Quiet Nvidia Strength: Technical Indicators Flash Green After Price Surge

After its recent spike, Nvidia has shown a period of sound technical stability, as evidenced by its continued strong consolidation around the $173 mark. Revisor Wealth Management increased its investment in the chipmaker to $4 million, indicating that institutional interest in Nvidia’s long-term development trajectory is still strong. As of recent trading sessions, Nvidia is displaying hints of base building above major moving averages—a promising technical signal for investors seeking sustained bullish momentum in AI and semiconductor stocks.

Nvidia Stock Gains Institutional Confidence as AI Demand Soars

Revisor Wealth Management‘s expanded stake contributes to a larger story of institutional investment in Nvidia shares. Nvidia’s fundamentals, which are fueled by record-breaking sales of AI chips and data center demand, continue to draw in smart money despite macroeconomic uncertainties and volatility in the chip industry.

Revisor’s holdings now constitute a significant allocation to the AI behemoth, in line with comparable actions taken by other hedge funds and asset managers, according to 13F filings. Even if the stock is consolidating close to its post-split price levels, this pattern might provide positive tailwinds for Nvidia‘s valuation.

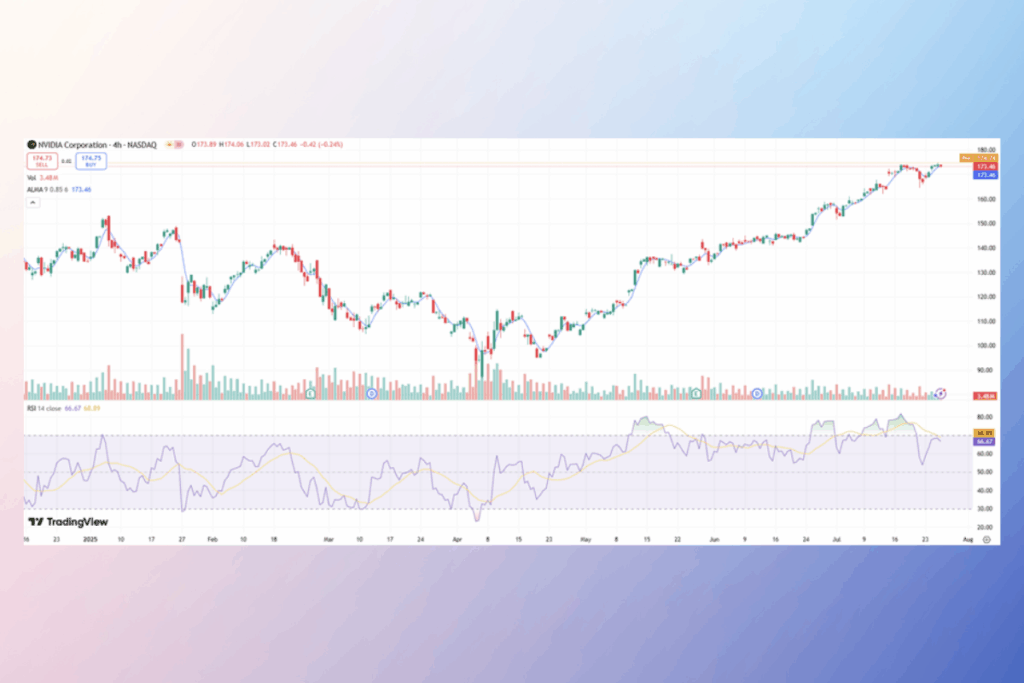

Nvidia Stock Eyes Breakout as RSI Stays Neutral

Technically speaking, Nvidia is presently consolidating in a narrow range close to $173, which is situated just above its 10-day and 21-day moving averages. The stock has space to climb without being overbought because the RSI is still neutral and the volume has been steadily dropping, which is frequently a sign of a breakout.

Rekindled upward momentum and a possible return to the post-split highs could result from a firm close over $175. In contrast, support between $165 and $167 is still crucial to preventing a more severe retreat. The expansion of AI infrastructure may be driving a larger rise, and long-term investors may see this sideways movement as a bullish continuation pattern.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.