Chainlink On-Chain Data Shows Accumulation Despite Weak Price

On November 5, Chainlink announced a major partnership with Dinari, a leading platform for tokenized U.S. equities. The collaboration aims to make the S&P Digital Markets 50 Index one of the first benchmarks to operate transparently on-chain, tracking 35 U.S.-listed companies driving blockchain adoption and 15 top digital assets.

Just a day earlier, on November 4, Chainlink revealed another strategic partnership—this time with Tradeweb, a global operator of financial marketplaces. Through DataLink, Chainlink will help publish Tradeweb FTSE U.S. Treasury Benchmark Closing Prices directly on-chain, bringing real-world financial data to decentralized ecosystems.

These integrations highlight Chainlink’s growing role in connecting traditional finance (TradFi) with decentralized finance (DeFi). Analysts view them as key steps toward wider blockchain adoption across established financial institutions.

Social Buzz Rises but LINK Price Lags

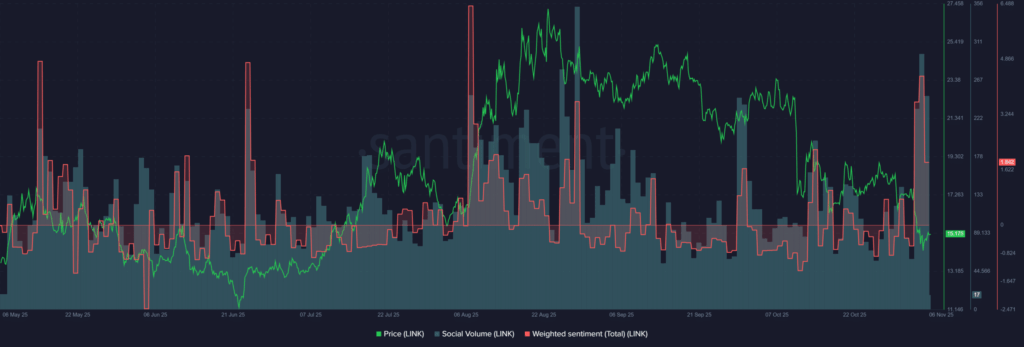

According to data from Santiment Insights, Chainlink’s social media activity has surged significantly over the past two months. The platform reported that the project’s partnerships and real-world integrations drove increased mentions and engagement.

“Chainlink’s partnerships with major financial institutions continue to boost its relevance across social platforms,” Santiment noted.

Weighted sentiment around LINK remained bullish, signaling optimism among community members despite weak price performance. Additionally, exchange reserves for LINK have declined, suggesting that holders are moving tokens off exchanges—a potential sign of accumulation rather than selling.

However, price charts tell a different story. On November 3, LINK’s daily candle closed below the August swing low of $15.44, confirming that bears still control the market. Technical indicators support this view: the MACD continues to show bearish momentum, while the OBV (On-Balance Volume) hit new lows, reflecting persistent selling pressure.

What’s Next for LINK?

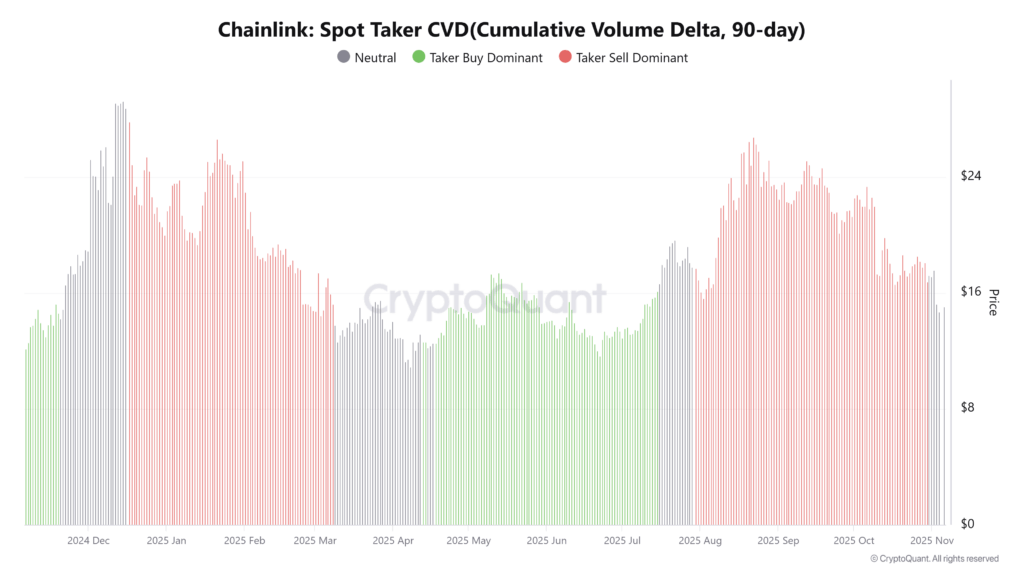

If the current downtrend continues, analysts warn that LINK could fall toward $11 in the near term. The spot taker CVD, which tracks aggressive buying and selling, has shifted from bearish to neutral—indicating a potential, but not yet confirmed, shift in sentiment.

For now, traders remain cautious. While Chainlink’s growing list of partnerships strengthens its long-term fundamentals, short-term price weakness may persist.

Comments are closed.