Metaplanet’s Bitcoin Strategy Draws Market Attention

Metaplanet has restarted large-scale Bitcoin accumulation following a temporary pause, with the size of its latest purchase catching market participants off guard.

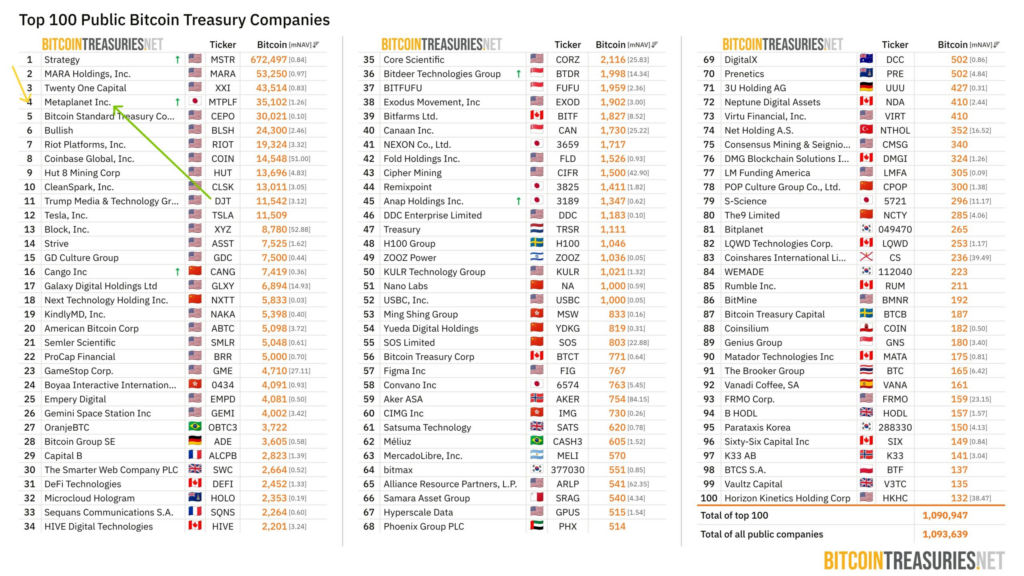

On December 30, the company disclosed the acquisition of 4,279 BTC, valued at approximately ¥69.855 billion. This move lifted Metaplanet’s total Bitcoin holdings to 35,102 BTC, placing the firm among the largest publicly listed Bitcoin holders worldwide. Despite previously slowing its buying activity, Metaplanet continued to rank fourth globallyamong public Bitcoin treasury companies.

Notably, the renewed accumulation occurred while Bitcoin was trading below the firm’s average purchase price, increasing short-term balance sheet pressure.

Equity and Debt-Funded Bitcoin Strategy

Metaplanet financed its Bitcoin expansion through a combination of equity issuance and Bitcoin-backed borrowing. During the fourth quarter of 2025, the company entered Bitcoin-collateralized credit facilities totaling $280 million, which were fully drawn and remained outstanding as of December 29.

In parallel, Metaplanet raised ¥21.249 billion through the issuance of 23.61 million Class B preferred shares. These shares were fully reflected in diluted share counts, increasing shareholder dilution while simultaneously expanding exposure to Bitcoin price movements.

Balance Sheet Exposure Intensifies

Bitcoin has become central to Metaplanet’s financial risk profile. As of December 30, the firm’s average Bitcoin acquisition cost stood at ¥15,945,691 per BTC. With Bitcoin trading below that level, Metaplanet faced more than $500 million in unrealized losses.

Management emphasized internal metrics such as BTC Yield and BTC Gain to assess accumulation efficiency. However, the company acknowledged that these indicators exclude debt obligations and unrealized fair-value losses, limiting their ability to fully capture balance sheet risk.

As leverage and dilution increase, shareholder outcomes remain closely tied to Bitcoin price volatility, refinancing conditions, and debt servicing dynamics.

Comments are closed.