Featured News Headlines

OKB Price Analysis: Will the Token Hold $81.96 Support or Fall Further?

OKB, the native token of the crypto exchange OKX, has captured investors’ attention with an eye-popping 200% rally, reaching a new all-time high of $125.88 on August 13. The surge boosted its market capitalization to an impressive $7.4 billion. However, this meteoric rise appears to be cooling off, as OKB has retreated to $104.4 at press time, signaling a possible reversal in its price trend.

Growing Bearish Sentiment and Whale Movements

Data from Santiment reveals a clear shift in market sentiment toward negativity after OKB’s recent gains. The weighted sentiment index moved deeper into negative territory, suggesting traders are bracing for a pullback. Supporting this outlook, the weighted funding rate in OKB’s futures market turned negative, showing an increasing number of traders are opening short positions in anticipation of price drops.

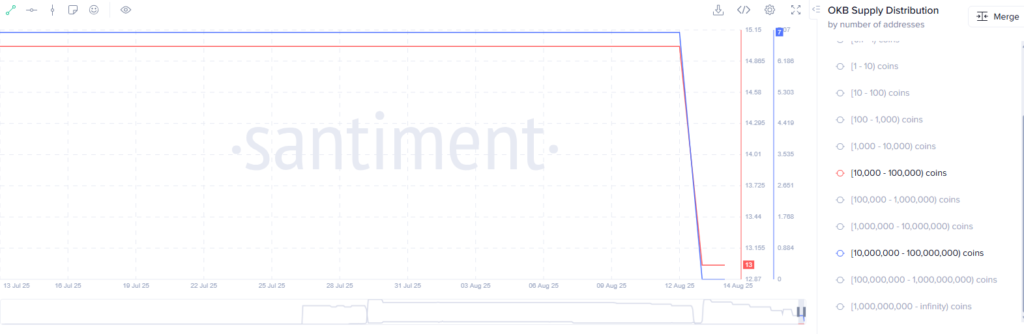

Adding to the bearish signals, whale activity indicates significant selling pressure. The number of whale addresses holding between 10,000 and 100 million OKB tokens dropped sharply right after the rally. This whale sell-off might trigger panic among retail investors who tend to follow these large holders, potentially exacerbating the decline.

Technical Indicators Point to Key Support Levels

Technically, OKB’s price action remains uncertain. After months of consolidation between $34 and $65 earlier this year, the recent surge lacked a clear continuation pattern. The Relative Strength Index (RSI) shows a bearish divergence after peaking above 90, suggesting a risk of correction while still indicating an overbought market.

The Average Directional Index (ADX) reading at 24 hints at a developing but not yet confirmed reversal trend. Traders will closely watch if this value rises above 25 to signal stronger momentum in the pullback.

Key support lies at $81.96, aligned with the 38.2% Fibonacci retracement level. A break below this could open the door for a deeper slide toward $44.20, a critical long-term support zone. On the flip side, a rebound from $81.96 might ignite another upward rally.

What’s Next for OKB?

The coming days are crucial for OKB’s trajectory. Will the token stabilize above current levels, or will the profit-taking and whale sell-offs unravel the recent gains? Market participants remain cautious as volatility looms on the horizon.

Comments are closed.