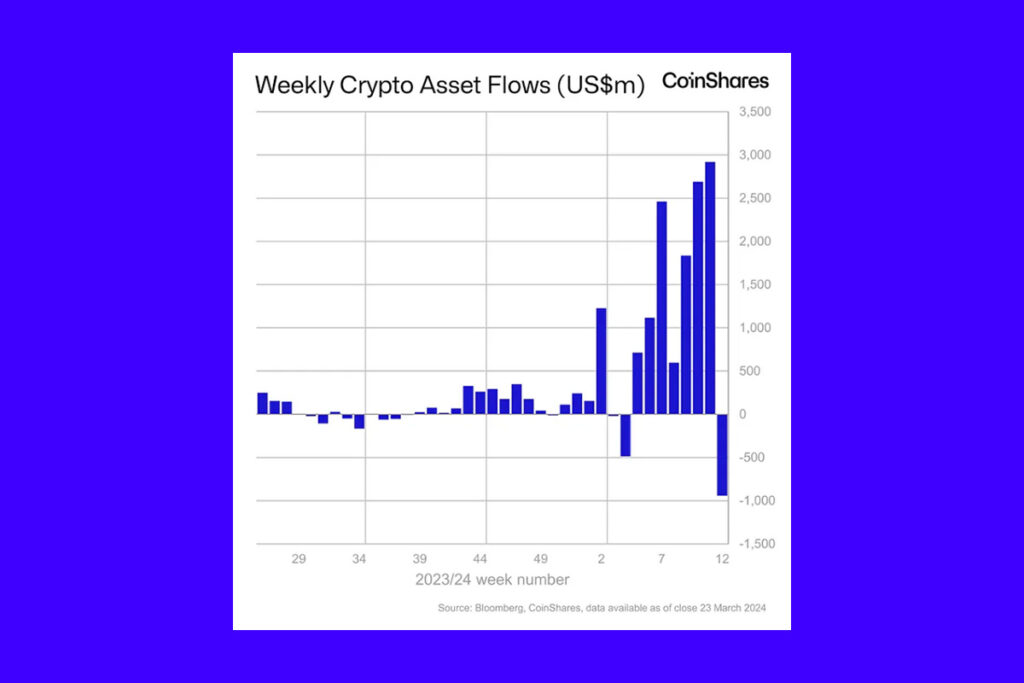

Crypto News – The most recent report from CoinShares shows that last week saw record outflows of $942 million globally from cryptocurrency funds held by asset managers like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares.

Net Outflows in Global Crypto Funds: More Than $1 Billion Outflows Last Week

The previous high of $500 million, established at the end of January, was almost doubled by last week’s outflows. Moreover, they continue a seven-week string of inflows totaling $12.3 billion, which includes the record inflows of $2.9 billion seen in the previous week.

Due to the underlying cryptocurrencies’ price correction, $10 billion was removed from the managed funds’ assets, while trading activity for crypto investment products fell by a third to $28 billion for the week. At $88 billion, the total AUM continues to surpass previous cycle highs.

Bitcoin wasn’t the Only One to Suffer Losses

Nearly $2 billion in withdrawals from Grayscale’s converted GBTC fund exceeded inflows of roughly $1 billion into the recently established Bitcoin ETFs in the United States.

We believe the recent price correction led to hesitancy from investors, leading to much lower inflows into new ETF issuers in the U.S., which saw $1.1 billion inflows, partially offsetting incumbent Grayscale’s significant $2 billion outflows last week,

James Butterfill, CoinShares Head of Research

It wasn’t simply the US-based funds or bitcoin in general that caused last week’s negative attitude. There were withdrawals of $37 million, $35 million, $25 million, and $4 million from cryptocurrency investment products situated in Sweden, Hong Kong, Switzerland, and Germany, respectively. In that order, investment products deriving from Ethereum, Solana, and Cardano also saw losses, amounting to $34 million, $5.6 million, and $3.7 million.

Leave a comment