Featured News Headlines

- 1 Bitcoin Treasury Company Metaplanet Trades at a Discount: mNAV Drops Below 1

- 2 Market Overview: BTC Volatility and Sector Pressure

- 3 Metaplanet’s mNAV Decline: What It Means for Investors

- 4 Expert Insights: Divergent Views on Bitcoin Treasury Models

- 5 Technical Analysis: Indicators Point to Weakening Momentum

Bitcoin Treasury Company Metaplanet Trades at a Discount: mNAV Drops Below 1

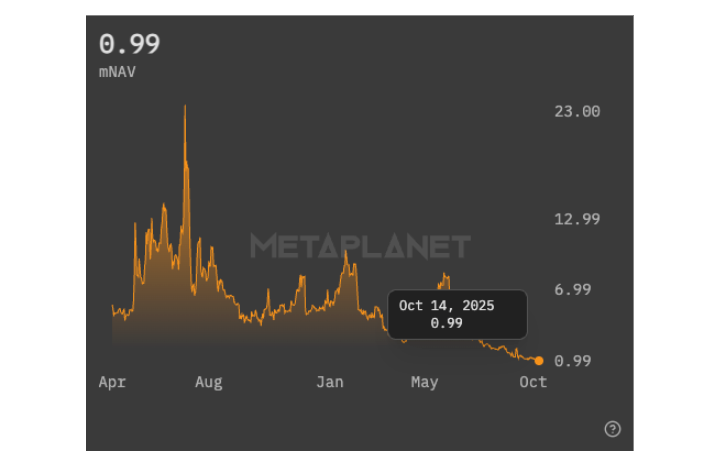

Japanese Bitcoin treasury company Metaplanet has seen its enterprise value fall below the net asset value of its Bitcoin holdings, a rare phenomenon highlighting growing market skepticism. The company’s market to Bitcoin NAV (mNAV) ratio dropped below 1 for the first time on record Tuesday, reaching 0.99, signaling that Metaplanet is trading at a discount relative to its Bitcoin treasury.

Market Overview: BTC Volatility and Sector Pressure

Bitcoin (BTC) is currently trading around $111,518 with a dominance rate of approximately 46.7%, while the total cryptocurrency market cap stands near $4.1 trillion. The market recently experienced massive liquidations exceeding $20 billion during the weekend, driven by escalating geopolitical tensions and macroeconomic uncertainties, contributing to heightened volatility across crypto assets.

Metaplanet’s mNAV Decline: What It Means for Investors

The mNAV ratio measures the relationship between a company’s enterprise value and the value of its Bitcoin holdings, offering investors insight into how the market values the company relative to its digital asset base. Metaplanet’s mNAV has fallen from an all-time high of 22.59 in July 2024 to 0.99, as its stock price plunged 75% from ¥1,895 ($13) to about $3.20.

This decline follows a pause in Bitcoin purchases since the end of September. The company currently holds 30,823 BTC on its balance sheet, valued at roughly $3.5 billion. When mNAV falls below 1, it suggests that the market values the company less than the worth of its Bitcoin, often reflecting concerns about operational risks, debt, or broader market sentiment.

Expert Insights: Divergent Views on Bitcoin Treasury Models

Melanion Capital CEO Jad Comair offered a contrarian perspective, stating, “Metaplanet trading below its Bitcoin NAV doesn’t signal failure; it reveals a market that still misunderstands Bitcoin treasury models.” Comair likened the current skepticism to early Tesla investors who undervalued the company’s transformative potential, adding that “once markets grasp the reflexive power of Bitcoin treasuries, these discounts will flip into persistent premiums.”

Conversely, Smartkarma equity analyst Mark Chadwick views the mNAV drop as indicative of a “bubble popping” in crypto treasury stocks but noted it could present a buying opportunity for long-term Bitcoin bulls.

Technical Analysis: Indicators Point to Weakening Momentum

Bitcoin’s Relative Strength Index (RSI) currently hovers around 51, signaling neutral momentum but a lack of clear directional bias. The Moving Average Convergence Divergence (MACD) indicator shows bearish crossover, with the MACD line below the signal line, suggesting downward pressure. The Directional Movement Index (DMI) reflects weakening trend strength, as the Average Directional Index (ADX) rests near 24, highlighting diminished momentum.

Price support is observed near the $108,000-$110,000 range, while resistance sits around $118,500-$120,000. A decisive break of these levels could define Bitcoin’s near-term trajectory.

Metaplanet’s mNAV decline exemplifies growing caution among institutional Bitcoin holders amid macroeconomic headwinds and geopolitical uncertainties. With public companies now controlling approximately 12.2% of Bitcoin’s circulating supply, shifts in institutional sentiment could significantly influence market dynamics.

Investors and analysts will closely monitor upcoming macroeconomic events—such as US government policy resolutions and international trade negotiations—that may restore confidence and stabilize crypto markets. Until then, volatility is expected to persist, and treasury-focused crypto equities may continue to face downward pressure.

Comments are closed.