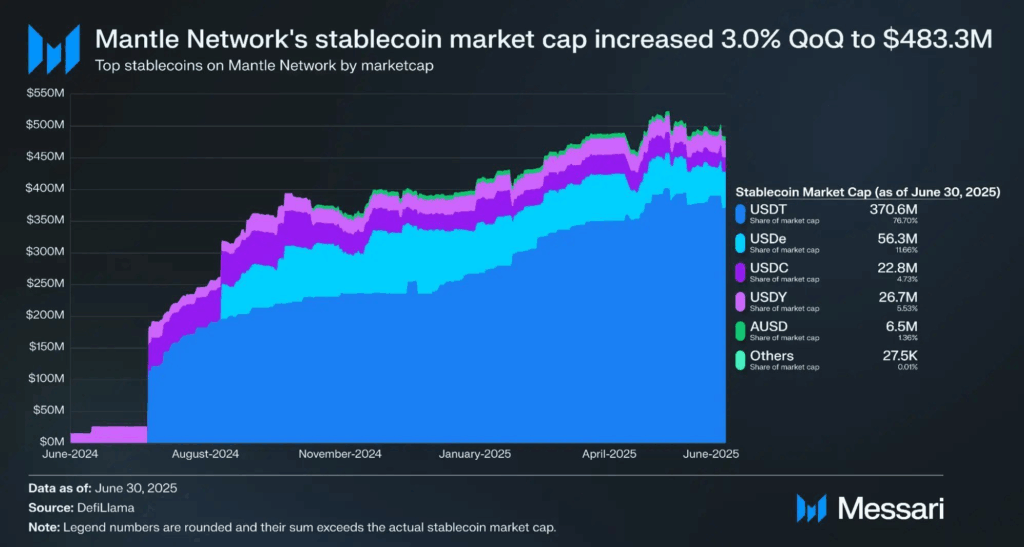

MNT Price Hits ATH as CeDeFi Momentum Builds

Mantle Network (MNT) is rapidly gaining recognition within the Layer-2 ecosystem. Surging over 150% from its July lows and recently breaking a new all-time high above $1.54, MNT’s rise isn’t just another bullish move — it’s backed by a powerful combination of technical strength, market flows, and evolving tokenomics.

At the heart of this rally is what the community calls the “Bybit Flywheel.” Users trading on Bybit receive fee discounts when holding MNT, creating a positive feedback loop. As demand for MNT increases, prices rise, encouraging further participation. This reflexive cycle could potentially include buybacks or burns funded by exchange revenue or Mantle’s treasury.

Analysts See Undervaluation in Key Metrics

Analysts point out that MNT is significantly undervalued compared to other major exchange tokens. One researcher on X noted, “MNT’s Market Cap-to-Volume and Market Cap-to-Open Interest ratios are the lowest among peers — just 0.1 and 0.15, respectively.” This suggests MNT may be in a re-rating phase similar to the early days of BNB or OKB.

Beyond speculation, MNT is benefiting from growing organic demand. Trading volume spiked 58% in the past week, new spot pairs were introduced, and fee structures adjusted. Additionally, the LTV ratio for MNT as collateral was raised — all pointing to increased utility and adoption.

Mantle’s deep ties with BITDAO and recent leadership additions from Bybit hint at more integration between DeFi and centralized platforms. While execution risks and market volatility remain, Mantle’s current trajectory places it in a unique position within the L2 and CeDeFi landscape.

[…] exchanges contributed significantly to CC’s price momentum. Over the past 24 hours, Bybit recorded nearly $220 million in CC spot trading volume, while MEXC exchange processed approximately […]