SOL Performance Slumps Despite Growing Real-World Asset Adoption

2025 is shaping up as one of the toughest years for crypto since 2022. As Q4 nears its close, the total crypto market capitalization continues to slide, prompting renewed discussions about whether crypto remains primarily speculative. Solana [SOL] stands out as a notable case within this challenging environment.

Technical Performance Shows Strain

Among the top five high-cap cryptocurrencies, SOL is the weakest performer, posting a 27% loss year-to-date. For comparison, Binance Coin [BNB] has gained 27% over the same period. This marks Solana’s poorest annual showing since the 2022 bear market. Net Realized Profit/Loss data also turned sharply negative, signaling that holders are realizing losses—a classic sign of capitulation. Many investors are either pausing for a clearer entry point or exiting entirely.

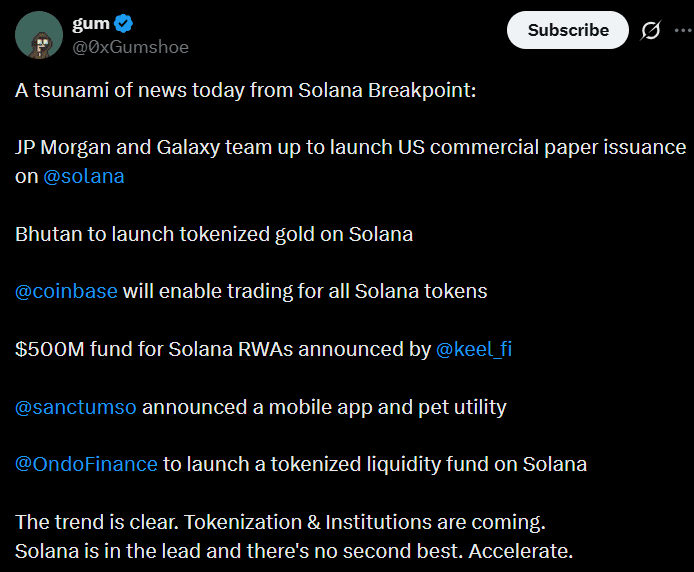

Despite this bearish technical backdrop, the broader Solana ecosystem is still demonstrating developments that sustain market interest.

Network Activity Reflects Growing Demand

Blockchain analytics underline this transition. Lookonchain reported a wallet transfer of 37k SOL from Binance, while Glassnode data shows approximately 2 million new addresses joining the network since mid-October, bringing Solana’s total to 6.5 million.

These figures suggest that despite technical weakness, Solana is sustaining FOMO with its partnerships and utility-oriented pivot. The coin is gradually shifting from a volatile speculative asset to a network with growing real-world adoption and use-case relevance.

Comments are closed.