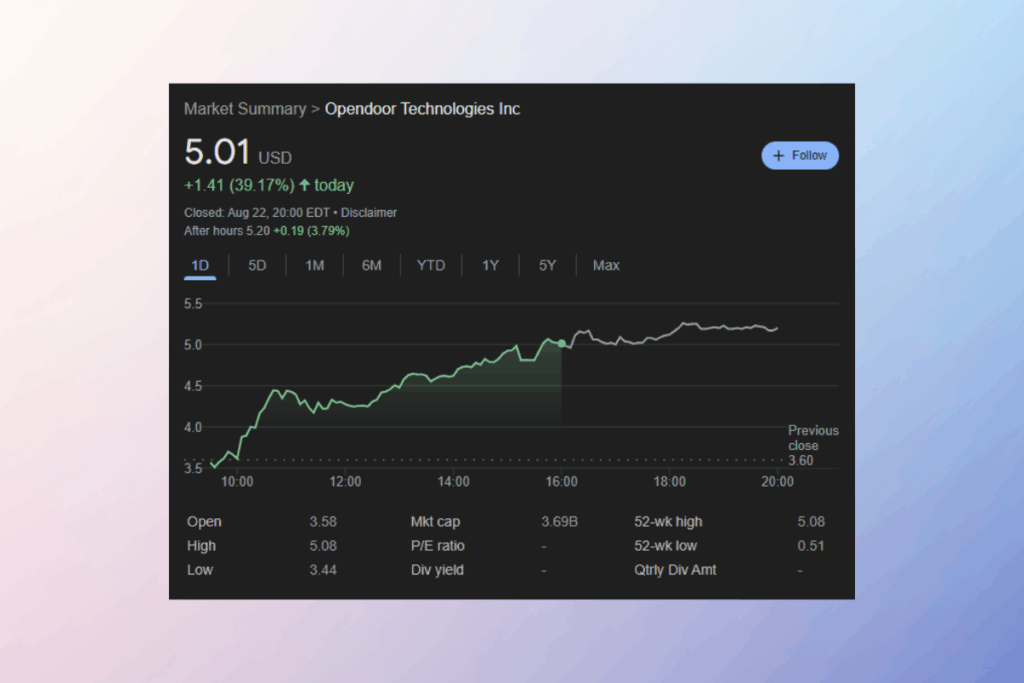

Opendoor Stock Hits New Heights: What Is Fueling the Rally?

Due to a recent dramatic increase in its stock price, Opendoor Technologies has once again attracted the attention of Wall Street. Through digital innovation, the real estate marketplace is renowned for redefining the process of buying and selling a home. Positive developments in the housing sector and calculated business decisions that are boosting investor confidence are currently helping it.

Opendoor Surges as Housing Trends and Tech-Driven Insights Align

The recovery in housing demand in the United States is one of the main factors propelling Opendoor‘s surge. Investor confidence in Opendoor’s business model’s ability to flourish in a more liquid housing market has been bolstered by declining mortgage rates and indications of home price stabilization. Institutional investors are also keeping an eye on the business’s capacity to quickly adjust to shifting market conditions. Moreover, Opendoor has reduced the risks associated with changes in property values by utilizing data analytics and AI-driven pricing algorithms. This was a significant obstacle in 2022 and 2023. Because of its increased efficiency, margins are getting stronger, and confidence in its long-term growth potential has returned.

Opendoor Stock Outlook: Strategic Measures Signal Long-Term Success

In addition to housing fundamentals, Opendoor’s stock is rising as a result of recent strategic measures. While cost-cutting and operational simplification have begun to have a positive impact on earnings, partnerships with significant real estate platforms have increased visibility. Investors are becoming more and more certain that Opendoor’s more efficient business strategy will result in long-term financial success in the upcoming quarters. Opendoor is currently one of the most followed real estate stocks due to improvements in key metrics and investor interest.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.