Featured News Headlines

- 1 Gold Soars, Bitcoin Hovers at $90K: 5 Key Signals Shaping Crypto This Week

- 1.1 Bitcoin Attempts $90K Reclaim While Bears Watch $80K

- 1.2 Gold and Silver Hit New Highs as Bitcoin Lags Behind

- 1.3 Bitcoin On-Chain Indicators Remain Bearish Despite Market Resilience

- 1.4 Negative Coinbase Premium Signals Weak US Demand for Bitcoin

- 1.5 Crypto Markets in Extreme Fear: Warning Sign or Buying Signal?

Gold Soars, Bitcoin Hovers at $90K: 5 Key Signals Shaping Crypto This Week

Both gold and silver are trading at all-time highs as Bitcoin starts the new week close to the $90,000 mark. This comparison draws attention to the increasing differences between traditional safe havens and digital assets. Macro uncertainty continues to influence short-term market action, investor sentiment is still brittle, and volatility concerns are increasing. In this regard, this week, Bitcoin investors should pay particular attention to these five important aspects.

Bitcoin Attempts $90K Reclaim While Bears Watch $80K

Following recent declines, Bitcoin has stabilized and is making an effort to regain the $90,000 range. There is still division among short-term traders. After months of distribution, some sellers exhibit fatigue. Others caution that a further decline toward the low $70,000s could result from losing $80,000. Technically, a crucial upward level is the 50-day EMA at $93,000. Bullish momentum at the end of the year would be enhanced by a clear break above it.

I believe that there probably isn’t much left to sell right now. So the main bearish scenario is a sweep of the lows. Losing $80k would take price to the next support at $73k-$72k, but this information makes it more unlikely – unless if there is a new trigger for it to happen. With this information, it wouldn’t surprise me to see an aggressive pump by EOY and the start of 2026. Clearing the local resistance at $94.5k (matches with the 1D50EMA) would be a clear sign. And then, it’d face a strong resistance at $100k.

Gold and Silver Hit New Highs as Bitcoin Lags Behind

As investors throughout the world go for protection, gold and silver continue to reach fresh all-time highs. The defensive stance is being driven by rising Japanese bond yields and central bank policy uncertainty. In contrast, Bitcoin is still well below its peak. This discrepancy points to capital rotation as opposed to a wide tolerance for risk. Long-term gains in cryptocurrency may be constrained by persistent macro hardship.

Just as you think Japan’s situation can’t get worse, it gets even worse. US households now own more equities than real estate as a percentage of their net worth, the 3rd such occurrence over the last 65 years,

The Kobeissi Letter

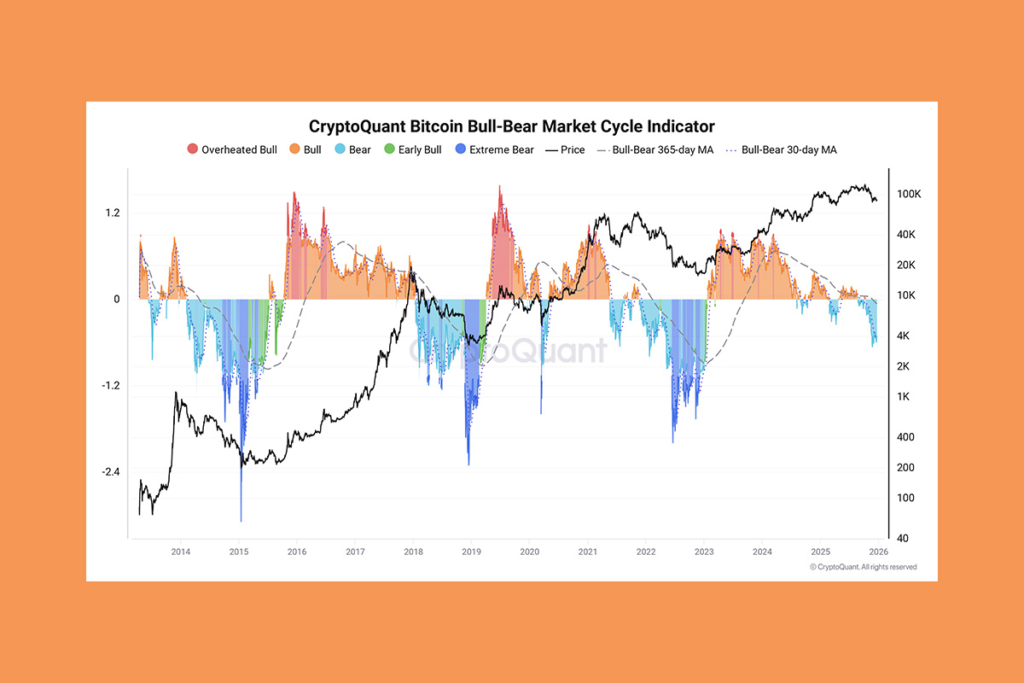

Bitcoin On-Chain Indicators Remain Bearish Despite Market Resilience

The picture painted by on-chain indicators is cautious. Like previous bear markets, Bitcoin‘s bull-bear market cycle measures are still negative. The profitability of traders is being impacted, and network activity has dropped. Even though the ecosystem of today is bigger and more robust, history demonstrates that periods of low activity frequently precede periods of extreme instability. Direction is still unclear.

Prices enter into bear mode when the indicators switch from Bull to BEAR,

CryptoQuant

Negative Coinbase Premium Signals Weak US Demand for Bitcoin

US-based purchasing interest is still lagging. The Coinbase Premium is still negative, indicating that American investors are still exerting selling pressure. This lessens Bitcoin’s short-term upward momentum. A recovery in US spot demand has historically been followed by long-lasting rallies. Price activity may remain range-bound until that change occurs.

Market without any clear direction for a while now. No major outliers in the data either. Things point to a slow end of the year. Early next year we’ll get a better idea of where this wants to head next.

Daan Crypto Trades

Crypto Markets in Extreme Fear: Warning Sign or Buying Signal?

The market is still very pessimistic. Even with Bitcoin’s surge to $90,000, the Crypto Fear & Greed Index continues to indicate tremendous dread. Investors who are contrarians view this as a possible opportunity. Markets have a history of deviating from consensus expectations. Bitcoin’s next significant move will probably depend on whether this fear results in surrender or an unexpected recovery.

The markets are in extreme fear, which have often been providing to be a great opportunity to be seeing a strong move afterwards. The recent crash on the markets for $BTC was a massive disconnect, and it’s just a matter of time, in my opinion, that the markets are going back to the fair price.

Michaël van de Poppe

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.