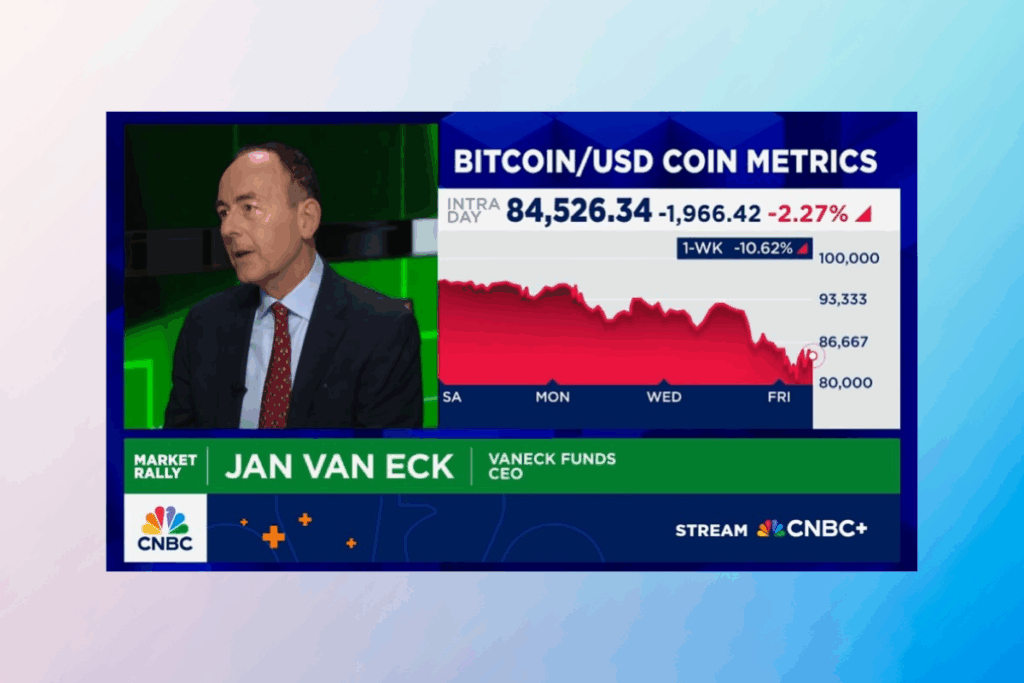

VanEck Says Bitcoin Is Safe for Now Against Quantum Computing Threats

Quantum computing advancements may pose a danger to Bitcoin’s encryption and privacy. But for the time being, it’s still a solid investment, according to Jan van Eck, CEO of investment management firm VanEck. Although the company predates the creation of the cryptocurrency, he claimed that it believes in Bitcoin. He went on to say that if they ever think the fundamental investing thesis is flawed, they will abandon Bitcoin.

There is something else going on within the Bitcoin community that non-crypto people need to know about. The Bitcoin community has been asking itself: Is there enough encryption in Bitcoin? Because quantum computing is coming.

van Eck

Bitcoin’s Four-Year Cycle May Trigger Major Correction

Van Eck concluded that pricing in the four-year cycle is currently underway. Instead of chasing prices in bull markets, he suggested utilizing dollar-cost averaging in bear markets. He stated that due to the on-chain realities and widespread worldwide liquidity concerns, Bitcoin must unquestionably be a part of investment portfolios. He gave a quick explanation of the cycle of halving. He went on to say that throughout the previous ten years, Bitcoin has seen a notable decrease every four years, and a substantial decline is anticipated in 2026. Investors have already set themselves up for this decline.

Every cycle is different. What’s obvious to everybody is that Bitcoin has gone up less this cycle, and so many people think it will go down less in the correction.

van Eck

Quantum Computing Remains a Long-Term Risk for Bitcoin

As the 2026 cycle draws near, market watchers are keeping a careful eye on Bitcoin‘s performance amid these van Eck revelations. Investors are becoming more disciplined and preferring long-term accumulation techniques over short-term speculation. Experts emphasize that macroeconomic variables, including changes in regulations and the state of global liquidity, will be critical in determining the future of Bitcoin. Furthermore, it is anticipated that institutional adoption would have a major impact on its market orientation. However, while traders and institutions are currently concentrating on managing cyclical volatility, quantum computing is still a possible long-term risk for cryptocurrencies.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.