Featured News Headlines

Coinbase Publishes Detailed Monad Token Sale and Allocation Plan

Coinbase has published detailed documentation about the Monad blockchain’s upcoming token sale, marking a rare instance of complete transparency in market maker arrangements. The disclosure reveals five participating firms, their allocated token amounts, and loan terms—a level of detail seldom seen in Layer-1 blockchain launches.

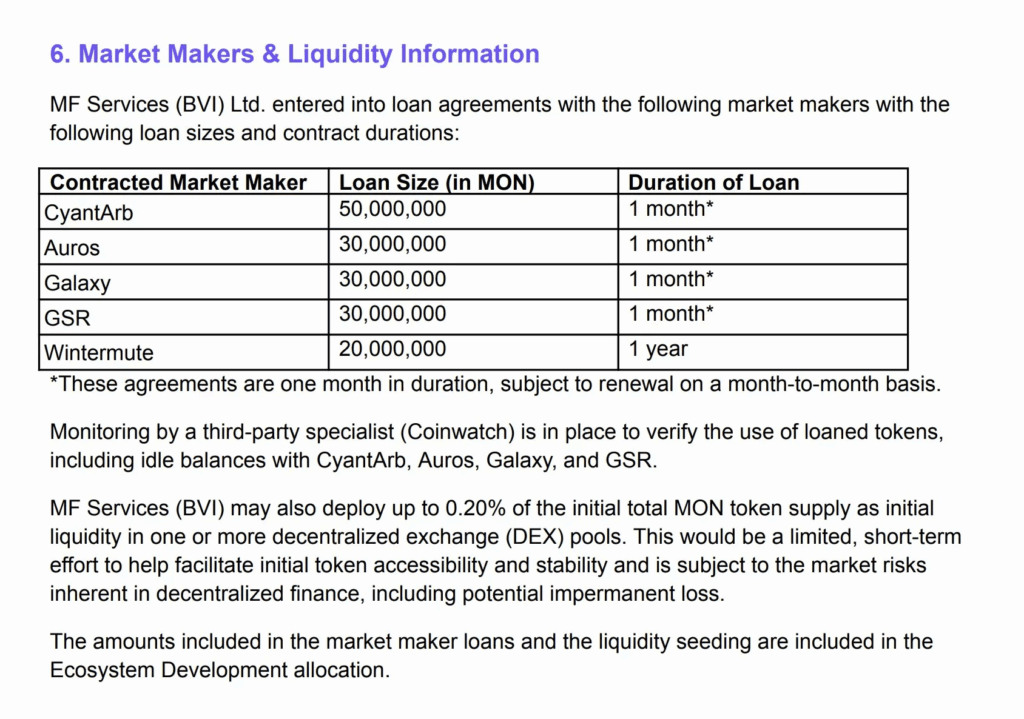

Which Market Makers Received MON Token Loans?

MF Services (BVI), Ltd., a subsidiary of the Monad Foundation, has executed lending agreements with five major crypto market makers. CyantArb secured the largest allocation with 50 million MON tokens for a one-month period, representing the most substantial short-term commitment among the group.

Three firms—Auros, Galaxy, and GSR—will each receive 30 million MON tokens under identical one-month loan terms. Wintermute stands apart with a 20 million MON allocation that extends for up to one year, providing the longest holding period among all market makers involved.

The combined allocation totals 160 million MON tokens, valued at approximately $4 million based on the initial price of $0.025 per token. These agreements can be renewed monthly, with monitoring handled by Coinwatch, an independent third-party agency tasked with tracking token usage and idle balances.

How Will Initial Liquidity Be Managed?

Beyond market maker allocations, MF Services plans to deploy up to 0.20% of the initial supply into decentralized exchange pools. Coinbase characterizes this as a short-term liquidity measure designed to ensure token accessibility and price stability during potential volatility spikes after launch.

The oversight structure includes regular reporting from Coinwatch to verify compliance with usage terms. This monitoring framework aims to prevent market manipulation and ensure tokens serve their intended liquidity purposes rather than speculative holdings.

What Are the ICO Sale Details?

The Monad ICO launches on November 17 at 9:00 AM EST and concludes on November 22 at 9:00 AM EST. The sale will offer up to 7.5 billion MON tokens, representing 7.5% of the total initial supply of 100 billion tokens.

Each token carries a fixed price of $0.025, calculated from Monad Network’s fully diluted valuation of $2.5 billion. This pricing structure provides participants with clear entry terms without variable rate mechanisms or tiered pricing models.

The project has established a comprehensive distribution plan that extends well beyond the initial sale period. Transparency in token allocation addresses a common concern in blockchain launches where unclear distribution can lead to market uncertainty.

How Will Tokens Be Distributed Long-Term?

Team allocations account for 27% of total supply, with strict lock-up and vesting conditions attached. All team tokens remain locked for one year following the Monad Public Mainnet launch, then release gradually over three years starting from the first anniversary.

The ecosystem development fund receives the largest share at 38.5%, with tokens unlocked immediately at launch. Investors hold 19.7% of the supply, while 4% goes to the Category Labs treasury, the entity formerly known as Monad Labs.

An airdrop event will distribute approximately 3.3 billion MON tokens or 3.3% of initial supply to Monad Community members and the broader crypto community following the ICO. Individual vesting schedules for team members typically span three to four years, tied to their project involvement dates.

The detailed tokenomics reveal a distribution model that balances immediate liquidity needs with long-term development incentives. Whether this transparency standard influences future blockchain launches remains to be seen as the crypto industry continues evolving its disclosure practices.

[…] Labs built Magma with funding from Bloccelerate, CMS Holdings, Animoca Ventures, and Arthur Hayes’ Maelstrom. […]