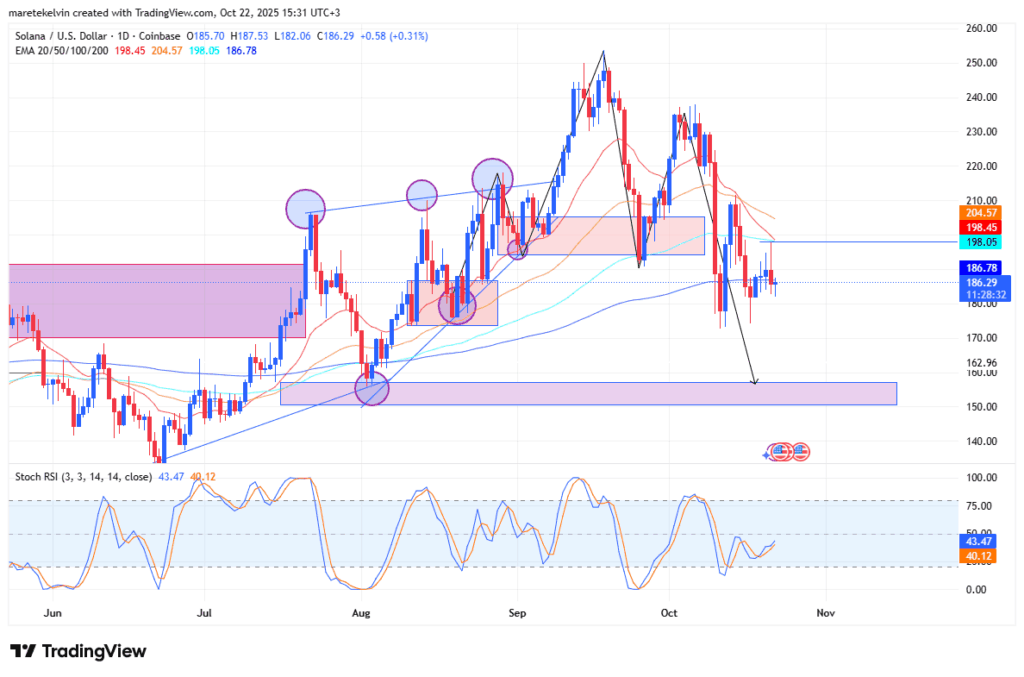

Despite the bullish on-chain sentiment, SOL’s daily chart shows a potential head-and-shoulders pattern, suggesting short-term bearish pressure. The token recently faced rejection at the $198 EMA resistance, adding to short-term caution.

However, with strong fundamentals and a network proving its mettle against centralized failures, Solana’s long-term trajectory remains bullish. A decisive move above the current resistance could reignite momentum and push SOL back into its upward trend.

Comments are closed.