Featured News Headlines

Monad (MON) Launch Sparks 35% Gain – What’s Driving the Early Volatility?

Monad’s MON token had a surprisingly strong debut, surging over 35% in a single day despite a generally weak market for new airdrop-led token generation events (TGEs). However, the initial hype is showing signs of cooling as early traders adjust positions and liquidity shifts.

Perpetual Traders Signal Bearish Tilt

Perpetual positions are revealing the first early signals for MON. In the past 24 hours, top traders and mega whales reduced net long exposure by 118%, flipping positions negative and indicating aggressive profit-taking. Smart money remains short-biased at $103.94 million, reflecting a sharp 628% decline, signaling that experienced traders are leaning bearish despite minor long-side adjustments by whales, which slightly reduce downside pressure.

Big-Money Flow Weakens on Short Timeframes

With MON’s launch on November 24, the 1-hour chart is critical for gauging early momentum. Indicators like the Chaikin Money Flow (CMF) failed to sustain upward momentum, suggesting large buyers are not supporting the price, while On-Balance Volume (OBV) remains flat and shows vulnerability. Historically, dips in OBV have triggered sharp 20–21% one-hour price drops, highlighting ongoing volatility and potential for rapid corrections.

Key Monad Price Levels to Watch

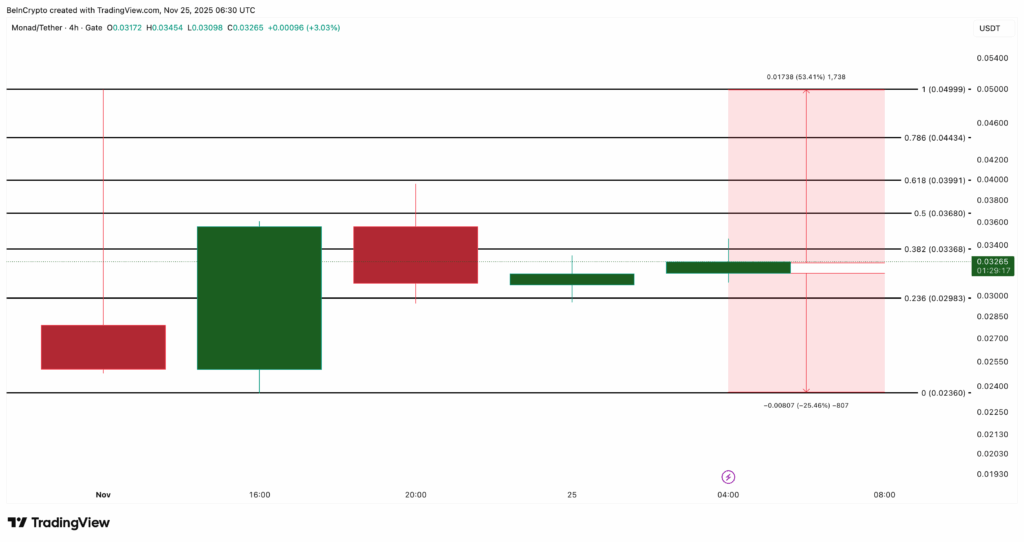

Monad (MON) is currently trading in a narrow range, with a few critical levels shaping its short-term direction. For bullish momentum to continue, the price needs a clean close above $0.044, which could pave the way toward the next target at $0.049, but this move depends on a CMF breakout and a rising On-Balance Volume (OBV) to confirm strength. On the downside, a drop below $0.029 on the 4-hour chart would expose $0.023, signaling a potential 25% pullback, a risk amplified by the ongoing flow of unlocked tokens from airdrop recipients into exchanges. In short, MON’s short-term path hinges on these pivotal levels, and traders are watching closely for any decisive breakout or breakdown.

The combination of perpetual data and early spot chart weakness underscores cautious sentiment among MON traders. Until momentum and volume signals improve, short-term swings remain a key feature of Monad’s post-launch trading environment.

Comments are closed.