Featured News Headlines

Revolut 1:1 Stablecoin Conversion Could Transform Cross-Border Payments

Neobank Revolut has unveiled a groundbreaking feature allowing its 65 million users to convert USD to stablecoins at a perfect 1:1 rate, with no fees or spreads. Users can now exchange up to $578,630 every 30 rolling days, effectively removing friction between fiat and crypto.

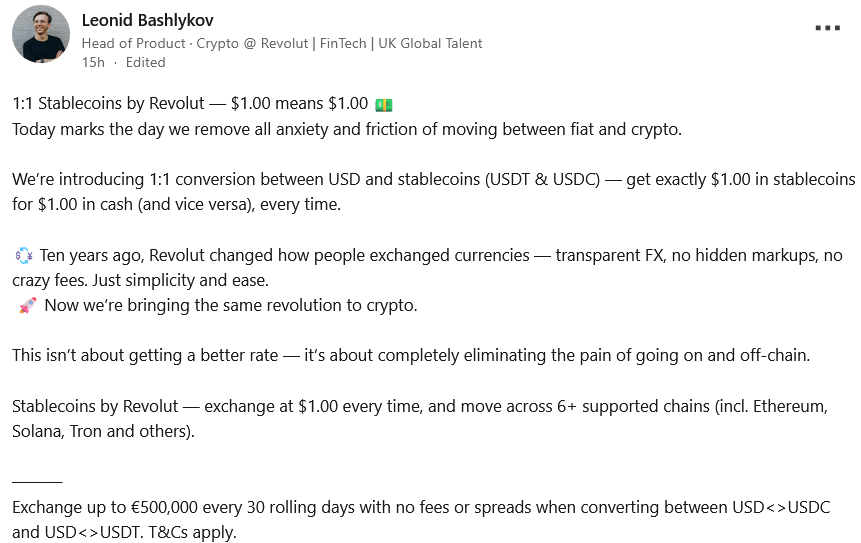

“$1.00 Means $1.00”: Revolut Eliminates Conversion Pain

Leonid Bashlykov, head of product in crypto at Revolut, emphasized the simplicity of the new system on LinkedIn: “1:1 Stablecoins by Revolut — $1.00 means $1.00. Today marks the day we remove all anxiety and friction of moving between fiat and crypto.”

The 1:1 conversion applies to USDC (Circle) and USDT (Tether) across six major blockchains, including Ethereum, Solana, and Tron. Revolut will cover any spread internally, ensuring users always receive the pegged value as long as stablecoins maintain their 1:1 parity.

Impact on Businesses and Global Transfers

Experts suggest this move could be transformative for small and medium-sized businesses (SMBs) in countries with volatile economies, like Turkey. Elbruz Yılmaz, managing partner at Outrun Ventures, highlighted that SMBs often lose value due to currency conversion fees, SWIFT charges, and slippage. Bashlykov added, “A clean one-to-one ramp turns stablecoins from a speculative asset into working capital infrastructure. Faster cycles. Less FX bleed. Better treasury control.”

Revolut’s Crypto Growth and Regulatory Milestone

Revolut reported holding nearly $35 billion in customer assets in 2024, a 66% increase from 2023, with transaction volumes rising sharply. This announcement comes shortly after Revolut secured a Markets in Crypto-Assets (MiCA) license from the Cyprus Securities and Exchange Commission, enabling regulated crypto services across 30 European Economic Area countries.

Since launching crypto trading in 2017, Revolut now supports over 200 tokens and allows users to pay with crypto for everyday purchases, cementing its position as a bridge between traditional finance and digital assets.

A Wider Trend in Stablecoin Adoption

Revolut’s move aligns with global efforts by major financial firms. Western Union plans a stablecoin settlement system on Solana by mid-2026, while Zelle and MoneyGram explore stablecoins for faster cross-border payments. Even SWIFT is developing a blockchain payment settlement platform for stablecoin and tokenized asset transfers.

Comments are closed.