Featured News Headlines

Solana Defies Market Slump with Institutional Support

While 65% of major native blockchain tokens fell in September, Solana (SOL) stood out with a strong performance backed by growing institutional interest and key technical upgrades.

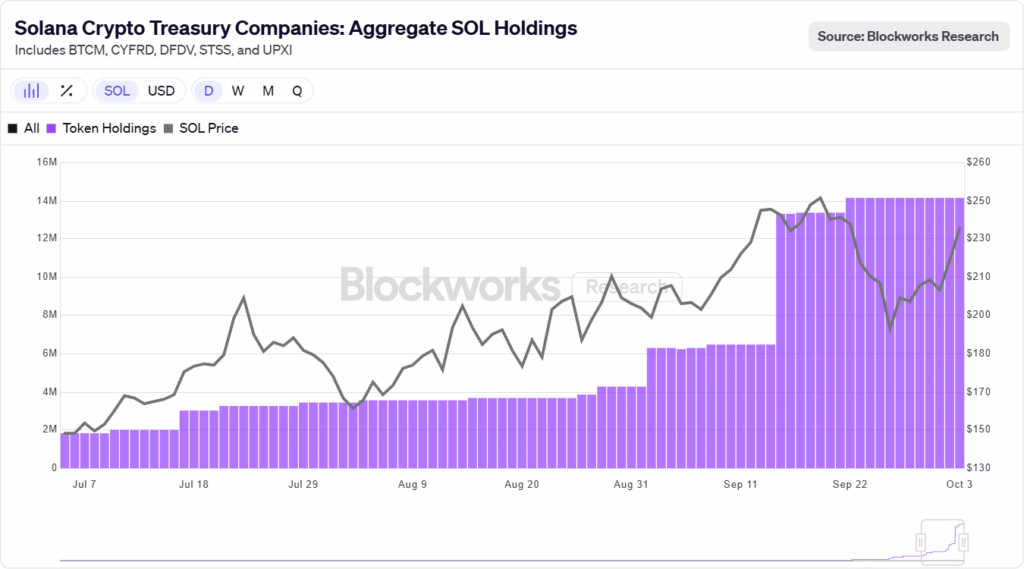

SOL Treasury Holdings Surge Over 233%

VanEck reported that out of 35 tracked native blockchain tokens, 23 declined during the month. However, Solana bucked the broader market trend thanks to an influx of demand from digital asset treasuries (DATs). Projects like Forward Industries and Helius went live in September, adding $2 billion in stablecoins and significantly boosting SOL usage.

According to estimates, Solana treasuries now hold 2.5% of total SOL supply — a jump of over 233% from the beginning of the month. In contrast, Ethereum DATs grew by only 35% in the same period.

While Ethereum still leads in absolute numbers (holding 3.56% of its supply vs. Solana’s 2.5%), Solana’s faster rate of treasury accumulation points to a shift in on-chain behavior and confidence.

Upgrades Fuel On-Chain Momentum

Solana’s Alpenglow upgrade, passed with 99% community approval, reduced block finality time to just 150 milliseconds. The Firedancer upgrade, set to eliminate block compute limits, also promises to further improve performance.

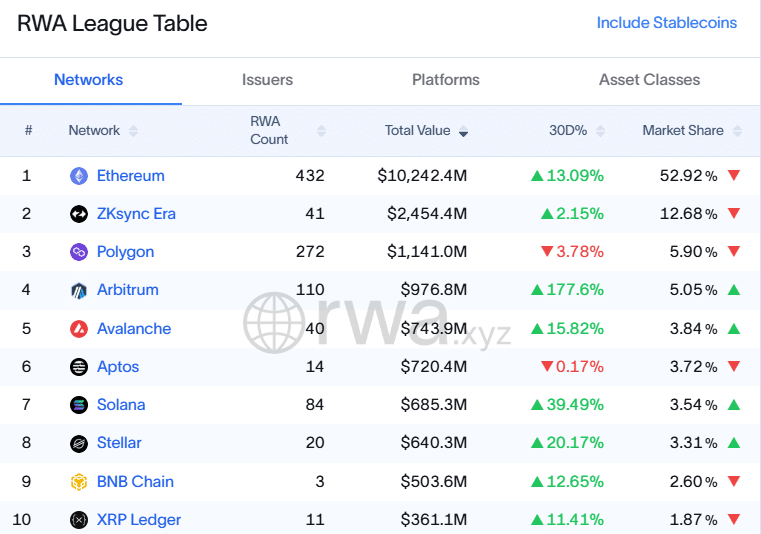

These upgrades appear to be drawing institutional capital ahead of their full implementation. Solana’s real-world asset (RWA) sector grew 40% in the last 30 days — triple Ethereum’s growth in the same sector.

Meanwhile, Ethereum’s upcoming Fusaka upgrade aims to enhance Layer-2 scalability in 2025. However, Solana’s roadmap, including a second Alpenglow upgrade in 2026, suggests further competition is on the horizon.

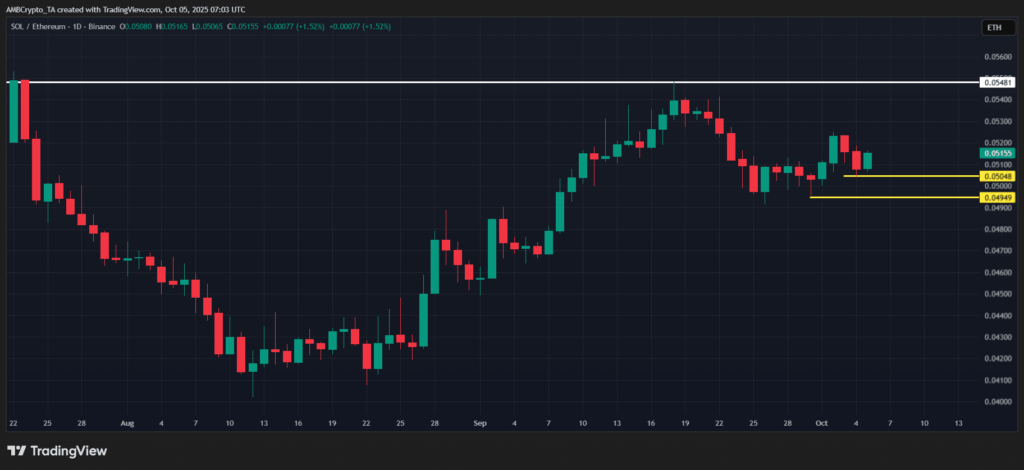

SOL/ETH Breakout Hints at Leadership Shift

September closed with SOL up 4.06% against ETH, which dropped 5.68% — Solana’s first clear outperformance since April. The SOL/ETH pair ended the month at 10.6%, showing a potential capital rotation away from Ethereum.

“Despite Solana’s inflated supply, it still outpaced Ethereum,” the report notes, underscoring the impact of on-chain metrics and institutional flows on price performance.

With Solana forming higher lows and holding support at 0.05 ETH, the stage may be set for a broader Q4 breakout.

[…] downtrend‘s accuracy is emphasized by the 4-hour timeframe. The asset is still following the downtrend […]