Featured News Headlines

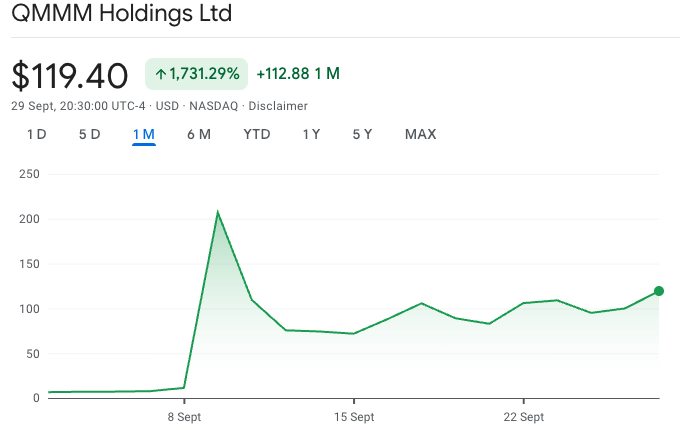

QMMM’s 1,700% Rally Halted by SEC Manipulation Probe

The U.S. Securities and Exchange Commission (SEC) has temporarily halted trading in QMMM Holdings amid concerns of possible stock manipulation. This action follows recent reports of regulatory scrutiny targeting crypto treasury companies.

Trading Suspension Due to Potential Manipulation

In a Monday notice, the SEC stated, “The Commission temporarily suspended trading in the securities of QMMM because of potential manipulation,” imposing a 10-day trading halt on the company’s shares. The agency pointed to allegations that unknown individuals promoted buying QMMM stock via social media, seemingly designed to artificially inflate the price and trading volume.

Rapid Price Surge Raises Questions

QMMM Holdings shares skyrocketed over 1,700% in the past month after the company announced plans on September 9 to purchase and hold major cryptocurrencies including Bitcoin (BTC), Ether (ETH), and Solana (SOL). This move follows a growing trend of companies leveraging crypto treasury strategies to boost their stock prices.

Experts Weigh In on the SEC Action

Carl Capolingua, senior editor at Market Index, told Cointelegraph, “Such SEC trading suspensions are very rare, generally because of the consequences for company management.” He added, “If the SEC can link those ‘unknown persons’ promoting the stock back to employees or management, penalties could be severe, including fines or jail time.”

Capolingua further clarified that QMMM’s crypto strategy itself “isn’t likely to be the focus of SEC scrutiny,” emphasizing that the alleged illegal stock promotion is the primary concern.

Tony Sycamore, analyst at IG Australia, advised caution, saying, “If investors want crypto exposure, these types of Hail Mary plays are not the way to go about it.”

QMMM’s Meteoric Rise and SEC Probe Context

QMMM shares closed at $119.40 on Friday, having surged from around $6.50 a month earlier. The stock even jumped from $11 to an all-time high of $207 in one day after announcing plans to develop a crypto analytics platform and commit $100 million to acquiring cryptocurrencies.

This trading suspension coincides with broader regulatory attention. According to The Wall Street Journal, both the SEC and the Financial Industry Regulatory Authority (FINRA) are investigating several companies that recently launched crypto treasury strategies. Regulators are scrutinizing unusual trading activity before these companies publicly disclosed their crypto plans.

Growing Trend and Market Risks

Crypto treasury strategies, which involve companies buying and holding digital assets, have gained significant popularity on Wall Street. More than 200 companies have announced such initiatives recently, according to reports.

While these announcements often boost stock prices, some analysts warn the market may be overcrowded. They caution that if the value of crypto holdings surpasses a company’s market capitalization, it could lead to significant financial instability.

Comments are closed.