Featured News Headlines

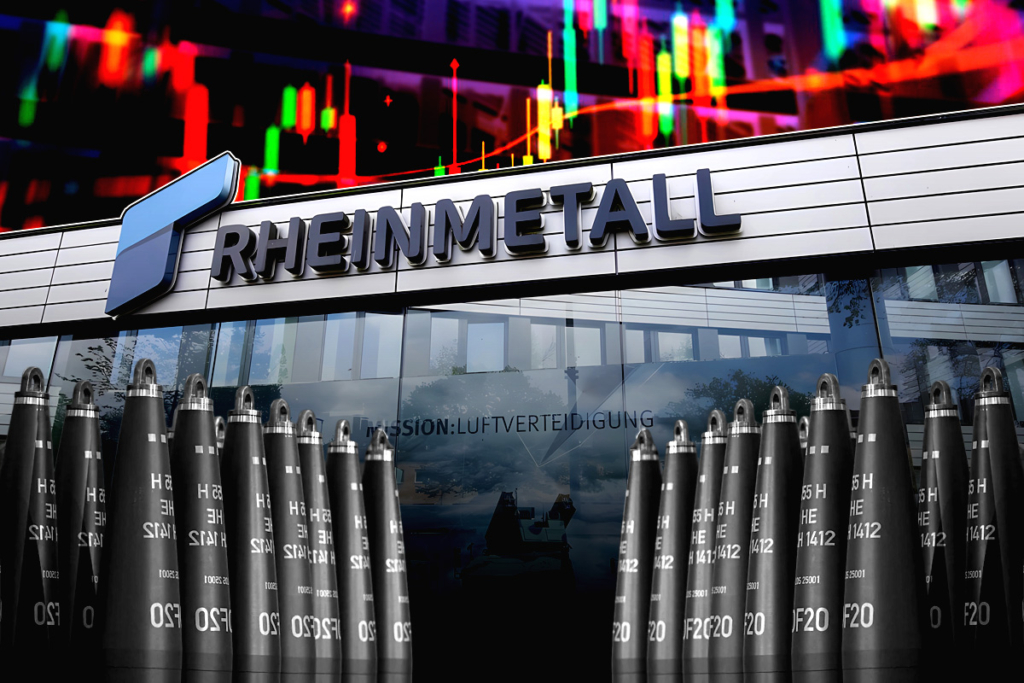

Rheinmetall Arms Europe for the Future With New Facility

Rheinmetall has opened a massive new munitions factory in Unterlüss, Germany—marking a major step in Europe’s defense manufacturing expansion. The facility will focus on producing 155mm artillery shells, aiming to reach 350,000 units annually by 2027. This comes as NATO allies face ongoing challenges to meet Ukraine’s growing ammunition needs.

The factory was built in record time—just 14 months—and is part of Rheinmetall’s €500 million investment. The company’s CEO, Armin Papperger, noted that the plant could soon become Europe’s largest munitions production site, reflecting broader military-industrial mobilization across the continent.

Strategic Timing Amid Ukraine War

The urgency for such a facility stems from the continued high demand for artillery in Ukraine. With existing stockpiles depleted and NATO scrambling to ramp up production, Rheinmetall’s increased capacity is expected to play a key role. According to Papperger, “next year we would be able to give a minimum of 100,000 [155 mm shells] to Ukraine,” with more going to other partners in subsequent years.

