Saylor: Quantum Computing Fears Might Be Bullish for Bitcoin

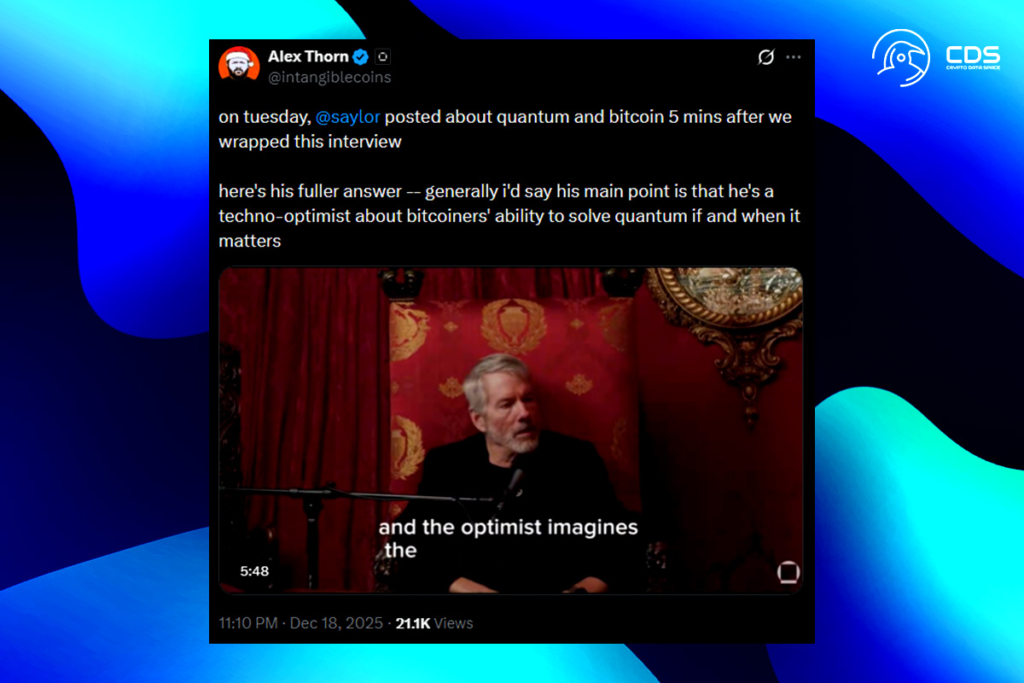

It has been suggested by Strategy CEO Michael Saylor that concerns about quantum may potentially work in Bitcoin’s favor. He spins what most people consider Bitcoin’s death knell as an impetus for a huge upgrade and price surge.

Saylor: Banks and Governments Will Mandate Quantum-Safe Upgrades

Saylor maintains that Bitcoin is not the only cryptocurrency that will face a quantum threat. Every single government agency, bank, and defense contractor on the planet will feel the effects of this worldwide crisis all at once. Upgrades to encryption standards that are resistant to quantum computing will be mandated by the US government, Apple, Microsoft, and key financial institutions. Everyone faces an existential threat. Thus, there will be no block-sized war-style debate. He draws a parallel to Y2K, a universally acknowledged date when software upgrades are mandatory or face catastrophic consequences.

Your bank will say… please install the new client software… if you don’t, we’re going to freeze your funds,

Saylor

Saylor Predicts Massive Bitcoin Supply Drop After Quantum Transition

According to Saylor, the Bitcoin network will essentially use a similar measure, requiring users to transfer their funds to new addresses that are quantum-secure. The business tycoon thinks that Bitcoin’s supply will drop significantly as a consequence of the switch to quantum-secure addresses. For example, to transfer Bitcoin to a new, quantum-secure wallet, users must sign the transaction using their previous private keys. However, those who have passed away without leaving a key heirloom will not be able to complete this migration. When the network blocks access to outdated, vulnerable addresses, the coins stored there will be permanently deleted from the ledger. Thus, since these coins cannot be transferred, Bitcoin’s effective supply will drop to 16 million.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.