MSTR Dips 8%: MicroStrategy Lowers mNAV Threshold for Share Issuance

MicroStrategy (MSTR) shares dropped to a four-month low, falling over 8% since Monday. The decline mirrors broader weakness in crypto-related equities and an 8.6% pullback in Bitcoin from its recent all-time high of $124,128.

Saylor Eases Share Sale Restrictions to Maintain Flexibility

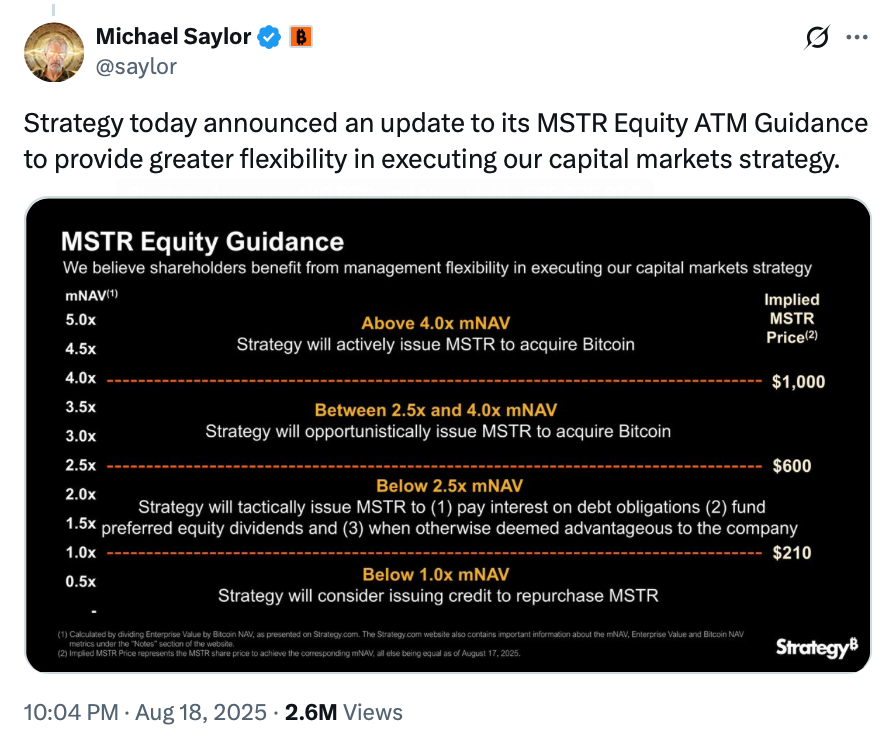

Michael Saylor, Executive Chairman of MicroStrategy, announced a change in the company’s equity strategy. In a post on X, he revealed that MicroStrategy may now issue shares even when trading below 2.5x its modified Net Asset Value (mNAV)—a key metric showing how the market values the company relative to its Bitcoin holdings.

The updated guidance allows the company to sell shares to cover debt interest, preferred equity dividends, or when deemed strategically beneficial. This marks a shift from previous commitments to only issue below that threshold for specific financial obligations.

Shareholders Split on Strategy Shift

While some investors see the update as a way to accumulate more Bitcoin at a discount, others expressed frustration, saying it contradicts Saylor’s prior statements. One former shareholder said he bought MSTR under the assumption shares wouldn’t be sold below the 2.5 mNAV mark—a position publicly stated during earnings.

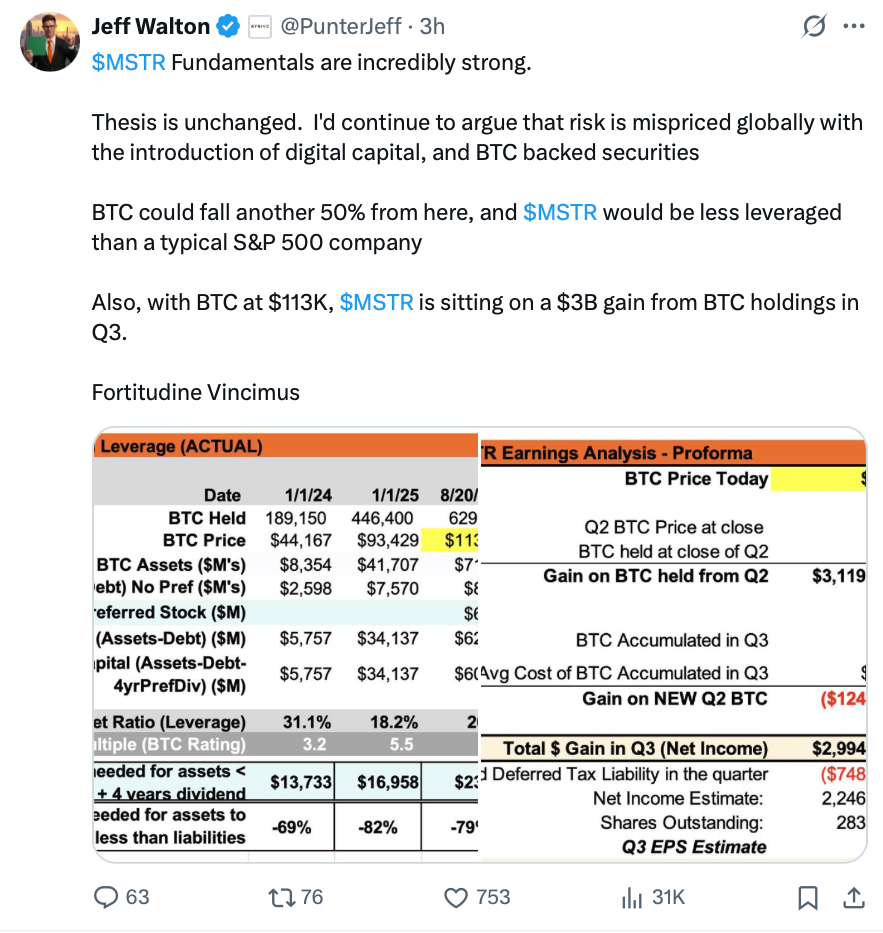

As of now, MSTR’s mNAV stands at 1.55, and the company holds 629,376 BTC, worth around $71.3 billion.

Comments are closed.