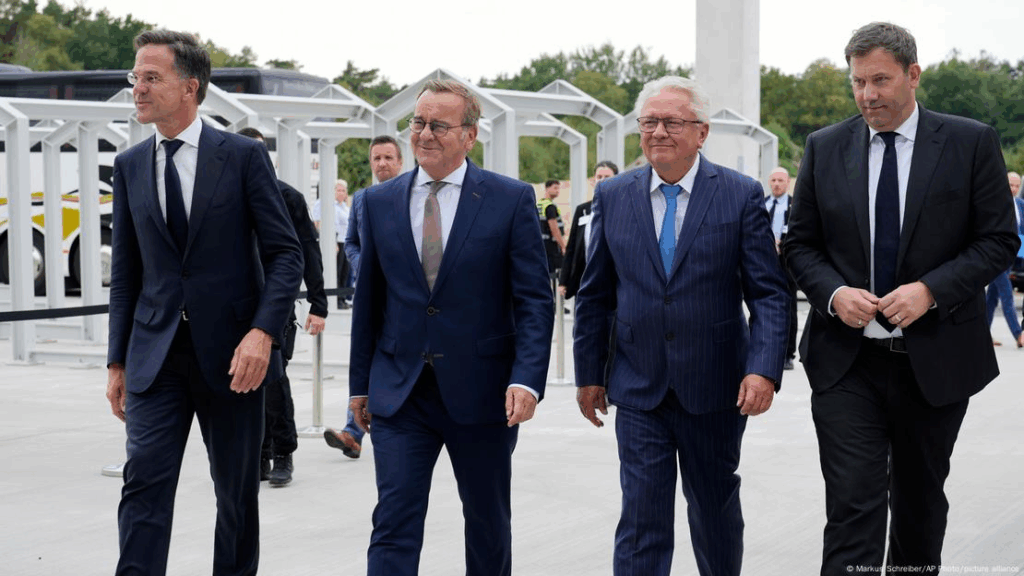

German Defense Minister Boris Pistorius praised the rapid development, stating, “The crucial thing is that we were able to open such a plant in a very short time… That’s what matters: sending the signal that we can do it faster.” The factory’s automation and integration with the broader Cronos defense network is expected to significantly boost output per worker.

Defense Investment Fuels Market Gains

Since Russia’s invasion of Ukraine in 2022, Rheinmetall’s market value has surged dramatically—up nearly 2,000%. Investor confidence has grown even more following Donald Trump’s re-election, as many expect increased pressure on European NATO members to boost defense budgets. The German government alone is planning long-term defense expenditure increases, which will likely benefit Rheinmetall and similar firms.

Beyond ammunition, Rheinmetall’s Unterlüss site will also include facilities for tank production and rocket motor manufacturing, making it a multi-domain production center.

Stable Growth & Political Implications

Despite being a traditional defense supplier, Rheinmetall’s sharp rise underscores how geopolitical shifts can reshape industrial priorities. Its growing footprint in Europe suggests not just a response to short-term wartime needs, but a strategic realignment toward long-term military preparedness.

At a broader strategic level, many analysts interpret the recent surge in European defense manufacturing capacity as a direct response to sustained pressure from the United States. During both his first and second terms as president, Donald Trump consistently urged NATO allies to significantly increase their defense budgets, emphasizing the need for greater burden-sharing among member countries. While these demands were often met with mixed reactions at the time, hindsight reveals that this persistent push may have been a critical catalyst accelerating Europe’s long-overdue industrial revitalization in the defense sector.

German Defense Minister Boris Pistorius underscored this point by acknowledging that no single factory—regardless of its size or output—can fully satisfy the vast and urgent needs of Ukraine in the current conflict. Nevertheless, he highlighted Rheinmetall’s rapid progress and the impressive scale of its new production facility as clear evidence that Europe is finally stepping up and adapting to the evolving realities of modern warfare. This new plant, characterized by its advanced automation, strategic production focus, and unprecedented speed of construction, represents more than just an industrial achievement; it symbolizes a fundamental shift in Europe’s defense posture.

The facility’s ability to produce hundreds of thousands of artillery shells annually reflects a broader transformation in European defense policy—from reliance on external support toward self-sufficiency and resilience. This strategic pivot is essential not only for addressing the immediate demands of the conflict in Ukraine but also for strengthening NATO’s overall preparedness in a rapidly changing geopolitical landscape. In this context, Rheinmetall’s new plant is seen as a cornerstone of Europe’s defense industrial base, providing critical capabilities that enhance both the continent’s security and its role as a key player on the global stage.

This development signals a renewed commitment by European nations to invest in cutting-edge military technologies and infrastructure, ensuring that they are better equipped to respond to future threats. As a result, the expansion of defense manufacturing capacity in Europe is more than a reaction to current events—it is a strategic realignment with long-term implications for the balance of power and collective security within the transatlantic alliance.

[…] in significant defense initiatives. The business has signed contracts worth billions of euros with NATO allies and other European countries. For the upcoming years, revenue visibility is guaranteed by these […]