Featured News Headlines

LTC Market Update: Bearish Trend Dominates After Support Collapse

Litecoin Price Analysis – On Thursday, 18 April, Bitcoin (BTC) surged to $89.5k before sharply pulling back to a new low of $84.5k, triggering turbulence across the crypto market. Litecoin (LTC) was not spared, dropping 7.5% in just five hours and posting a fresh lower low at $72.64. At the time of writing, LTC was trading at $75.89.

Long-Term Support Zone Lost

Over the past two weeks, Litecoin bulls lost control of a critical long-term support zone at $80-$84, a region previously highlighted by AMBCrypto as pivotal for sustaining bullish momentum. The report noted that the bulls’ strength had been waning, with LTC struggling to maintain upward pressure. Even its inclusion in Bitwise’s 10 Crypto Index ETF (BITW) failed to provide a significant price boost.

Next Downward Targets in Sight

Using the Fixed Range Volume Profile for 2025, analysts identified LTC’s Value Area High (VAH) at $120 and Value Area Low (VAL) at $83. Historical trends show that after LTC traded above the VAH in early October, a 10/10 crash occurred, and the OBV indicated a near-total dominance by sellers.

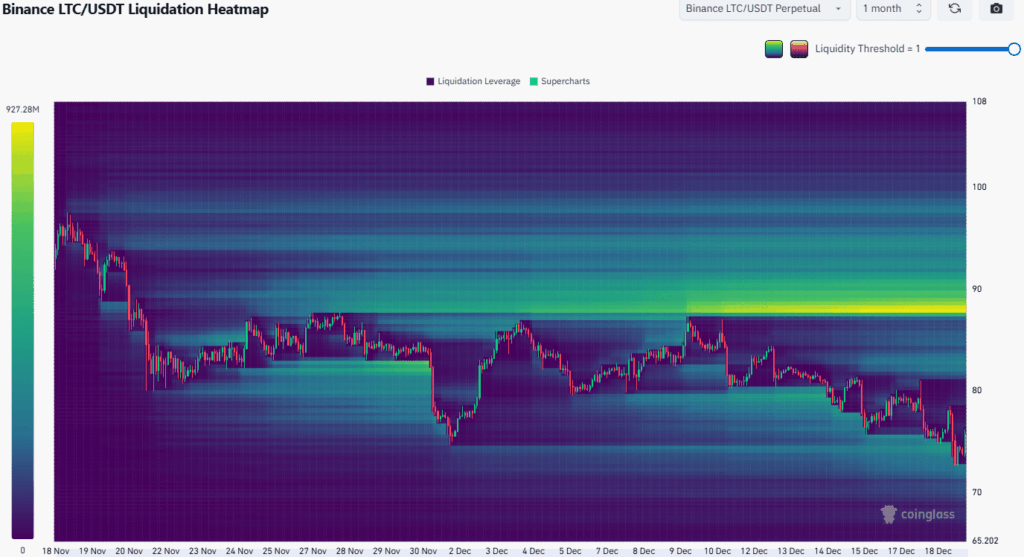

After volatility in November, LTC attempted to defend the $80 support, but the effort was insufficient to halt the downtrend. With the $80 level breached, the next long-term support targets for bears are $73.4, $66.5, and $59.6. The 1-month liquidation heatmap confirmed that liquidity around $73 had been swept, though a minor bounce toward the magnetic zone at $82-$83 may occur.

Bullish Scenario Remains Less Likely

The bullish path remains challenging. A magnetic zone at $88, filled with short liquidations, could theoretically pull LTC higher. Only a market-wide sentiment shift and a cascade of liquidations might push LTC past $90, potentially reclaiming bullish momentum.

Traders’ Outlook: Bearish

Analysts stress caution for bullish traders. LTC’s recent loss of the $80-$84 support area, combined with weak buying pressure on higher timeframes, signals that the altcoin remains in a bearish trend. Shorting bounces toward resistance could target $66 and $59, keeping traders aligned with the prevailing downward momentum.

Comments are closed.